How to comprehensively measure your credit union’s performance

How well is my credit union doing? How does it compare with other credit unions? What are my credit union’s key weaknesses and how could we improve? To answer these key questions, credit union managers and boards must first be clear about what “doing well” means. In other words, what are their credit union’s goals? And how well are they meeting those goals? For credit unions, doing well means serving the financial needs of their members and communities successfully and sustainably. Thus, credit unions must provide services their members value, ensure that they can do so sustainably, and measure how well they are achieving those goals.

The aim of this article is firstly to review the key services that credit unions provide to meet their members’ financial needs, and secondly to review eight key measures of performance that focus on credit union goals. And, finally, to combine the eight measures into a single comprehensive measure that ranks all credit unions from 0 to 100, like class percentiles.

Thus, this comprehensive measure readily summarizes each credit union’s overall performance and places it in perspective among all other credit unions. More importantly, reviewing a credit union’s ranking for all eight component measures can help identify not only strengths, but also areas for further improvement.

Credit Unions’ Goals: Providing Services that Meet Members’ Financial Needs

To meet their members’ financial needs, credit unions should aim to provide their members and communities with the following:

- A wide variety of well-priced and accessible credit options, e.g., credit cards, student loans, small amount loans, other unsecured personal loans, auto loans, mortgage loans, and business loans;

- Well-priced and convenient savings vehicles, from checking accounts to certificates of deposit, as well as access to brokerage services from other credit union-related providers;

- Well-priced, convenient payment services, from checking accounts to debit and credit cards, and online and mobile payments;

- A wide variety of other services that are well-priced, from financial education to money orders, check cashing, wire transfers, international remittances, and many more;

- Quality, convenient, friendly member service though a wide range of channels from in-person at branches to ATMs and phone, online, and mobile access; and

- The opportunity to, and fulfillment of, participating in democratically-controlled and democratically-run cooperative endeavors that are vibrant, growing, and open to new members from their broader communities.

Eight Key Measures of Member-Centric and Financial Performance

How then to assess a credit union’s overall performance as well as determine areas for improvement? To answer these questions, each individual credit union should, first and foremost, ask members directly. In addition to community outreach, focusing on call report data, readily available across institutions, allows for a broader statistical comparison between a credit union and its direct peers.

Such analysis should be done routinely and focus on, at least, the following eight key measures of performance. These include five (or six) that clearly focus on the member-centric goals listed above and two additional, more traditional, measures of performance that focus on financial sustainability:

- Deposit benefits, i.e., how much higher are interest rates for deposits in a credit union than at banks?

- Loan benefits, i.e., how much lower are interest rates for loans in a credit union than at banks?

- Loans per assets, i.e., what fraction of a credit union’s funds are serving the credit needs of its community?

- Delinquent loans per loans, i.e., an indirect, but effective, measure of the extent to which credit unions focus on the credit needs of their overall community. (Very low delinquency ratios highlight institutions that focus on prime borrowers and that serve the credit needs of members with weaker credit histories less well.)

- A product breadth index, i.e., a count of how many “non-core” products (out of 29) each credit union offers, as reported in their NCUA credit union profile;

- Merger- and inflation-adjusted asset growth rate, since credit unions that provide better service are likely to attract more members and more of their funds over time;

- Return on assets (ROA), since credit unions that grow their assets quicker must also increase their retained earnings to ensure both their financial solidity over time and meet regulatory capital requirements and expectations;

- Net worth (capital) per assets, as a measure of a credit union’s ability to withstand economic shocks such as adverse interest rate and credit cycles.

These lists of goals and performance measures underscore that credit unions serve diverse memberships with at times potentially competing interests. For instance, a credit union could charge member-borrowers high interest rates to be able to pay member-depositors high interest rates. Further, efforts to focus on long-term solidity, for instance by limiting credit risk, could detract from the goal of servicing the credit needs of the overall community. Ultimately, credit unions’ boards and managers must decide how to allocate benefits and resources. While there is no single, commonly accepted method to making these difficult choices, the choices must be made, whether in an ad hoc manner, by inertia, or after careful consideration.

