The digital transformation imperative for credit unions

For more than a century, the pulse at the heart of credit unions was widely known to beat loudest in the measure of member happiness. Satisfaction was always a distinctly unbeatable competitive advantage credit unions have long enjoyed over most of their for-profit cousins.

Until now.

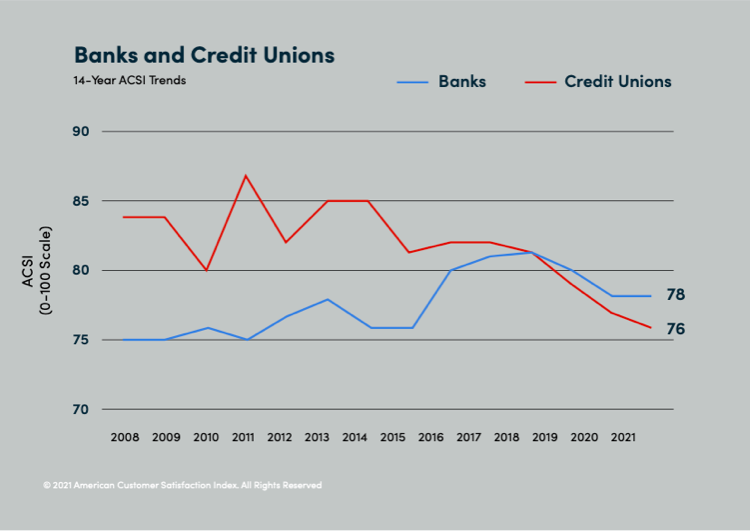

Origence’s new Playbook for Digital Transformation examines how over the last decade, the signal strength of member delight with their credit union has become progressively weaker and critically irregular. Since 2017, the American Customer Satisfaction Index found that satisfaction with credit unions has dropped sharply every year and is currently recorded at historic lows. Meanwhile, satisfaction with banks has increased and for three years in a row, banks have received a better satisfaction rating than credit unions. This downward rhythm is unhealthy and if the trend-line is left untreated, the outcome could prove fatal for your credit union and unrecoverable for the movement as a whole.

Building a foundation for digital transformation

The new Digital Transformation Playbook outlines the critical first steps your credit union can take toward your digital transformation journey. Every chapter and verse of the playbook maintains a clear line of sight to the goal of creating an unparalleled member experience, a north star that must shine brightest. While the playbook paints an open sky picture of the future for those who commit to a digital transformation, it all begins exactly where it should – on the ground, with a solid foundation.

Starting the journey

After helping you define what digital transformation means for your credit union, the playbook closely examines why and how the needs of your members have changed. As promised, the playbook then prescribes easy-to-follow steps and practical guidance for how your credit union can make the organizational shifts required to meet the new baseline expectations of your members.

Transformation requires change

True transformation can require dramatic changes in culture, product, processes, and platforms. When you commit to future-proofing your credit union with a built-in capacity for sustained resiliency, you must begin the journey by re-thinking every aspect of your entire business model. It is best to travel lightly. When crossing the chasm, you will leave most of the old business model behind and adopt new ways and means. This requires a genuine, organization-wide appetite for change and an uncommon willingness to accept the risks, costs, and pain that come along with it. When you’ve reached the other side of the proverbial bridge of opportunity, your credit union may feel different to you, but will likely have become much more familiar to the people you serve.

BONUS: Transformation begins at the top

The playbook was intentionally written for every staff member of a credit union who wishes to participate in digital transformation and is personally committed to increasing member satisfaction. While the playbook does not address the role of the chief executive directly, we believe there are four key responsibilities that they should own. If you are a credit union CEO, this bonus content is for you.

Success in this endeavor only becomes possible when the CEO believes in the possibilities and is determined to lead the organization through the transformation journey. If you adhere to the following tasks well, every staff member of your organization will be more motivated and effective as you work to achieve the promise of digital transformation together.

- Communicate the digital transformation goals, KPIs and results clearly, consistently, and frequently

- Demand digital inter-departmental collaboration, and the use of project management tracking and performance tools

- Empower rapid decision making, provide budget authority and encourage the sharing, and testing of new ideas that directly achieve the KPI goals

- Track and measure progress, hold the team accountable with formal reviews, and celebrate every success