Don’t miss the boat – Why credit unions need to digitally transform now

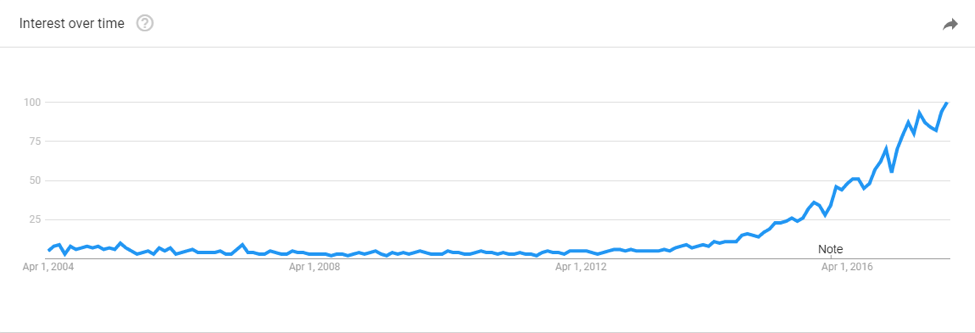

The term “digital transformation” has been a very hot topic recently, creating new conversations and products across a wide range of industries. This chart below, via Google Trends, displays the worldwide popularity of the phrase “Digital Transformation” in web searches since 2004. As shown in the graph, after remaining stagnant for over a decade, the term’s popularity has exploded in just the last year or so, raising questions about what this means, and how it will impact your organization.

An accepted definition for digital transformation is, “the application of digital technologies to fundamentally impact all aspects of business and society”. The important part of this definition is to realize that digital transformation does not mean just building a website, a mobile app, or obtaining a data warehouse. It means using your digital technology to transform your business processes. It means shifting your company culture to take advantage of your digital data to make informed data-driven decision and stay ahead of the ever-changing expectations of your members or customers.

Competing on Member Experience

The financial services industry is particularly affected by this sweeping conversation. Credit unions are not only competing against big banks and the thousands of fintech startups disrupting the traditional business model, but they are competing with the high-tech/high-touch experiences provided by dozens of other companies that members are interacting with every day. Can your credit union match the experiences offered by other companies your members may be regularly interacting with, such as:

CVS Health

- Opened a digital innovation lab in 2015 to develop cutting-edge digital services and personalized capabilities

- Offers unique interaction options such as digital prescription and insurance card scanning

- Customers can take advantage of curbside pickup through mobile app usage

Starbucks

- Instead of just a mobile app, Starbucks built an “end-to-end consumer platform anchored around loyalty”

- Mobile Order and Pay app so they stay top of mind, upsell orders, and customers can avoid lines and feel appreciated

- Starbucks utilizes data obtained from the app to better understand customers, their desires, and make better business decisions.

Domino’s Pizza

- Internet of Pizza – A free web platform that enables developers can build connectors to digital devices and services

- You can now order pizza through digital channels including Google Home, Facebook Messenger, Apple Watch, Amazon Echo, Twitter, and text message using a pizza emoji

- Digital customer loyalty program to incentivize digital interaction and re-orders

- Domino’s Tracker – Watch in real-time as your pizza is made and delivered to your door

Can a member at your credit union expect this same type of digital interaction? These companies understand that they need to digitally transform, constantly, to meet the growing needs of their customers. Therefore, they build significant customer loyalty as a result of using their data to serve customers/members.

When prospective members expect this type of high touch digital service for something as simple and trivial as ordering a pizza, will they choose to trust their financial well-being to a credit union that hasn’t digitally transformed? Or will they select a major bank with a flashy mobile app because they are able to comfortably and seamlessly gain information and execute their financial decisions using their preferred channels?

The Digitally Transformed Credit Union

Are you there for your members, even when they are not in the branch (and not asking for help)? At a digitally transformed credit union, your data is working for you (and your members) to show trends, preferences, and valuable insights about your members. This allows you to provide the service your members deserve, treating them with personalized and targeted communications and offers to improve their lives and achieve their financial goals, even without asking the credit union for help first.

The digitally transformed credit union also utilizes these technologies and creates a data-driven culture. In today’s arena, an organization cannot make business decisions based on “feelings”. Credit unions need to make confident, informed decisions. Data provides answers to the questions financial institutions need to be asking.

Digital Transformation is a hot topic because it is a necessary initiative for credit unions. Industry disruption will not stop, and community institutions are not immune if they cannot offer superior service compared to the larger providers. Digital transformation does not come in a box, but is a process and a journey credit unions cannot afford to wait on. At the same time, digital transformation represents incredible opportunities for credit unions. Credit unions, right now, must begin by building and acting on an effective data strategy. As a movement, credit unions can collaborate and grow together through data analytics to provide superior service to members of our communities.