Understanding your most valuable members with a multi-dimensional view of member engagement

Here’s some bad news and good news.

The bad news (which comes as no surprise): the U.S. is officially in an economic recession. The good news?

Following every economic crisis, from the Great Depression of the 1930s to the Great Recession of 2008, credit unions have increased both their membership numbers and the quality of those relationships. In fact, credit union membership has grown steadily during the last decade since the last economic collapse and has created a new challenge in itself:

How can credit unions better understand their membership in order to identify the most valuable engagement behaviors and develop strategies around them?

At a high level, the three prongs of an engagement-driven approach include:

- Identifying your most-engaged members

- Reactivating your least-engaged members

- Acquiring the “right” new members

What is Member Engagement?

The term “member engagement” can mean different things to different credit unions. Often it is viewed through the lens of narrow, single measure, such as the number of relationships or income generated. At CU Rise Analytics, we believe it must be specifically defined, and take a multitude of factors into consideration.

With a standard view of member engagement, a member with a sizeable mortgage loan or CD might receive top billing. The income generation would classify them as a valuable member, but in reality, it doesn’t reflect how much interaction is actually occurring between the credit union and member.

When factoring other criteria, a highly-engaged and valuable member may look a lot different. It might be a member with just a checking account, but this member has multiple ACH/POS transactions, regular payroll deposits, and uses online banking frequently. Every time the member transacts, the credit union’s brand is reinforced, and loyalty is built incrementally. When there’s a need for a new banking solution, the credit union will be top of mind.

On the surface, member engagement is a simple idea – but a more complex analysis is needed to fully decipher it. Insights need to be derived from a complete look at transactional, operational, and behavioral data. Quantifying it requires a more sophisticated approach that includes defining the variables and building a statistical model to perform the analysis.

The picture of engagement should include a view of relationships, type of relationships, number of transactions, channel usage and length of association. It won’t be a single indicator like profitability, but a deeper look at the touchpoints and interactions that determine a member’s value.

So far, the CU industry lacks a sophisticated mechanism to enable this multi-dimensional approach.

A New Way to Analyze Member Engagement

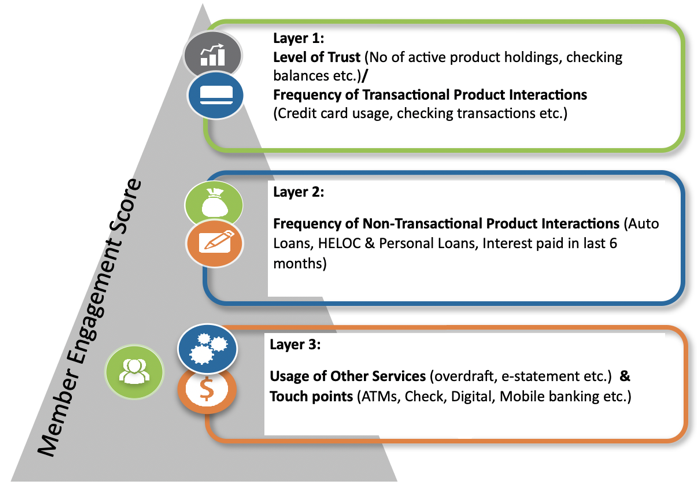

The data scientists at CU Rise Analytics built a highly comprehensive engagement calculation model to address credit unions’ need to understand member engagement more deeply. It looks at products as transactional or non-transactional, and considers the monetary value of transaction types. For example, mortgages and direct loans are considered non-transactional because of the low number of transactions. But, the monetary value of each mortgage transaction is high, so that factor is weighted.

Using these classifications, the following graphic depicts the layered approach to member engagement.

This model helps to quantify an engagement score for each member. Demographics are also factored, and every variable is assigned a weight in order to arrive at a cumulative score. Based on each member’s unique engagement score, they can be further classified into segments.

One Credit Union’s Five-Segment Approach

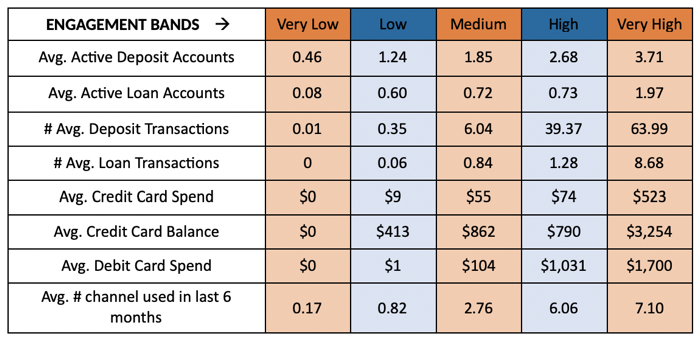

A credit union with more than 30,000 members wanted to understand its member engagement. They classified their members into five different engagement bands using a multi-dimensional engagement model:

Members in the ‘very high’ engagement segment have the highest average deposit balance and are transacting higher amounts compared to members in other engagement bands. However, members in ‘medium’ and ‘high’ bands have an almost equal number of loan products and loan transaction size. Members in the ‘very high’ segment have almost double active loans and are more deposit engaged than ‘high’ band. This shows that nearly 2-3% members falling into ‘very high’ band are “the best” members.

At the other end of the spectrum, the least-engaged members don’t have checking accounts, maintain primary accounts with other financial institutions, and are largely inactive. These members have the highest chance of attrition. The credit union can now target them with appropriate measures to re-engage them and increase their interaction with the credit union.

The credit union is currently working on building personas and crafting targeted, relevant strategies to move members from less-engaged into more-engaged scoring bands. They are also taking action to preserve and strengthen their most-valuable relationships. They are now in a position to:

- Quantify engagement and segment members accordingly

- Create personas to more deeply understand “ideal” members

- Develop a channel strategy that improves interactions

- Build out a three to five-year engagement-driving roadmap

From Complex to Simple

Once you have a system in place to deliver complex and complete insights around your member engagement, making important strategic decisions becomes easier, quicker and more clear. This more sophisticated approach may completely redefine the way your credit union perceives what’s truly valuable.