If you’re a woman, the stats say you’re 43% more likely to end up in poverty during retirement than men. The factors contributing to this are complex and often misunderstood. And, if you are a woman, you are likely to lose out on a half of million dollars in income over a 40-year career compared to your male counterparts.

I’ve been identifying and fighting causes of what holds women back most of my life and as the CEO of Summit Credit Union, our entire focus is on helping women and their families avoid poverty, and instead excel, by understanding and addressing in a variety of ways what drives this outcome.

(A special thanks to Tansley Sterns for highlighting Summit’s expertise in her article in CUInsight, “More than my husband’s wife.”)

There are three simple yet impactful changes you can make at your credit union that will help women and their families.

The first thing to know: poverty in retirement can happen to anyone, including you, your spouse, your mom, sister, daughter. As leaders, there are two fairly easy steps you can take in your hiring practices to help the situation.

1. Eliminate negotiating starting salaries

Put together a good offer to a candidate and let them know your policy is to not negotiate starting salaries. Women are statistically less likely to negotiate salaries. This can hinder their earning potential and put women behind men in similar roles from day one. Even a $3k difference in starting pay that continues over a 40-year career could create a retirement savings gap over $1.5 million dollars. Surprising, isn’t it? There are many courses offered to help women negotiate—Summit offers them too—but if we know it is a skill many women are not comfortable with compared to men, then let’s stop trying to change them.

2. Refrain from asking candidates what they are currently making

There are states that do not allow employers to ask this already, but most states have not taken that step.

Why does asking this simple question contribute to the pay and lifetime earnings gap? Let me demonstrate how this works. Say a position you’re hiring for has a salary range of $55,000-$75,000. You have a great candidate, and HR asks what she’s making in her current position. Her response is $50,000, so you offer her $57,000—about a 15% raise. But what if a male candidate answered $60,000, and you offered $67,000—a lower increase at 11.6% raise. Both starting salaries are in the position’s salary range. The percent increase is higher, but the man is earning $10,000 more per year. For the man in this scenario, raises are bigger, bonuses are bigger. Retirement fund matches are bigger. The gap gets unintentionally larger.

Addressing the gender wage gap is essential not only for women's financial security but also for our economy and community well-being. If the wage disparity between genders were eliminated, there would be an additional $540 billion available to working women and their families to allocate toward student loan repayments, mortgage payments, childcare expenses, prescription costs, groceries, emergency needs and more. Given that 70% of U.S. mothers are the primary financial providers before their children reach adulthood, closing this gap is a must for the overall well-being of future generations.

The World Economic Forum estimates it could take 134 years to close the global gender pay gap. We don’t have that kind of time. I encourage credit unions to lead the way in eliminating pay practices and publicly share their pay data. It will lead to fair outcomes for everyone and improve the financial health of our 140 million members.

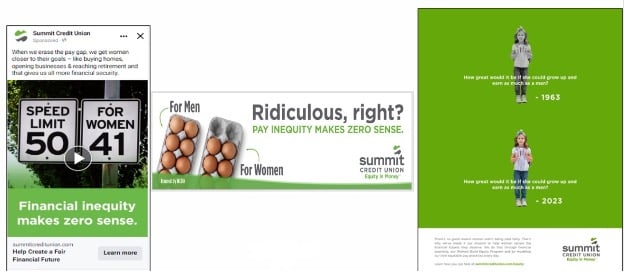

We started the pay practices challenges with an advertising campaign several years ago, highlighting financial inequity through metaphors and analogies. Our aim was to inspire and continue conversations around the wealth gap, advocating for financial equity and wellness so everyone in our communities can thrive.

3. Track and publish compa-ratio information

We also share our employment data on our website. While our numbers do not always show where we’d like to be, tracking and transparency is important in closing gaps where needed. The reasons for the pay gap are complex and varied, including career choices and societal messages. The good news is that as leaders we can all make these three changes to close the gap one person at a time, securing a stronger future for the women in your life.