The Treasury’s emergency capital investment plan is a real boost to 85 credit unions

In December 2020, as part of its COVID relief package, Congress created the Emergency Capital Investment Program (ECIP) to encourage low- and moderate-income (LMI) community financial institutions to augment their efforts to support small businesses and consumers in their communities. The program is limited to Community Development Financial Institutions (CDFIs) and Minority Depository Institutions (MDIs).

Treasury formally launched the ECIP in March 2021, by posting an application form, instructions, and other program materials. To qualify for a capital investment under the ECIP, an applicant was required to complete an ECIP application form, which included four questions designed to ascertain the applicant’s responsiveness to community needs and its capacity to execute on a lending plan for its LMI communities. Credit union applicants were also required (1) to be low-income designated credit unions (LICUs) and (2) to gain approval from the NCUA to issue subordinated debt.

At the time of ECIP’s passage, Congresswoman Maxine Waters remarked upon its priorities:

“This Congress, my Committee has prioritized the importance of diversity and inclusion, seeking ways to ensure the financial system is more inclusive and gives a fair chance for all consumers to own a home or start a small business … A good example of this is our work on minority depository institutions (MDI) and community development financial institutions (CDFI), which are financial institutions that play a critical role as lenders in low- and moderate-income (LMI) and communities of color. These institutions are on the front lines of meeting the financial needs of communities that are disproportionately underserved by traditional financial institutions and are primary lenders to LMI and communities of color, including during the COVID-19 pandemic. CDFIs and MDIs assist minority entrepreneurs that are overlooked by traditional financial institutions.”

A press release from the Treasury Department echoed Congresswoman Waters’ observations, noting that CDFIs and MDIs often make smaller loans and work with borrowers who might require more time-intensive and personalized technical support. The Treasury also trumpeted the expectation “that recipients will multiply the impact of ECIP by leveraging additional capital from private and philanthropic sources to further expand lending to their communities.”

Just before year end, Treasury announced that $8.7 billion will be awarded under the program. This includes awards of an estimated $2 billion to 85 credit unions.

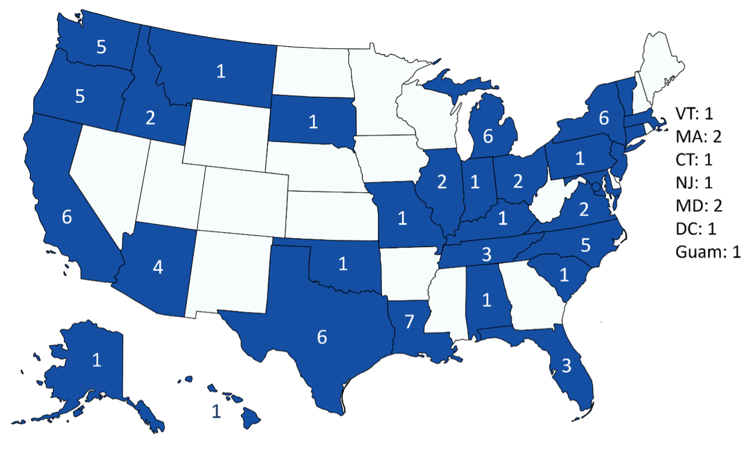

Geographic Reach:

The program’s 85 participating credit unions serve members in 32 states, Washington D.C. and the US Territory of Guam. Seven Louisiana credit unions will receive capital. Six credit unions in each of Michigan, New York, California and Texas are also taking part in the program. The geographic diversity of the recipients of the program is to be lauded as it represents the continued commitment to a true, nationwide recovery from COVID-19. Additionally, it demonstrates much needed investment in, and development of, all regions of the United States, not merely the economic centers. The geographic reach of the program is depicted below:

To better understand the program’s likely impacts, we took a deeper dive into some of the key performance indicators of the credit unions participating in the ECIP.

Asset Size and Member Count:

Treasury awards were granted to credit unions with a mean asset level of $726 million and a median asset level of $275 million. These averages are larger than the national averages for credit unions, for which the mean assets are just over $400 million, but the program remained unbiased in granting money when looking at asset size. By asset level, Suncoast ($14.3B) was the largest credit union to receive an allocation and New Covenant Dominion was the smallest ($1.4M), representing almost the full range of credit union sizes in the country Credit unions receiving capital had an average of 54,289 members. The highest member count is at Suncoast (985,025) and the lowest member count is at New Covenant Dominion (330).

Net Worth Ratio and Loans to Shares Ratio:

Treasury awards were granted to credit unions with a mean and median net worth ratio of 9.81% and 9.11%, respectively. This is lower than the national mean and median net worth ratio of all credit unions which sit 10.24% and 10.61% respectively, indicating that the firms taking part in ECIP are slightly less capitalized than the country’s credit unions taken as a whole. However, it appears that the firms taking part in ECIP do an overall better job of utilizing their available capital to help their members. The loans-to-shares ratio in the group averaged 77%, significantly higher than the national average of just under 70%. This difference in loan-to-shares will be realized in the day to day lives of members as these credit unions are better able to fund peoples’ goals, aspirations, or necessities during the continued recovery from the COVID-19 pandemic.

Designation:

Of the credit unions that received money in the ECIP program, 62 are CDFIs, 5 are MDIs, and 18 hold both distinctions. The federal focus on these designations helps ensure that the money distributed in the ECIP program is aimed at the areas most in need of investment. These designations represent a commitment to helping diverse communities that have traditionally been neglected or ignored by traditional banking, from Sisseton-Wahpeton Federal Credit Union serving members of the Sisseton-Wahpeton Sioux tribe in South Dakota to South Side Community Federal Credit Union serving the south side of Chicago. These designations are not easy to gain or maintain and demonstrate these credit unions’ commitment to their members and the credit union mission of serving their communities.

Where Do We Go From Here?

The Treasury’s ECIP awards are expected to begin funding toward the end of Q1, with the process likely to continue well into Q2. Before receiving its funds, each credit union will be required to execute a package of transaction documents that is yet to be finalized by Treasury.

After receiving its award, each credit union is required to report its quarterly lending data to the Treasury Department for the duration of the program in order that Treasury can accurately measure the program’s impact against its intended objectives.

Co-author – Eli Krahn