The role of the branch is changing but it’s importance remains

Today’s financial services environment is characterized by change. Several drivers of change include consumers, technology, and delivery systems. Moreover, financial institutions must change with these elements to remain relevant and competitive in today’s economy. In addition, balancing service to younger and older segments and their preferences for how service is delivered will define success for the financial institution in the future – and keep in mind, that the customer is the judge of service quality.

One of the biggest questions that we hear is, “How do branches maintain their relevance in an increasingly technological age?” Surveys underscore that 60 – 80% of new banking relationships are established through the branch network. Those numbers are even higher for the community based-financial institution. However, once the new relationships are made, regardless of the financial institution’s size, they migrate through a variety of delivery channels, with each customer seeking his or her most comfortable and effective method of interacting with the institution. So…how does the branch fit today and tomorrow?

Omni-channel

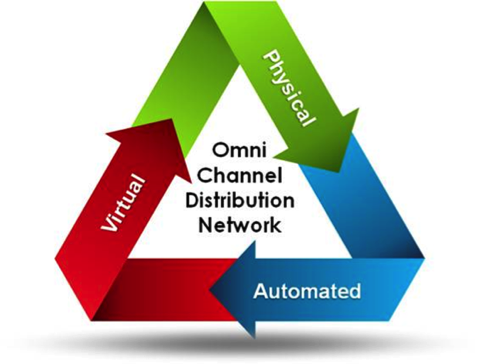

These comments lead to a description of the future distribution system that financial institutions will employ (that is, if they haven’t already started) – the omni-channel distribution network. This network combines physical, automated, and virtual channels into a flexible, consistent customer experience.

Furthermore, the physical branch synchronizes these channels by establishing customer expectations and the institution’s image in the market. The automated channel includes the institution’s ATMs and Interactive Teller Machines (ITMs). These channels are often self-service or assisted-service and can operate 24/7/365, locally. The virtual channels include the phone system, web-based, and mobile platforms. These channels may be self-service or offer some level of assistance and operate 24/7/365…globally.

Evolution of Physical Channels

In the omni-channel network, the physical channel contributes to service density by providing visibility, accessibility, and the institution’s full range of products and services. As always, convenience is a driver in the consumer’s choice of financial institution. Regarding the physical channel, convenience is usually aligned with a habitual consumer commuting pattern between where individuals live, work, and shop.

As the retail branch evolves, it will be developed with a specific target market and “business case” as the motivation. Branches will have a reduced footprint, scaled to meet member demands and styled to match market preferences. Space within the branch will be open and flexible to facilitate change as needed to respond to changing market conditions.

Ultimately, the branch will serve as a location for financial education and advice. The branch must emphasize personal service, and delivery methods will emphasize connection with members. Credit Union personnel will literally be a handshake away from their members. Further, the environment must communicate the products, services, and benefits offered by the institution. It also will showcase a variety of technologies so that once a member is on-boarded, they will have a great understanding of the variety of ways they can interact with their credit union.

Universal Bankers

An increasing number of financial institutions, particularly at the community scale, are opting for “dialog delivery” relying on a universal banker. As the concept’s name implies, the universal banker greets the member at the door and begins a conversation, listening all the while for opportunities to connect member’s needs with the credit union’s abilities. This conversation unfolds in the walk from the door to the teller pod and continues as the transaction takes place. If a need is discovered, the member is invited to join the universal banker in a more private work station to meet the need. If no additional needs are discovered, the member is walked to the door and the process is repeated with the next member.

Scale and Purpose

The branch of the future will be scaled and styled to accomplish several purposes. Many markets will include a cornerstone branch. This office is usually a large format facility staffed by universal bankers and subject matter experts, and additional amenities. This office is the institution’s “statement” in the marketplace.

Community branches are smaller than the cornerstone offices, but offer a similar level of service. They are focused on customer service and sales, staffed by universal bankers, and showcase the institution’s technology and automation. They offer the ability to schedule subject matter experts either by appointment of through an automated or a virtual connection.

Micro branches are often found in storefront locations or leased space. These offices can be transaction focused, but are staffed with fewer employees and more technology to boost efficiency. They are heavy on technology, automation, and branding. Micro branches rely on automated channels to provide most of the transactional capacity, with employees available for sales and service as needed.

Finally the self-service branch is fully automated and heavily branded and has no employees. You can imagine a full-service ATM installation or, more likely in today’s economy, an ITM creating an outpost of service for customers with extended hours capability

Conclusion

Although the role of the branch is changing, retail branches remains an important element in an institution’s omni-channel delivery strategy. As financial institutions evaluate their current networks or contemplate new branches, they must be keenly aware of the market they intend to serve and the business case that supports the decision. In the future, branches will be smaller and will focus on customer service and sale of more sophisticated products and services. The branch will work in a hub-and-spoke relationship with a variety of other delivery channels to offer the customer a wide variety of access points to the institution to deepen wallet share and long-term stickiness with the institution.