The future is now: Digital applications are key to survival in 2020

The coronavirus pandemic is impacting everyone. Above all else, our thoughts are with those who are sick, as well as with our healthcare workers and first responders who are on the front lines fighting this terrible virus.

And while the emotional toll this pandemic is taking on individuals and communities can’t be overstated, neither can the impact it’s having on businesses all across the country and around the world. This pandemic has escalated importance of remote-access and/or “touchless” transactions as the key to the vitality of organizations moving forward. If you are an organization that relies on in-person exchanges of goods and services, you are an organization that’s severely impacted by this virus – from the nail salons, retail storefronts, entertainment, dine-in restaurants, to travel…. The list goes on and on.

However. If you are a credit union that CAN leverage technology to keep business going, but you are not currently doing so, you’re putting members and employees at risk – as well as risking future health and success of your organization.

The pandemic is a wake-up call for us all on so many levels, but especially for the business community, and specifically the credit union industry, in how we leverage technology to serve our communities. This is an opportunity to re-think processes to ensure the health of our community and the growth of our organizations into the future. Make no mistake, COVID19 is terrible. But the current situation presents an opportunity for digital transformation of our industry – and ultimately improved service delivery.

And while many credit unions are, in fact, still relying on paper forms and applications, even the CUs that have switched to digital forms are facing some challenges.

How do we address this? Now more than ever, it’s important to consider the value of moving to an (improved) online solution. Simply stated: if you don’t have digital account and loan application solutions in place, what is your plan for survival in 2020? This was nicely explained in April 8 post on The Financial Brand(TFB), authored by Jim Marous, TFB co-publisher when he said: “Unless your organization is prepared to not open another new checking, savings account or loan relationship for the foreseeable future, now is the time to …. convert all back office operations to support new digital relationships using digital technologies and seamless integration.”

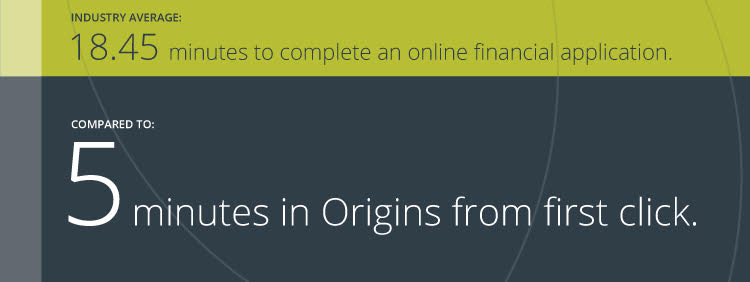

Need more supporting data before you act? Consider this. First Service Credit Union (Asset size: 760 million) in Houston, Texas, was the first to pilot and launch Origins for online account opening and loan applications in 2018. They established the eCU Technology CUSO to offer these digital solutions to other credit unions in 2019.

What do your March numbers look like? And what are your projections for Q2 of 2020?

ECU Technology is here to equip our customers with the tools and resources to ensure their ability to complete and succeed in a world where remote-access is the bridge and the key to being able to conduct business moving forward.

We’re here to help you, as you work to help your members and your communities.

CONTACT INFO:

Larry Hayes

lhayes@ecutechnology.com

281.705.4841