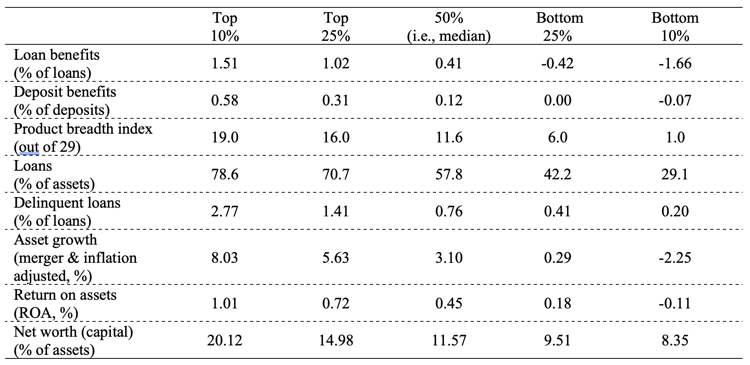

To evaluate how well it serves its many types of members, credit unions should assess their performance across, at least, the eight key measures listed above. To place each credit union’s values in perspective, Figure 1 below presents the values for credit unions that performed at the top 10%, top 25%, median, bottom 25%, and bottom 10% for each measure.

Some credit unions may find they rank high across several measures (e.g., in the top 10%) but poorly in others (e.g., in the bottom 50%). Combined with member input (from surveys and word of mouth), such credit unions could conclude that their focus on some measures (or members) comes at the expense of other measures (and members). For instance, some credit unions might find they offer good rates to prime borrowers, but that they could increase their focus on borrowers with weaker credit histories. Other institutions may conclude they offer good rates to both borrowers and depositors, but that their product offerings to other consumers are comparatively narrow.

Figure 1: Eight key measures of member-centric and financial performance across performance percentiles (from the 10% top performers to the bottom 10%), averages for 2016–2020

Note: the values in this cell are not averages (e.g., computed among the top 10% of credit unions), but values for credit unions at the 90%, 75%, 50%, 25%, and 10% level when ranking credit unions from best to worst.

A Comprehensive Measure of Credit Union Performance

Despite the unavoidable tradeoffs across measures (and members), credit unions aim to do as well as possible in all areas, serving their diverse members in a sustainable manner. To summarize overall performance, to be able to rank each credit union among its peers, one may combine the eight measures into a single comprehensive measure of member-centric and financial performance.

To do so, one may rank all 5,000+ credit unions in the United States based on their performance in each of the eight measures, from best to worst. To minimize the potential impact of one-time events for any individual credit union, one may use five-year averages of performance, in this instance 2016–2020. (Using rankings instead of weighted averages also likely minimizes the impact of data errors, outliers, and one-time events). Next, one may sum all eight rankings for each institution, resulting in an index that can be used to generate a new overall ranking. Lastly, the rankings (from 1 to 5,000+) may be expressed as percentiles, as in grades, from 0 (worst performers) to 100 (best performers).

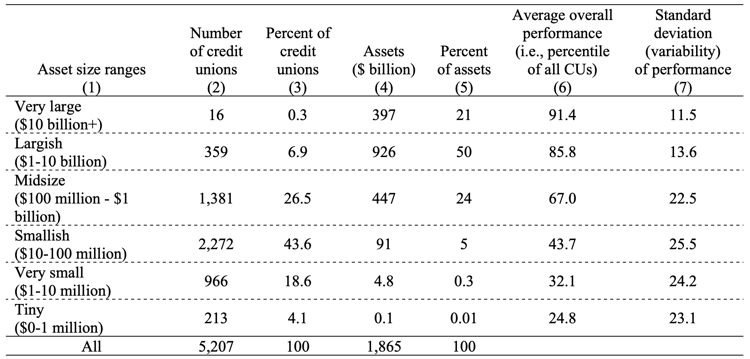

Figure 2: Number of credit unions and assets (in 2020) and their overall performance and variation in performance (during 2016–2020), across asset size ranges

