Members are hungry for guidance and intervention

More than eight in ten Americans cite inflation as a source of stress and nearly 60 percent are concerned about having money to pay for present necessities. It seems safe to say the economy is causing some challenges for consumers, leaving the door wide open for regional and community financial institutions to connect with account holders and support their financial journeys.

Using de-identified data* collected over nearly five years, across more than a million account holders, and represented by nearly two dozen financial institutions ranging in assets from $500 million to $15 billion, supplemented by primary market research** among more than 800 digital banking consumers, Alkami has identified current attitudes and perceptions of the latest financial services and national economy. We’ve also identified several areas of opportunity for credit unions to empower members and differentiate themselves from competing megabanks and neobanks.

Inflation is hitting members and their institutions where it hurts

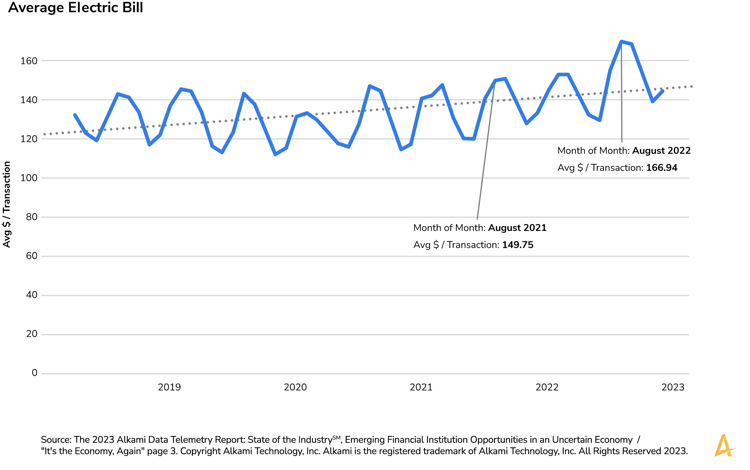

Alkami telemetry data shows electricity bills increased more than 11 percent, on average, from August 2021 to August 2022, a peak month for consumption.

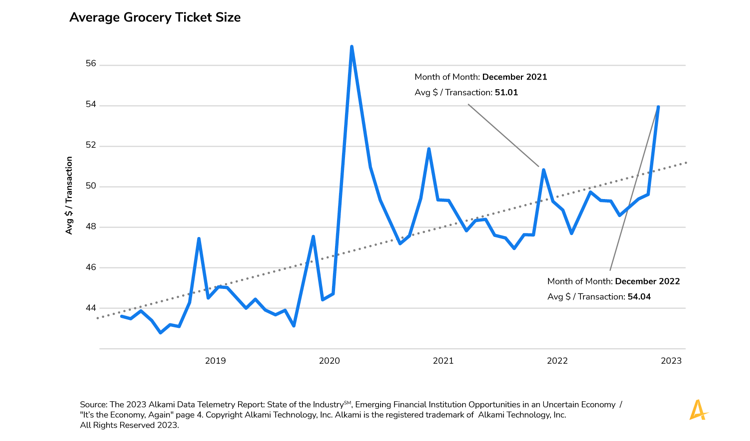

Consumers are spending more at the grocery store too. If we go back to 2019, pre-COVID, average grocery transaction size was remarkably stable at approximately $44. COVID lockdowns lead to a big spike in that average transaction size, as consumers were stocking up and trying to limit the number of trips they made to the store. As COVID receded, the average ticket size moved downward again, but never to its pre-COVID levels; and, from mid-2021, the average ticket size is trending upward. In fact, holiday grocery shoppers spent 5.9% more on an average trip to the store in December 2022 than they spent one year earlier.

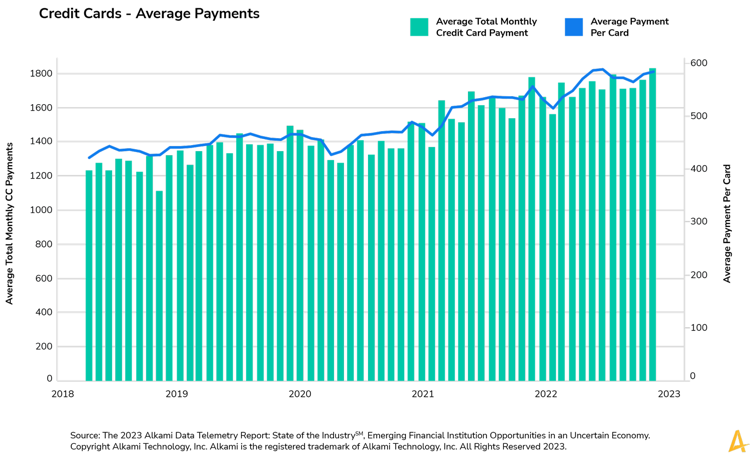

There has been a steady increase in dependence on credit cards. 34 percent of consumers we surveyed said their reliance on credit cards has grown in the past 12 months. We see that illustrated in the above telemetry data chart, where the average single credit card payment increased from just above $450 at the beginning of 2021 to just over $600 at the end of 2022, and the average total monthly credit card payments per account holder hitting $1,800 for the first time.

The current inflationary environment is creating downward pressure on deposit growth, too, with consumers’ top cited reason for withdrawing more money in the past 12 months being to pay for “normal” expenses. As this inflationary economy increases the cost of everyday expenses, we are likely to see continued reliance on credit to shoulder expenses, as well as dwindling cash-on-hand.

49 percent of consumers say they are worried about their financial situation and 40 percent report that managing their finances is “overwhelming.” Thankfully, with the help of customer data insights tools, credit unions can, in near real-time, monitor the financial health of their entire ecosystem. And armed with that information, they can quickly deploy tailored educational content, outreach, and offers specifically to those members most affected.

Steps you can take now

According to Alkami’s primary market research, fifty-six percent of consumers said they want their financial institution to know if they are under financial stress by monitoring the activity on their accounts and reach out to offer financial education, support, and options to help them become financially well.

57 percent of consumers surveyed responded favorably to a bank or credit union offering a pre-approved loan based on transactional behavior. The finding is even stronger among younger consumers, with 65 percent of millennials wanting the same, the highest in the study. Furthermore, 42 percent of consumers wish they had more analytical tools to track and manage their financial situation.

All of this data tells us that what credit unions can do to build a solid foundational relationship with their members is to start a financial wellness program and monitor members’ data trends closely for signs of trouble. Turn sentiment into action by analyzing account holder data for patterns of distress, then proactively reach out with new credit or deposit offers. Members want and expect this level of caring interaction and it’s time to deliver it.

About the data

For more information on the above data points, consumer opinions and data trends, download the 2023 Alkami Data Telemetry Report: State of the Industry℠, Emerging Financial Institution Opportunities in an Uncertain Economy.