Credit unions are challenged to facilitate business loans quickly with limited information. It’s a high stakes activity with limited upside and significant downside risk. Digitization would address a lot of the issues including streamlining manual form collection, decisioning and monitoring, and give credit unions an easy way to gather information on business members. But with so many things to update, it has never been the first priority. Only the earliest adopters are using Application Programing Interfaces (APIs) to gather business information through a pipeline automatically, as opposed to a form or portal for manual processing.

The Paycheck Protection Program (PPP) changed everything. It is a different type of lending process. Typically, loans consider whether businesses have enough money to pay back the cost of the loan. PPP however is effectively a grant, seeking to stimulate the economy by covering the cost of employees during this unprecedented time. The legislation was passed quickly, in weeks instead of years. As a result, implementation was not without its challenges. It was confusing and judging by the court of social media there were many businesses who didn’t get funded and among the others who did, many felt pressured to return the funds. PPP was different for a lot of reasons, but probably most famously for the 11-page forgiveness calculation form which was so convoluted that it was compared to filing taxes and inspired endless memes on twitter of animals throwing computers against walls.

Me trying to secure an SBA small business loan #PPPLoan #PPPFail pic.twitter.com/8s3Z2Y0e73

— Robert Ferrari (@BrandMoxi) April 28, 2020

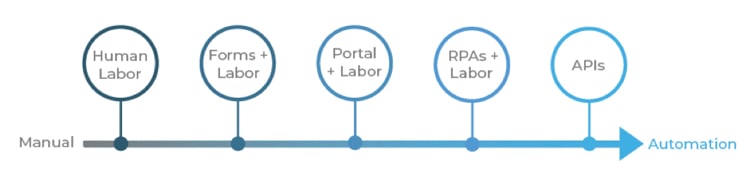

Suddenly, lenders had to provide a process for a loan that never existed before. This brought about unforeseen—and welcome—collaboration between credit unions and tech platforms to automate the process. Even here, however, there was a spectrum of technical capability that credit unions had to choose from. They could simply put more lending officers to work, they could adopt technology that helped gather forms and manually process them, they could use something called Robotic Process Automation (RPA) which used robots to automate the manual process and finally they had APIs which would gather information and calculate it automatically.

Data in the past has been unstructured and difficult to access, but APIs act as a pipeline carrying data in a usable way, eliminating the need for resource-hungry manual processes. With respect to lending, with just a few clicks APIs replace the need to gather financials, calculate them and monitor them. Even so, many in the industry opted for manual calculation, file management systems or RPAs. Think of APIs as a pipeline carrying data instead of water. These processes are akin to either walking to a well or using a robot to go to a well to get water instead of turning on the tap and having it flow freely using APIs.

$9.6 billion in PPP loans have been disbursed through credit unions, but it was not an easy process. Credit unions that relied on manual processes struggled to approve businesses in a timely fashion. Paperwork, time and technology investments were substantial. NAFCU’s EVP and General Counsel Carrie Hunt and staff spent weekends attempting to work through PPP issues including the cumbersome E-tran portal, pages of confusing paperwork, and the sheer volume of loans and the time it took to process them.

Digitization Grows Membership

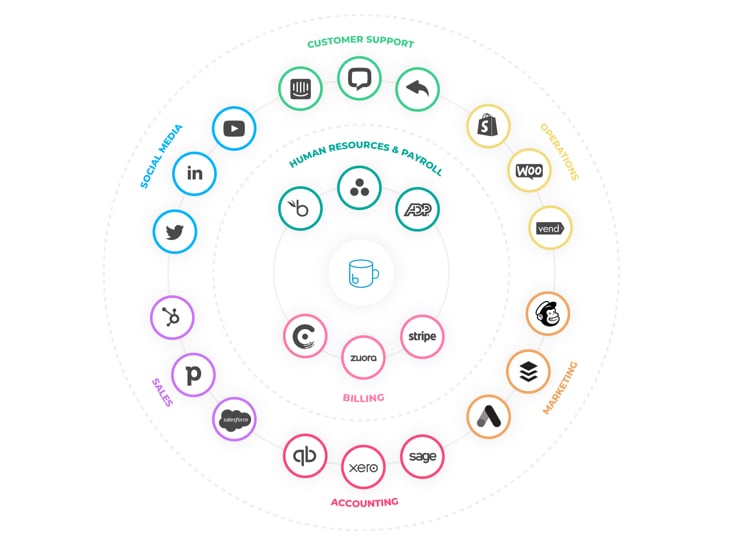

PPP offered support to over four million businesses in a few short months. That was exceptional. However, there was a huge opportunity missed when it came to supporting new businesses. Attracting new membership is the number one goal for credit unions going into 2020 and digitization makes it possible. 81% of credit unions believe that partnering with Fintech companies to deliver seamless solutions is a means to improve member experience. Credit unions are beginning to excel over their counterparts in the area of digitization, but there remains room for improvement. 29% of credit unions already have partnerships with fintechs in the area of credit and lending, but the partnerships are limited in scope. It’s felt by business members and credit union employees and customer delightis a goal that seems forever just out of reach.

With the urgency to process PPP loans quickly, existing customers were prioritized over new ones. With existing customers, Know Your Customer (KYC) compliance measures are already in place. With legacy systems, it was impossible to gather enough information on new businesses and lenders who adopted API technology were more than happy to fill the void. Square saw 76,000 new customers with $820 million dollars in PPP loans processed. Credit unionsthat could have realized this capability would have provided business member delight and experienced new growth. Had credit unions been open to adopting technology available to them earlier in the last decade, they would have been in the position to dominate the industry.

Customer Expectations are Driving Digitization

As a result of the manual approach, there’s been a lot of questions about PPP, a program that should be praised for offering $659 billion dollars into the market. The real question is "are the lessons from PPP enough to inspire Credit Unions to digitize?" Shopify CEO, Tobi Lütke states, “We are experiencing 2030 [digitization] in 2020”. Credit unions are faced with a current reality too big to ignore: APIs don’t just automate the core, they offer access to business member information and the ability to serve them in real time, bringing about delight. PPP is soon coming to a close, and in its wake customer expectations have never been higher. Social distancing has caused business members to seek services online and thanks to tech giants such as Amazon, there is a certain expectation for personalization. Meanwhile, most business customers report they would share their data for more convenience and tailored services.

The industry will never be the same again. PPP accelerated the digitization process for credit unions kickstarting the rapid adoption of fintech solutions.Credit unions are fast adopters and have a history of differentiating themselves from other FIs by emphasizing their community focus and personalized member services. They offer more than the players who saw new customer adoption because they are full service and member first.It is exciting, and only time will tell if credit unions adopt the tech that is waiting for them. Digitization is more than taking a paper form and making it electronic, it’s a fundamental shift from manual calculator to utilizing technology to manage the manual. APIs to business software make this possible.Let us take the next step to true automation in partnership together.