From rewards to security, discover what matters most to consumers choosing a credit card

Consumer credit card usage typically ebbs and flows in tandem with national economic cycles, yet recent research has revealed another key component of modern consumer payment choices: customer experience features.

In “The Convenience Catalyst: How Customer Experience Features Drive Credit Card Usage,” a PYMNTS and Elan collaboration, we examine key factors motivating consumer selection and use of credit cards for payment like cash-back rewards and credit-building tools. According to our recent survey, three out of four consumers in the United States choose credit cards based on the appeal of interest rates, personal data and fraud protection and rewards offers. The results also found that specific demographics, such as parents with children living at home and those with income challenges, valued specific customer experience features more highly than others.

The report is based on a survey of 2,094 adult American regular credit card users that was conducted between Sept 15 and Sept 24, 2021. Respondents were asked questions regarding their credit card payment preferences and usage histories. Regular credit card users are defined as consumers over the age of 18 who have at least one credit card, have made at least one purchase with it in the last 12 months and typically have a balance to pay each month.

The report produced key findings, among them the following highlights:

Convenience is a key reason consumers pay by credit card, but it is not the only important component of consumer payment choice, as 73% also use them for other reasons, including rewards and data security.

Twenty-seven percent of active credit card users cite convenience as the most important reason why they use credit cards as their go-to payment method. Also ranked highly are rewards: 25% of consumers primarily pay via credit cards to access usage-based rewards. Security and interest rates are among the most common attributes that active credit card users say motivate their choice to pay via credit cards. PYMNTS’ research found that 79% of all active users choose credit cards instead of other payment methods based on their data security, and 69% choose them for their interest rates. Active credit card users living with children care far more than other active users about flexible payment options and stronger personal data security. These users are more than twice as likely as active users without children to choose credit cards for their flexible payments options and nearly twice as likely to choose them for their stronger personal data security protection.

Offering a wide array of features as part of credit card membership is key to appealing to consumers’ wide array of needs. Active users consider an average of 4.8 factors when choosing cards.

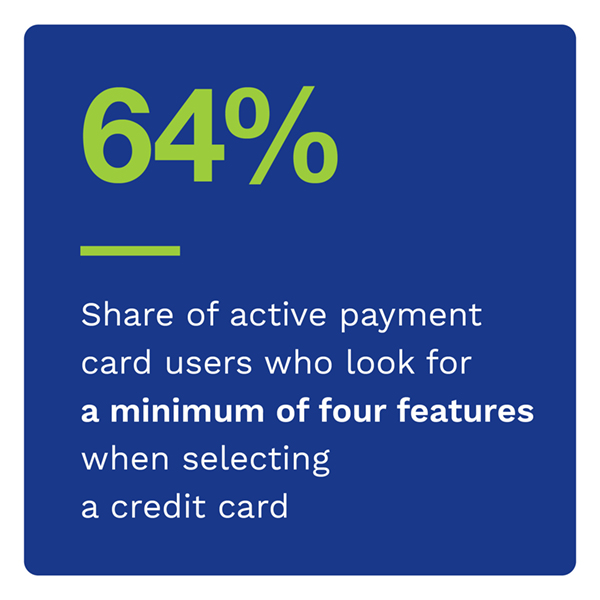

Roughly 89 million adult consumers (64% of active users) look for a minimum of four different features when deciding for which credit cards they should sign up. Consumers living paycheck to paycheck who struggle to pay their bills and those living with children are the most demanding when it comes to what they expect from their credit cards. Research revealed that 74% of consumers living paycheck to paycheck and struggling to pay their bills consider at least four factors when choosing a credit card compared to 64% of all active users.

Most high-demand card users are likely to be younger and have higher incomes than the average user. Research found that 42% of high-demand users are high-income consumers; 36% of low-demand users have high incomes. This further highlights that high-income consumers can have tight budgets and often use credit cards to manage their finances.

Those living with children consider as many as six factors on average when choosing credit cards, spotlighting the importance of providing a wide range of features to win over consumers in this segment. Among consumers living with children, 80% consider at least four factors when thinking of paying for a purchase with a credit card. Research shows that 75% of active users who are parents cite credit-building tools as a key factor when deciding between cards. One in three users who have children have co-signed a child as an account owner for a credit card, with 40% citing helping their children build credit as the top reason to do so. By contrast, just 52% of consumers who do not live with children say credit-building tools are key to their choices.

Understanding Consumer Choices

Consumers are committed credit card users, indicating an affinity for smart credit card usage by revolving payments as needed, and for convenient and useful features they find important. They are also motivated by a belief that good credit worthiness is essential for their children and that helping them build a solid credit history is important for their futures. A new era of digital conveniences has empowered today’s consumers: They expect frictionless payments, rewards and other user experience features. Most active credit card users are now basing their choice of credit card on more than four factors — a dramatic shift from the days when consumers frequently chose credit cards based on lower annual fees and interest rates.

In addition to providing basic features, banks and credit unions need to be prepared with top-of-the-line products and offering features that consumers care about such as rewards, data security, and privacy, to gain top-of-wallet status. Utilizing tailored credit card options to gain the loyalty of new and existing cardmembers will increase the growth of a financial institution. Overall, having the right products helps build engagement and appeal to today’s discerning consumers in a competitive market.

Read the full report: “The Convenience Catalyst: How Customer Experience Features Drive Credit Card Usage”

About Elan Financial Services

As America’s leading agent credit card issuer, Elan serves more than 250 active credit union partners. For more than 50 years, Elan has offered an outsourced partnership solution that provides credit unions the ability to offer a competitive credit card program. Elan has developed industry-leading technologies to improve cardmember satisfaction and drive growth all while sharing the program economics with its partners. In 2022, Elan launched the Across the Country Charitable Giving program supporting nonprofits across the country in partnership with select credit union partners. For more information, visit www.cupartnership.com.