Wholesale remedies for your funding blues

For much of 2018, locking in deposits was top of mind for financial institutions. The general consensus was that rates would continue to increase throughout the year. In anticipation, financial institutions rolled out a slew of CD rate specials, high-yield money market accounts and online deposit-gathering portals. However, after four rate increases in 2018 and a fear of stalling the economy, the Fed has now hit the pause button. The Treasury Yield Curve has become inverted for the first time since the financial crisis, causing market watchers concern about the future prospects of the economy. Furthermore, a general consensus has emerged that the Fed will, in fact, lower interest rates by the end of the year. This rate uncertainty is causing financial institutions to rethink how to best continue funding their balance sheets.

Overall, financial institutions’ cost of funds rose substantially over the past year. Specifically for community-sized financial institutions, they saw median cost of funds rise from 52 bps in Q1 2018 to 81 bps in Q1 2019. This increased cost of funds has produced a strong year-over-year median deposit growth of roughly 5.5 percent for Q1 2019, outpacing median loan growth of 2 percent for the same time period. This highlights the degree of urgency for most financial institutions in growing deposits throughout 2018 and the first quarter of 2019. It is also the cause of stress for financial institutions when facing the current yield curve and Fed probability chart.

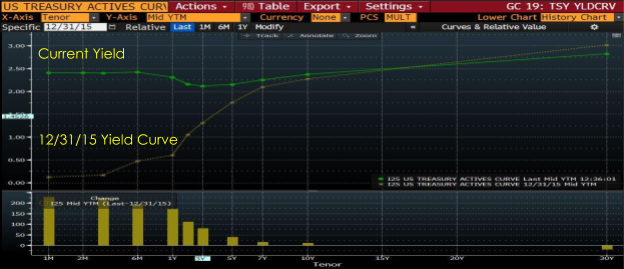

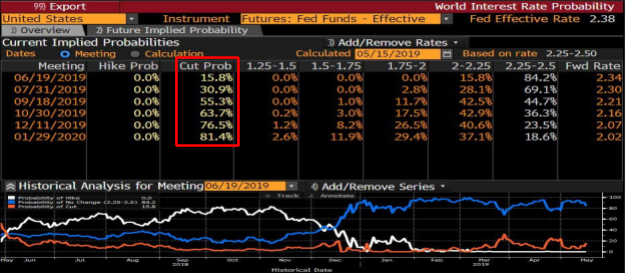

Depicted in Figure 1, the current yield curve is inverted from six months to 10 years, eliminating investor risk premium for making duration investments. Furthermore, looking at the Fed probability chart (Figure 2), financial institutions are hesitant in offering term deposits due to a growing consensus that the Fed will cut interest rates toward the end of 2019 or early in 2020. With these dynamics, financial institutions with strong loan growth find themselves between a rock and a hard place. How do they effectively fund their balance sheet?

Managing funding costs and maintaining deposit stability are key themes for 2019. Outside of maximizing core depositors and reaching new retail depositors, wholesale funding strategies are not only relevant, but necessary to compete. Wholesale funding allows financial institutions to aggregate large groups of deposits to recreate stability up and above their core. Additionally, these sources provide “quiet” funding, allowing financial institutions to segment depositor groups and control marginal costs of funds without cannibalization. It is important to note that not all wholesale funding sources are the same. Proper vetting is required prior to engaging wholesale sources to define the dynamics of the underlying depositor, such as credit standards, investment policies, associated cash flows, etc. This process allows a financial institution to understand the depositor’s behavior and how they will react during changing credit cycles.

With increased competition for depositors and interest rate uncertainty, financial institutions are finding themselves hard pressed to implement the “correct” deposit gathering/retention strategy. When used appropriately, wholesale funding sources can create stability and provide diversification. Understanding the unique characteristics of wholesale sources is paramount to successful integration and should be conducted prior to receiving deposits.