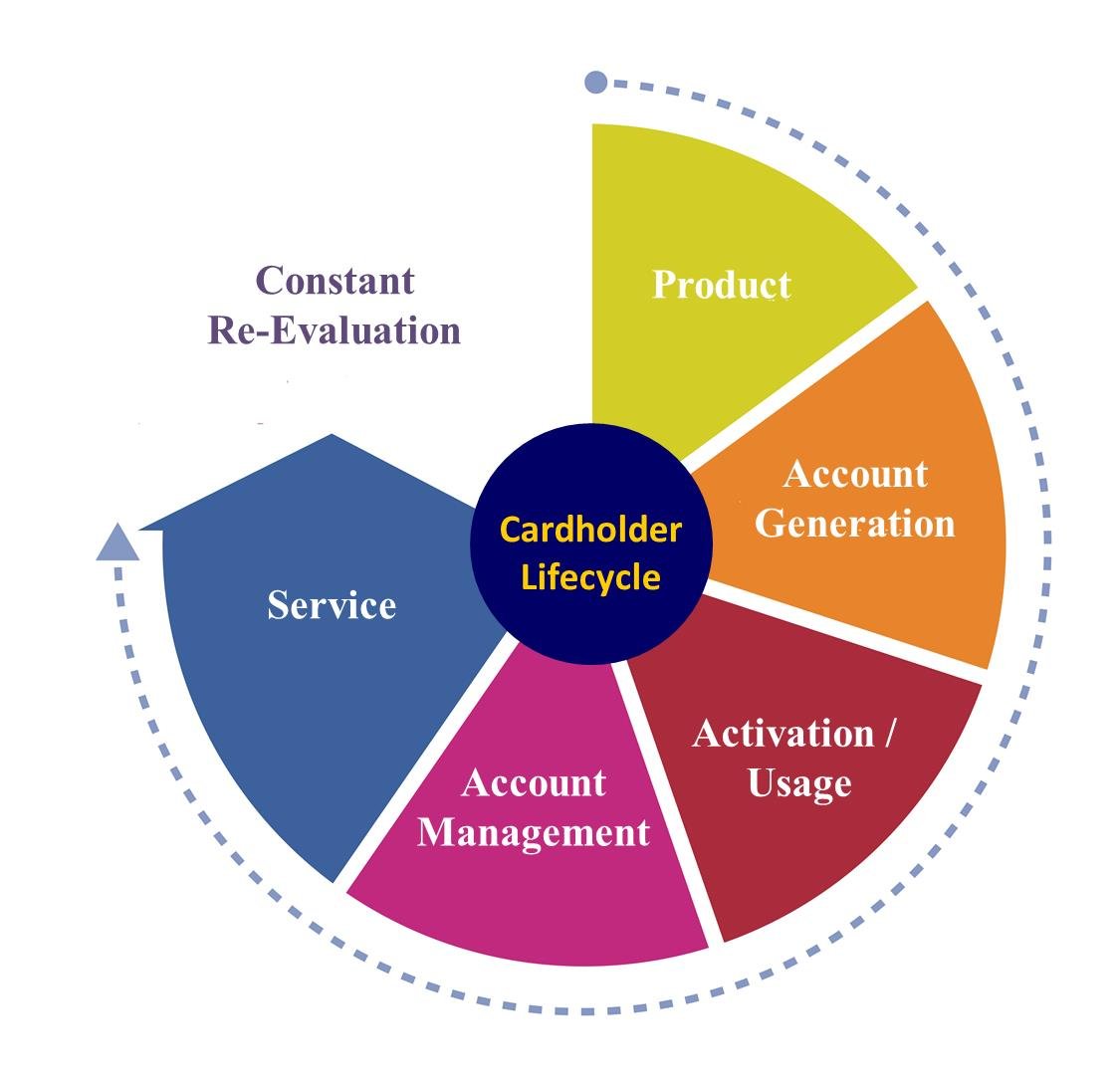

Creating exceptional consumer experiences throughout the cardholder lifecycle generates high levels of engagement and precious word-of-mouth marketing. When you achieve both of those objectives, you are two steps closer to a fully optimized credit card portfolio – a product that can generate up to a quarter of your credit union’s net income.

What follows is a breakdown of the cardholder lifecycle, along with insight into workable, measurable strategies for optimizing cardholder experiences within each phase.

Product

The credit card landscape is very competitive and only becoming more so as the economy experiences an uptick and consumer confidence reaches pre-recession levels. A credit union issuer does not have to compete on every aspect of a credit card product. However, cards teams should design a compelling product that takes into account the features, terms and conditions offered by those issuers going after the same segment(s) of consumers.

