Banking built for Black America. Queering banking for the better. Banking for environmentalists. Financial services companies that target specific consumer demographics or interest groups seem to be becoming a “thing” these days.

If that sounds downright, well, credit union-y — hey, it is! Just as credit unions were originally founded to serve an affinity group—like schoolteachers, farmers, or members of a church—there are a number of new financial services companies that have recently embraced this approach, though in a less localized way.

For years now, many credit unions have been focused on broadening their membership, expanding beyond SEG groups and into new regions, and sometimes merging with or acquiring other credit unions along the way. But at what point does the breadth of a credit union’s membership begin to detract from its unique value proposition? At what point does a credit union become a Jill-of-all-trades and a master of none?

After all, targeting a specific demographic or affinity group can make a lot of sense. With it, comes the ability to:

- Deeply understand—and serve—the people who rely on your financial service.

- Innovate and scale up new programs and products more quickly and efficiently

- Build a staff that closely aligns with the needs of the member community

- Say “no” to opportunities that don’t meet a core need of your narrow target audience

That’s not to say every member of demographic X will be a carbon copy of the next, but there are often commonalities that make it easier and more efficient to meet their specific needs and prioritize your efforts accordingly. Interestingly, as many credit unions have been focused on expansion beyond SEGs and affinity groups, new financial institutions are cropping up with an explicit mission to serve targeted demographics.

Why is this? Well, as my mentor and the founder of one of the largest executive coaching companies in the small business space used to say, “Strategy boils down to one word: Focus.” If your strategy doesn’t help you to focus, then it’s not really a strategy – it's just a bunch of complicated words. That’s why I believe we are seeing the growth of these affinity-based banks right now.

Here are a few to consider. Interestingly, none of them are true financial institutions; instead, they partner with a bank for some of their services and to allow their members access to FDIC protection on their funds.

First Boulevard

Positions itself as: Unapologetic Banking Built for Black America.

Mission: To empower Black Americans to “take control of their finances, build wealth and reinvest in the Black economy.”

How it evolved: According to this article from TechCrunch, like many of the digital banks that target the Black community, First Boulevard was ignited by the murder of George Floyd. Its co-founders, Donald Hawkins and Asya Bradley, see it as the answer to what Black Americans “really needed to get out of a vicious cycle.”

The founders both had fintech experience and knew there was room in the marketplace for their idea: At the time of their founding there were only 19 Black banks in the United States, with collective holdings of roughly $5 billion. As of early February 2021, First Boulevard had attracted at least $5 million in funding.

Tailored products and services: According to the TechCrunch article and First Boulevard’s website, First Boulevard plans include:

- Cash Back for Buying Black™ program will help members earn up to 15% cash back when they spend money at Black-owned businesses.

- Guidance in building generational wealth by connecting members to wealth-building assets—such as money market accounts, high-yield savings and cryptocurrency.

- Inclusive hiring that reflects the community it serves: The staff at the time of the TechCrunch article was 60% Black and 85% Black, Indigenous, and People of Color (BIPOC). Its leadership team was 66% women and 100% BIPOC.

Credit union equivalent: Black-owned credit unions have offered Black Americans alternative ways to save and borrow for more than a century. Today, there are fewer than two dozen across the country (check out this article in Shoppe Black for the complete list), but many, like Hope Credit Union, DC Credit Union, and St. Louis Credit Union, continue to champion financial equity and offer products tailored to the needs of underserved communities.

Daylight

Positions itself as: “Queering banking for the better” and a “Bank account that rewards you for spending in line with your values.”

Mission: To build a more equitable financial life for LGBTQ+ folks and their chosen families.

How it evolved: According to TechCrunch, Daylight is headed by three LGBTQ+ entrepreneurs and has secured $5 million of seed funding as of June 2021. It estimates its potential member population at 30-million-plus Americans and plans to build an LGBTQ+ marketplace and a platform that offers discounts and rewards for shopping at merchants who support the queer community.

Daylight also strives to help this community deal with debt factors other communities don’t have, especially related to health and gender transition expenses.

Tailored products and services: Daylight’s website highlights the following offerings it plans to roll out:

- A spending tool that helps the user see how queer-friendly their spending is, plus up to 10% cash back for spending at queer bars and LGBTQ+ allied businesses.

