The 35-day government shutdown affected credit union members across the country. While they waited, wondering how long it would last, businesses and other organizations jumped in to assist with offers of free meals, services and other help.

Within days of the shutdown, credit unions were doing what they do best, helping people. When members were affected, credit unions throughout the United States began proactively announcing programs designed to ease the burden of not receiving a paycheck.

In the true spirit of the CUNA-League system, we began looking at ways to help get the word out to members, media and government officials in order to make known what options credit unions were offering to assist. Associations and leagues used all available platforms to spread the word. Social media, traditional public relations outreach and direct contact with legislators were all employed. CUNA began collecting information from the states, creating a clearinghouse of information that listed credit unions and what they were able to offer to help their members survive the shutdown. That landing site became a vital source of information for communicating with government officials looking to tell constituents where to find help.

Successful outreach stories started rolling in:

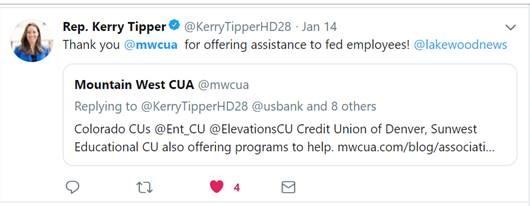

- In the Mountain West Credit Union Association’s region (Arizona, Colorado and Wyoming), media releases were sent out detailing the programs implemented by the region’s credit unions. Those lists were picked up and included in stories on the news sites. From there, they got the attention of state legislators.

- The Credit Union Association of the Dakotas (CUAD) sent press releases and engaged social media outlining what credit unions were doing to help. Additionally, they issued a joint statement/press release with two North Dakota state bankers’ associations urging consumers to contact their local financial institution for assistance. CUAD CEO Jeff Olson testified on behalf of credit unions in the North Dakota State Legislature, which gave the opportunity to say firsthand what financial institutions were offering. In South Dakota, Olson and Jay Kruse, CUAD’s Chief Advocacy Officer, spent time on the floor educating lawmakers on the actions credit unions were taking to support their members.

- The New Jersey Credit Union League reached out on multiple fronts. They used their existing communications vehicles and social media to run stories they generated. Additionally, they proactively encouraged their member credit unions to share their efforts in order to gather and promote them. Finally, the League included stories in their newsletter specifically targeted to lawmakers and reached out to elected officials as opportunities arose.

- The Carolina’s Credit Union League’s Advocacy team injected the availability of credit union assistance into regular conversations with legislators. They also tagged legislators on related social media posts which proved successful. For example, after posting about credit unions offering shutdown assistance on Facebook, their post was shared by SC Senate Majority Leader Shane Massey.

- The Heartland Credit Union Association (Kansas and Missouri) heard directly from Congressman Emanuel Cleaver’s staff (D-MO District 5) when they reached out to the Association for help in highlighting how credit unions were helping in the Kansas City region.Together with Congresswoman Sharice Davids (D-KS District 3), Cleaver held a joint news conference promoting the groups that were helping government workers. Credit union representatives joined the news conference and spoke about credit union assistance programs. The efforts garnered a lot of press coverage that helped get the word out.

- The Maryland & DC Credit Union Association has strong relationships. That foundation gave them the platform to advise every member of the DC Council, Maryland General Assembly and the Maryland and DC Congressional delegation of what credit unions were offering their constituents impacted by the shutdown. Because of their relationship with Congressman Anthony Brown (MD), the Association was invited to participate in a town hall for his constituents. The message spread from there, reaching other members of the delegation including Representatives Jamie Raskin(who hosted a Facebook Live with MD|DC CUA)and Dutch Ruppersberger(town hall).

And these are just a few examples of league advocacy efforts yielding political support and promotion for credit unions nationwide! If you’d like to know more about how your league advocated on your behalf during the shutdown, reach out to your league president, and I’m sure they will be more than happy to share.

Credit unions across the nation rallied to do what is at the core of our movement, help members achieve financial stability. And our movement is poised to help yet again, should there be another need. It’s in our DNA. It’s what sets us apart.