While it’s important to have a competitive annual percentage rate (APR), rates should not be the only factor that differentiates a card from what is offered by the competition. Consider features and benefits like:

- Multi-product benefits

- No foreign transaction fees

- Bureau score and education

- Cell phone protection

- Price protection

- Local merchant discount program

Account Generation

A steady stream of new, financially healthy applicants will help keep your portfolio balanced and profitable. Today, credit unions have a plethora of channels through which to drum up new business. Consider the following omni-channel account generation opportunities.

Branch: To get the most out of a branch sales strategy, set goals for each of your locations based on the overall sales goal of the credit card program and the member segment best represented by its location. Motivate front-line staff with achievable outcomes and incentives.

Online: Generating applications online is a great way to reach younger generations. Be prepared for a lower approval rate, however, as you will tend to get more of what are known as “credit-seekers” through this channel. Credit seekers are individuals who apply for credit with above-average frequency, as they are often denied based on their less-than-stellar credit profile.

Phone: Cross-selling through phone service channels can be very successful in the right environment. Follow-up calls to an acquisition campaign, for example, can provide a lift in overall response. Ensure you are following Telephone Consumer Protection Act (TCPA) guidelines with any efforts done via phone.

Direct Mail: With the right segmentation and targeting strategy, direct mail is still extremely effective, even in the digital era. In fact, recent studies show it is still much more effective for response than email. Consider pre-approvals and response modeling to improve your success and cost per account.

Email: Email has proven to have a much lower response rate than direct mail. However, the cost to deploy is also much lower, providing a higher ROI. Consider utilizing both direct mail and email in conjunction to maximize your new account acquisition results.

Social Media: While generating applications may be difficult through social media, the proper strategy can definitely help you obtain referral business and engagement.

Activation / Usage

The first 60 days of a new account is the most important time in the cardholder lifecycle. This is when card activation occurs, as does the best chance of earning top-of-wallet status. Therefore, having an early life-on-books strategy is key. Cards teams should strive for activation within the first 45 days. Follow-up campaigns to those who haven’t activated within 30 days are often very successful, particularly if paired with new cardholder perks.

To establish top-of-wallet behavior, consider offering a first-use bonus, such as double or triple rewards points for the first 60 days. Another effective strategy is to offer bonus points for frequently recurring purchases, such as gas, groceries or regular payments, like utilities or auto loans. This establishes a pattern of behavior, puts the card in a default auto-pay position and quickly elevates your card from something new to something essential.

Account Management

Encourage cards and marketing teams to collaborate on the creation of an ongoing promotions calendar to keep your cardholders engaged. The goal should be to stimulate purchase activity and balance growth. Your calendar should also account for keeping cardholders engaged even during those times of the year when transactions typically lessen. Likewise, ensuring cardholders have you top-of-wallet during busy spending seasons will be important.

Also, consider including strategies for ongoing line management and potential product upgrades. Recognizing and adapting to consumer life stages, like college graduation, marriage, a new job or retirement, will undoubtedly keep cardholders engaged. Remember, as more consumers automate the sharing of their personal data, more competitors are able to target them with customized and tailored credit card offerings. Staying attuned to the information your members are regularly sharing via social media, digital apps and retailer loyalty programs is important as you continue to compete inside the Big Data revolution.

Service

Today, every business is operating in the Age of the Consumer, where the voice of your member has a better chance of being heard and applied than ever before. For this reason, cards teams can’t overlook the importance of consistent and friendly cardholder service.

Ensure your service representatives are properly trained to field questions and concerns. One bad experience can have far-reaching implications, as today’s connected consumers are not shy about sharing their impressions of a financial institution. Employ one-call resolution and staff empowerment strategies that give your representatives the control they need to ensure a positive outcome. Consider:

- Offering a courtesy fee waiver one time per year

- Allowing reversal of finance charges under a certain dollar amount

- Waiving a replacement card fee with basic criteria

For delinquent cardholders especially, it’s important to continue acknowledging the reasons they chose to do business with a credit union in the first place. Often, it’s because of the cooperative’s focus on individuals, not dollars. Therefore, an empathetic approach to collections – especially in the earlier stages – may be the most effective way to ensure payment while also providing a continued positive experience.

Managing the consumer experience within each phase of the cardholder cycle can be simple. With just a few tweaks here or a minor adjustment there, your cards can turn into the type of product that reignites the loyalty of existing cardholders – and brings new ones through the door.

To learn more about optimizing credit card portfolios, download the white paper “Getting the Most Out of Your Credit Card Program.”