Understanding acquisition models: Cloning Model vs. Response Model and what’s best

For the acquisition of new customers, it is vitally important to identify which neighborhoods and which households to target and which neighborhoods to avoid all together in a branch footprint—even if a good prospect has been identified. There are two popular models that can be extremely beneficial in the process, if used correctly.

With the introduction of sticky products, onboarding/cross-sell, and most institutions’ desire to gain more share of wallet, customer and household attrition rates have slowly started to creep down. Meaning fewer prospects are in transition looking for a new financial institution.

Typically, acquisition strategies are very expensive and require a large commitment from a financial institution. Acquisition strategy spends are also the only form of mass media that is scrutinized down to the last penny/cost per net new account because it is the only form of mass media that is virtually 100% trackable.

But if done correctly, these activities can equate to a 15%-50% lift over a baseline or a 60%-110% lift over a non-mailed control in new retail checking accounts, which is matched by no other form of media.

Keys to Successful Acquisition Programs

There are 6 keys to a successful acquisition program

- Science

- Frequency

- Product

- Offer

- Prospect

- Sales Culture

This article focuses on the Science and identifies which modeling process would best suit the situation.

Two Types of Models

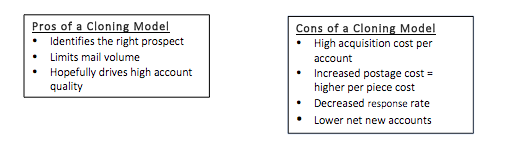

Cloning Model: The process of a cloning model (and all models should) starts with current customers or a subset of current customers viewed as ideal or the most profitable.

A third party data provider would then append roughly 1,000 different data characteristics to these customers and identify the attributes they all have in common. These data elements range from affluency data to response data, hobbies, interests, and even philanthropic data. These data elements are then appended to prospects within a defined radius of each branch for marketing via direct mail.

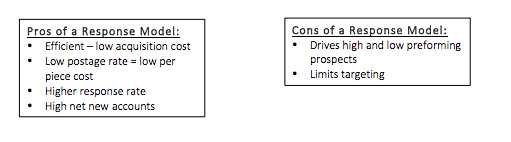

Response Model: Similar to the cloning model, this process starts with current retail checking account households. These households are then analyzed at a carrier route or zip+2/zip+4 level.

For this model, the group of households is then looked at for many different characteristics including (but not limited to) market penetration, distance to branch, recency of activity in the last 3, 6, 9, and 12 months, competitor location, and drive/commute times.

The “areas” are then ranked from the very best to the very worst in a given radius. This makes it easier to identify the point at which it is no longer still efficient to mail deeper into the model.

Many different acquisition companies typically specialize in one of the two processes outlined above, and some will claim their cloning model takes into account response data. But the only way to truly have the best of both worlds or “have your cake and eat it too” is to engage a partner that will truly run both models to maximize mailing results.