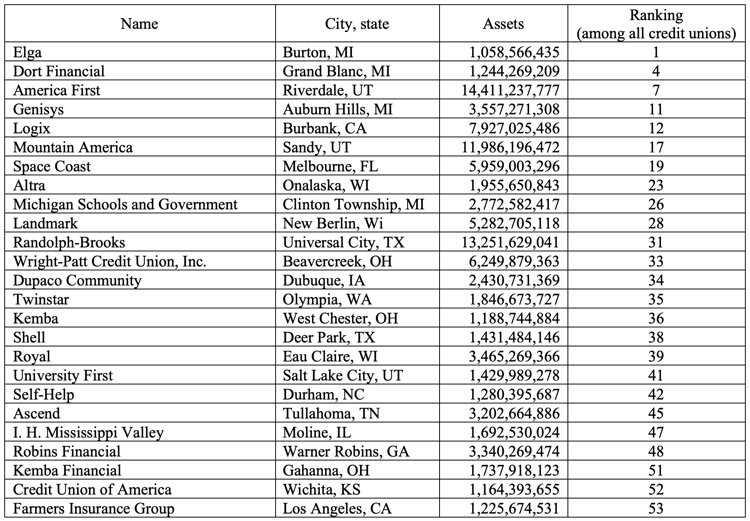

Figure 3: Top performing large credit unions (with over $1 billion in assets)

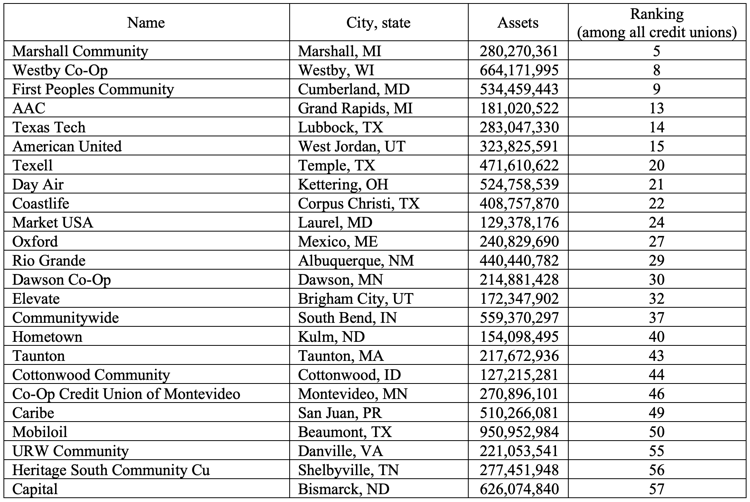

Figure 4: Top performing midsize credit unions (with between $100 million and $1 billion in assets)

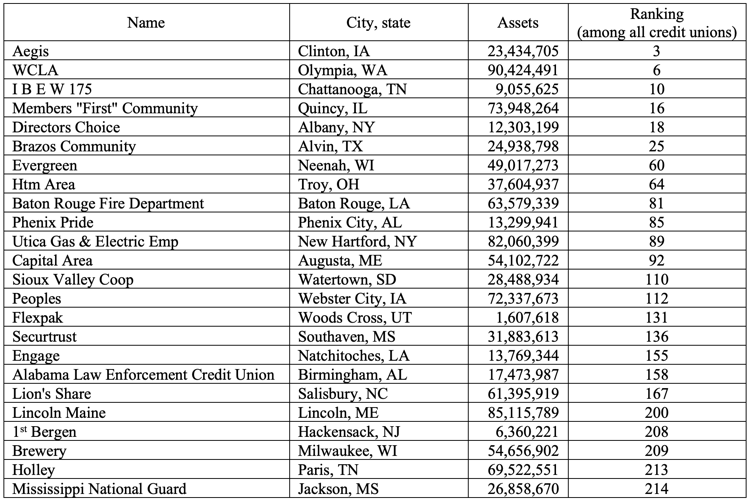

Figure 5: Top performing small credit unions (with under $100 million in assets)

Takeaway

As in many previous studies, larger credit unions on average perform better across most measures of member-centric and financial performance (see Figure 2, column 6), but while size plays a key role, it is not the sole factor in determining performance. While smaller credit unions on average do not perform as well, many smaller credit unions still perform as well or better than their larger peers (see column 7).

Finally, to highlight that there are top performers across nearly all asset size ranges, Figures 3, 4, and 5 present the top 25 institutions for three broader asset size ranges, highlighting that credit unions of all sizes can succeed in serving the financial needs of their members and communities.