Supporting CUNA’s awareness campaign is a matter of survival for credit unions. Yes, survival.

Would you be surprised to learn that credit unions’ market share has been flat, hovering around 7%, for the past 30 years? If that surprises you, you’ll probably be positively shocked to learn that many credit union leaders believe that our already-puny slice of the financial services pie could actually cease to exist if we don’t come together now to address the misconceptions that consumers have about credit unions as a whole.

Gone are the days when individual credit unions could stumble along, not worry too much about competitors or innovation, and expect their institution will be okay. That’s not today’s reality. The pace of change in financial services is such that we simply can no longer survive squirreled away in our little niches. Yet none of us is big enough or rich enough to do it on our own. So, as has been the case with so many other successes in our industry, we need to band together in a collaborative way to make some big changes in how America sees credit unions.

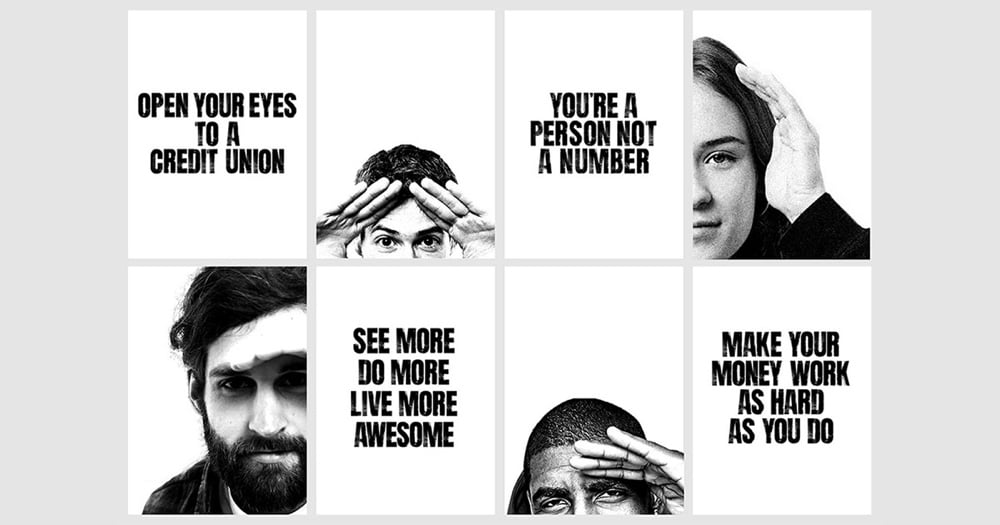

That is what CUNA’s Open Your Eyes campaign is about. The campaign is rooted in research showing that while 92% of consumers have heard of a credit union, 72% aren’t likely to consider using a credit union. That’s because: 1. they think we’re not everywhere, so it would be hard to get to their money; and 2. they think they can’t join.

You and I know those things aren’t true. But, no matter how effective our individual brand marketing is, it can’t effectively reverse those misconceptions which are at the heart of the “consideration problem” we all face as credit unions.

Unlike many marketing programs which seek to boost immediate sales, the Open Your Eyes campaign seeks to boost the credit union category over the long term – creating new perceptions and new memories about credit unions among large numbers of people over a long time. The campaign needs to be sustained over time because we don’t buy checking accounts or mortgages like we buy groceries. It might be a year, two years or even longer before a person makes a major financial decision. And when they do, we as credit unions need to be right at the front of their mind so they come and check us out.

There are lots of other issues affecting credit unions that I’m truly passionate about resolving. D.E.I. (diversity, equity and inclusion) is right around the top. But, guess what? None of that matters if we’re out of business. Providing substantive support of CUNA’s Open Your Eyes initiative is one of the smartest moves any credit union executive can make to ensure that the movement survives and is able to continue transforming lives and making the world a better place.