by Scott Butterfield

As the year draws to a close, I want to take a moment to share the reasons why I think 2013 will be the year of the low-income designated credit union:

Consumers need credit unions now more than ever

Squeezed by the rising cost of living, a record number of Americans – nearly one in two – have fallen into poverty, or are scraping by on earnings that classify them as low-income. Since the recession began in 2007, the number of working families that qualify as low-income has risen for three straight years to 31 percent, or 10.2 million. There are more low-income families in America today than there as been in the past decade, according to an analysis by the Working Poor Families Project and the Population Reference Bureau, a nonprofit research group based in Washington.[1] Even by traditional measures, many working families are hurting and they need credit unions now more than ever.

Today, nearly one-third of all credit unions are low-income designated for the purpose of meeting the rising economic needs of their local communities

As of this month, the total number of low-income designated credit unions (LICU) has risen to 1,912. Additionally, the overwhelming majority of new LICUs have less than $100 million in assets. More than 80 percent of the newly designated LICUs fall below the $100 million threshold, and the median asset size of new LICUs is $23.8 million.[2] This designation coupled with a focus on serving lower-income consumers is exactly what many in the less-than-$100 million crowd need to grow membership and loans.

The underserved demographic represents the best opportunity for credit unions to compete for loans and win. Lower-income individuals and families have loan needs that are not being met by traditional financial institutions and even many credit unions. Simply stated, this group needs and wants what credit unions have to offer.

Loan growth is a challenge for a majority of small- to mid-sized credit unions.

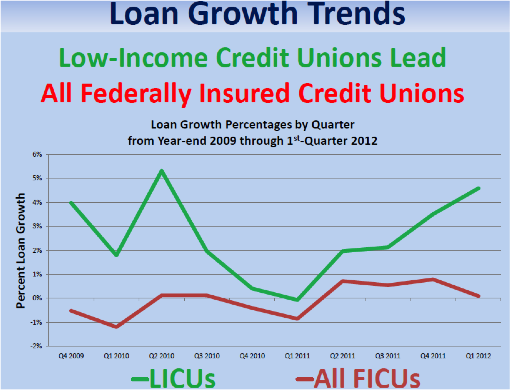

According to the CUNA Economics & Statistics Mid-Year 2012 Summary of Credit Union Operating Results (September 18, 2012), credit union loan growth is positive and this is good news. However, it’s important to note that most of the loan growth is coming from larger credit unions, those with assets of more than $100 million. Loan growth for credit unions with less than $100 million, about 80 percent of all U.S. credit unions, is still very flat. However, this trend is different for low-income designated credit unions. On June 15, 2012, NCUA Chair Matz reported at the National Federation of Community Development Credit Union Annual Conference (see table above) that loan growth among low-income designated credit unions is growing at a faster pace than all federally insured credit unions.

LICUs have access to secondary capital and other special benefits – most importantly:

- The power to raise secondary capital

- Exemption from the cap limiting member business loans to 12.25 percent

- Access to the NCUA Community Development Specialists

This is probably one of the best kept secrets in credit union land…LICUs have been utilizing secondary capital for years! In fact, thanks to the National Federation of Community Development Credit Unions, the NCUA and the U.S. Treasury, 48 credit unions received $70 million in secondary capital as part of the 2010 Community Development Capital Initiative.

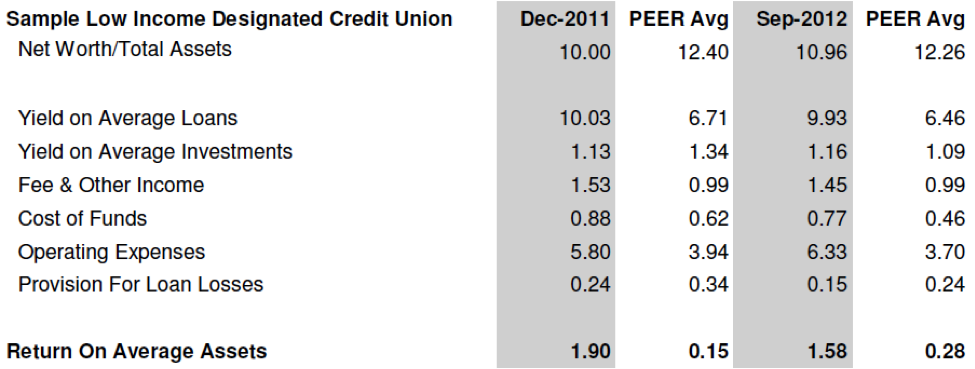

While different, the LICU business model works. Credit unions are in the risk business. Like anything other strategy we pursue – mortgage, indirect auto or MBL – serving the underserved requires a solid business plan and appropriate steps to mitigate risk. As you might guess, delinquency and operating expenses are typically higher at a low-income credit union. However, what you might not suspect is just how much higher their average loan yield and fee income is. You might also be surprised to learn that their loan losses tend to be closer to peer. To illustrate the difference between a LICU and traditional credit union model, I have included NCUA FPR key ratios for one of my LICU colleagues. The credit union listed is in the $10 to $50 million asset category. These results are typical for the LICUs I work with:

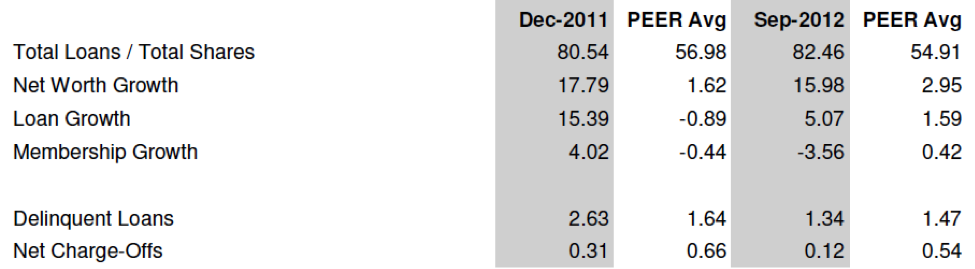

Here are a few more noteworthy ratios:

This credit union’s operating and delinquency ratios are higher. Serving lower income consumers cost more. More one-on-one counseling sessions, more hand holding, and more collection activity. But at the end of the day, these higher expenses are more than offset by exceptionally high loan yields and fee income. The fact is, the low income service model works.

Purpose-driven LICUs really matter

Successful LICUs are more relevant to the needs of their communities. They grow and prosper, and make a significant social impact in the lives of their members and the community. These credit unions take credit union relevancy to a much higher level. This is so much more than providing the lowest loan rate in town to consumers who can qualify for a loan just about anywhere. Purpose-driven LICUs are relevant, having social significance andhaving some bearing on, or importance for, the real-world issues facing their communities. In 2013, newly established LICUs will be busy planning, developing and implementing new strategies while hundreds of non-LICUs will be investigating whether or not the model makes sense and whether or not they may qualify.

For more information on low-income designation, visit:

http://www.cdcu.coop/i4a/pages/index.cfm?pageid=365#NCUA_TA

http://www.ncua.gov/about/Leadership/CO/Pages/OSCUI.aspx