Using probabilistic revenue strategy for effective onboarding

by. Kesna Lawrence

Building long-term relationships of loyalty and trust with your account holders is the essence of good business, and the relationship begins when you bring on new customers, a process known as onboarding.

Through effective onboarding, the financial institution introduces the new account holder to the company, thereby taking advantage of the critical honeymoon period to discover their needs and expectations.They establish a preferred channel of communication and, in general, to get the budding relationship off to a solid start. And a fundamental part of that relationship is the ability to determine the right products and offers to promote to which account holders.

The good news is that the tool now exists to make those decisions with precision, using customer and product data to calculate the expected revenue from a particular marketing choice before the first contact is even made. The tool: Probabilistic revenue strategy.

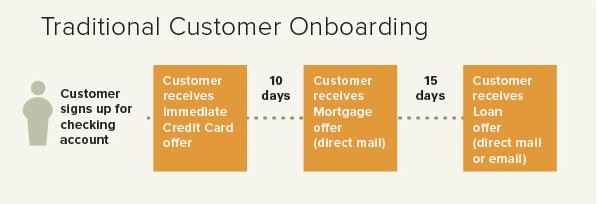

Traditional onboarding is based on a “shotgun” approach: shoot out the same promotion to a large number of customers who may or may not be in the market for the product and who may or—more likely—may not respond. Besides being an inefficient use of resources, the shotgun approach risks breaking customers’ trust by bombarding them with what feels like a barrage of irrelevant advertising. This can be particularly damaging in the first 90 days when the customers are still forming their opinions about the financial institution to which they’ve just entrusted their money.

continue reading »