Simple analytics to improve service to members during the COVID-19 crisis

The speed and depth of the current COVID-19 pandemic has created a once in a lifetime challenge for many credit unions. The member marketing and service strategies in place at the beginning of the year have become obsolete in a matter of weeks. How are you navigating your credit union through this turbulent time? One tool that has proven useful is a simple topline segmentation analysis of your member base to articulate member service strategies, define segment messaging and coordinate operational resources.

The primary benefit of using this strategy framework is that you don’t need sophisticated software; just someone in your office who knows how to run reports from you core system and the basics of excel.

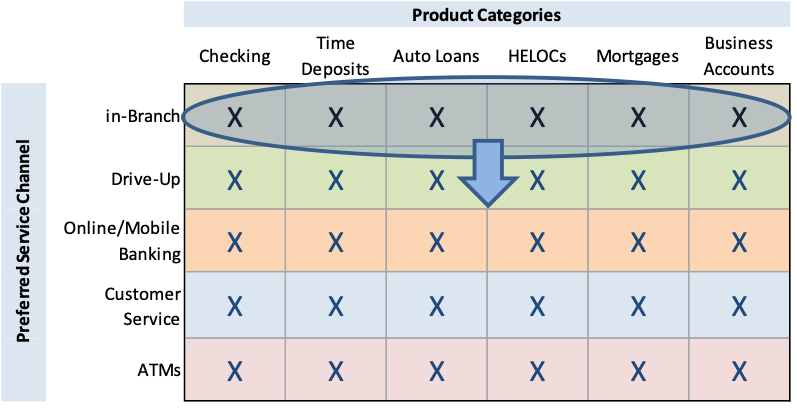

The framework works with two primary variables that tend to have the most influence on the context of your member interactions. The two variables are:

- Member service delivery preferences including; online, mobile, customer service, automated phone banking, in-branch, drive-up and ATMs.

- Accounts utilized by individual members. It is simpler and you can be just as effective by using account categories such as; checking, time deposits, IRAs, car loans, mortgages and HELOCs.

If you match these two variables in a cross-tab it creates a topline strategy roadmap for member account, service migration and messaging. The illustration below is a rough example of what your strategy grid might look like. Given the social distancing requirement, the primary focus is to move all members who use the branch as their primary servicing channel to another available channel. Secondary priorities include; emergency loan modifications to business and individual members, as well as, personal financial management assistance to help members respond to the crisis.

It’s possible to further refine this type of segment roadmap by incorporating the number of accounts/services of each member household or use an aggregate household balance of all accounts to provide further definitions within each segment.

Tactics can also be driven from this framework. As an example, you can provide the list of members who prefer in-branch service and have your branch associates call these members to discuss new service options and benefits. These calls can be made with your front line associates already knowing the accounts and service preferences of the members they are calling. Many of these in-branch member interactions can be replaced with either scheduled appointments or use of the drive up window. Many credit unions have expanded their drive up hours to increase the convenience of this service option.

For those members who do not use online or a mobile banking application, incentives can be offered to individual members for a first online deposit or any online transaction such as payroll deposit, debit card or balance transfer. This group typically can be 15% – 20% of your member base.

This is a stressful time for everyone, so it is especially important to make members feel you understand their situation and can provide the help they need to make it through this crisis. By creating a strategy framework for addressing required member service changes, all your associates will be working off the same page and as a result messaging will be consistent across all communication channels. Consistent and coherent messaging goes a long way to creating confidence in your institution. Stay strong, be kind to those who need your help, and we will all get through this crisis together.