The credit union way: Extreme member service

In 1967, a group of credit unions formed NAFCU to fulfill a need in the marketplace – the industry needed a strong, assertive voice in Washington to represent them at the federal level. And 52 years later, NAFCU is still that voice, growing stronger each year alongside our members, while remaining steadfast in our relentless approach to advocacy.

This year, the credit union industry celebrated the 85th anniversary of the passage of the Federal Credit Union Act, establishing credit unions and setting a precedent of community outreach and responsible products within the financial services sector.

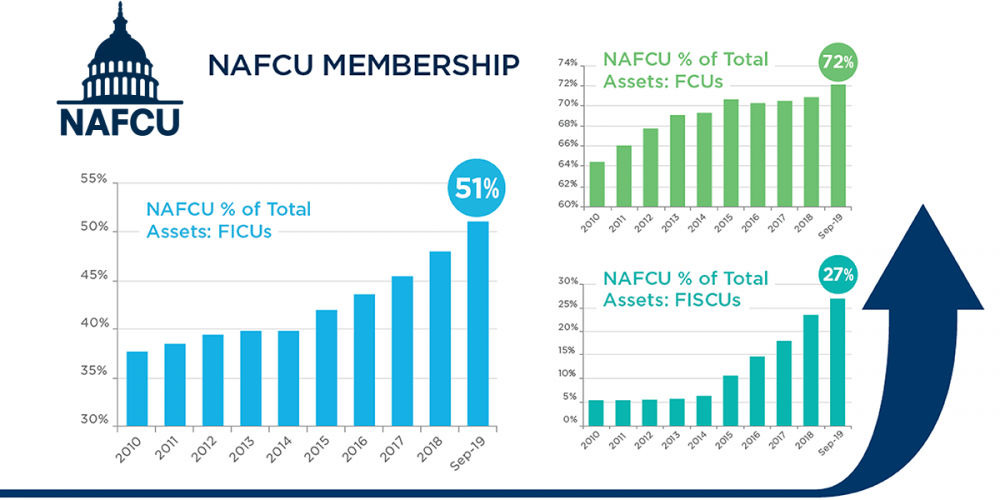

There is a reason that 118 million Americans and counting have put their trust in our not-for-profit, cooperative industry. There is also a reason that NAFCU has seen its membership grow 37 percent over the last six years, and now represents 51 percent of the industry’s assets.

That reason? Extreme member service.

Every day, credit unions go above and beyond for their members, whether it is offering responsible products and services or a helping hand within their communities in times of need. Credit unions are proof that a member-focused mission results in growth, no matter the attacks or challenges posed by bankers.

Amid the partial government shutdown earlier this year, credit unions proactively stepped up and extended a helping hand to impacted federal workers. When natural disasters struck, countless credit unions – big and small – sent gift cards, donated food and water, and reinvested in affected communities.

Extreme member service is also what NAFCU provides the credit union industry. Our compliance team answered more than 10,000 member questions in 2019. Our government affairs team led industry efforts to have over 20 bipartisan bills introduced in Congress, and our research team connected representatives from member credit unions with six Federal Reserve Banks nationwide.

The NAFCU team, as a whole, answered the call to serve the industry and understood that advocacy is something that happens every day. On a daily basis, we put ourselves in front of key policy and decision makers, including elected officials to ensure credit unions have a seat at the table.

We are driven by our mission to strengthen credit unions and provide extreme member service. Together, NAFCU and the credit union industry achieved amazing wins this year. Check out our 2019 accomplishments to see highlights of those victories.

I previously shared these sentiments on an episode of The CUInsight Experience. Looking towards 2020, it will undoubtedly be a busy time in Washington, but NAFCU is prepared to continue fighting on your behalf.

We are excited to move full speed ahead with NAFCU’s bold advocacy agenda and resources, responsive compliance assistance, and forward-looking education and training programs.

My colleagues and I look forward to continuing to serve the industry in 2020, and if you are interested in growing with us, do not hesitate to reach out. The NAFCU team stands ready to help… because to us, it’s personal.