by Tom Glatt Jr

We have had an amazing response to our post entitledThe Credit Union Membership Growth Problem, a response that has included the submission of a number of questions. Over the next few days we will work to address a few of these questions starting with this one: Are membership growth problems relegated to credit unions of certain sizes? The short answer is…

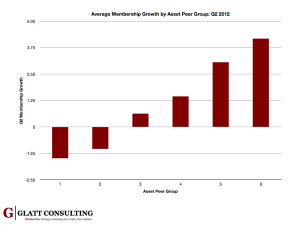

Yes! Before we dive into the details of our findings, however, it will help to shed light on what we mean by size, and what small is relative to large when we talk about size. In this particular case we are using assets to define size, and credit union assets range from approximately $20K to $49B. This is an extreme range, with the largest credit union over 2,000,000 times greater in size than the smallest credit union. Because of the breadth of the size range, it is beneficial to reflect on membership growth amongst like-sized credit unions, averaging growth for all credit unions within certain asset group categories and then comparing the categories to one another. We decided to use the asset groupings created by the National Credit Union Administration to define asset peer groups, which are as follows:

- Group 1: Credit unions with assets less than $2,000,000

- Group 2: Credit unions with assets from $2,000,000 to less than $10,000,000

- Group 3: Credit unions with assets from $10,000,000 to less than$50,000,000

- Group 4: Credit unions with assets from $50,000,000 to less than$100,000,000

- Group 5: Credit unions with assets from $100,000,000 to less than$500,000,000

- Group 6: Credit unions with assets $500,000,000 or more