- A Visa card in their chosen name—which could be different than their legal name.

- Content tailored to LGBTQ+ people—“not just ‘friendly’ to them.”

Credit union equivalent: Superbia describes itself as a new financial marketplace made for our LGBTQ community with a mission to eradicate systemic LGBTQ discrimination and accelerate our inclusion and equality. It plans to open the first-ever credit union to serve the national LGBTQ community when it opens later this year (pending regulatory operational approval).

Aspiration

Positions itself as: A resource that “…helps our customers spend, save, and invest with a conscience so you can make money while making the world a better place.”

Mission: Here for You, Not Just the Few. Big Banks and Wall Street work their hardest for the wealthiest few. At Aspiration, we work to bring the best financial solutions to everyone.

How it evolved: Aspiration was founded in 2013 and opened for business in February 2015. As stated on its website, “We didn't set out to build a bank. We set out to build a better world.”

Tailored products and services: According to its website, Aspiration offers:

- The promise that members’ savings and debit card purchases will never be used to fund the oil or coal industries.

- “Plant Your Change”—the ability to eliminate your carbon footprint by planting trees.

- Automatic offset of carbon dioxide from every gallon of gas purchased with their Aspiration Plus credit card.

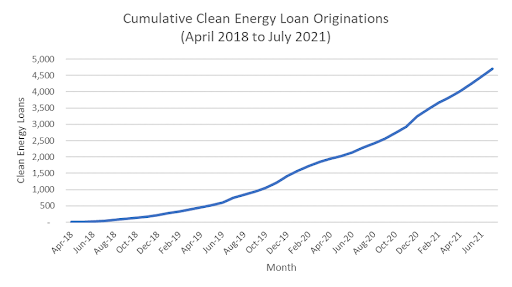

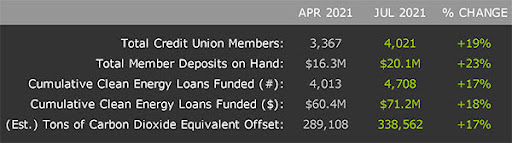

Credit union equivalent: Clean Energy Credit Union was founded in 2018 and focuses solely on providing loans that help people afford clean energy products and services such as solar electric systems, electric vehicles, home energy efficiency retrofits, electric-assist bicycles, and net-zero energy homes. Its vision is a world where everyone can participate in the clean energy movement. In just three years, it has made over 4,700 clean energy loans and grown from zero to over $20 million in assets. It grew its deposit base by $4 million in the second quarter of 2021 alone.

They track their progress publicly in their scorecard, which captures their membership, deposits, loans funded, and carbon dioxide offset:

Will these affinity-based financial institutions succeed?

Over a decade ago, Ron Shevlin, Director of Research at Cornerstone Advisors, asserted in The Financial Brand that “affinity-based banking (or credit unioning) won’t work. It’s been tried before — remember the Women’s Financial Network? Or Bank Blackwell? Just because a group of people share an affinity for something like golfing or Harley-Davidsons, it doesn’t mean that their financial needs are similar.”

He might have a point. Yet while these financial institutions are still quite young, and their success is not guaranteed, we think there are lessons to be learned from all of them. Here are some of the questions affinity-based banks can inspire credit unions to ask:

- Can you offer targeted cash-back credit card rewards for certain kinds of businesses that are aligned with your members’ values?

- Do your hiring practices matter to your members, and does your staff reflect your community?

- Can you offer an inspirational deposit product targeted directly to certain kinds of loans, like green loans or loans for BIPOC and/or women-owned businesses?

- Can you help members see if and how their spending is supporting the types of businesses they believe in?

- Can you boldly and transparently communicate that member deposits will never go to funding oil or coal projects?

- Can you share a public scorecard of your growth and progress that incorporates social impact metrics?

Am I suggesting that credit unions stop expanding or adopt an affinity-based model? No. But I am suggesting that you think carefully about your core focus, your differentiators, and your target audience(s), as well as what you can learn from these innovative new financial institutions when it comes to creating greater focus in your positioning and products.

Members of a specific demographic often do face similar financial challenges, and a financial institution that’s uniquely motivated to create products and services tailored to their needs can drive innovation and inclusion in the financial industry at large – a worthy goal to which all of us can aspire.