Disclaimer: I owe the idea for this post to Jon Bittner. You should download his personal finance application, Splitwise, right now. It’s free and awesome, I use it all the time to split expenses with friends.

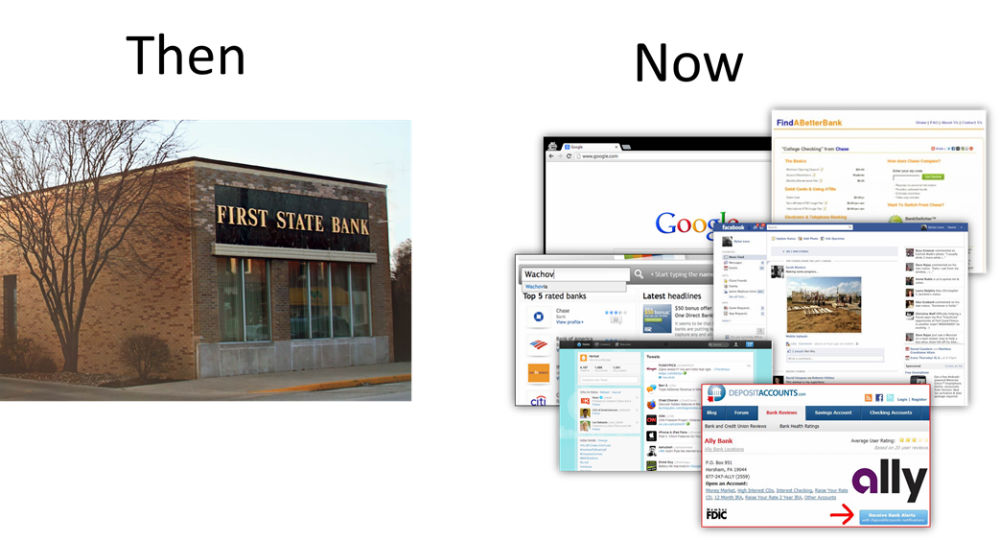

Back in the ye olde days before the internet, financial marketing used to be simple. Buy a plot of land, preferably in a busy commercial center. Build something up with a roof on top. Stick a sign out out front. Your branch was the be-all-end-all of your marketing strategy. Consumers needed a branch where they lived, and so when it came time to look for a financial institution, they took a drive around the block and picked the building that looked the prettiest.

Today, instead of driving around the block, consumers open their computers. At first glance, this seems like a trade up. No need to pay rent, fuss over the upholstery, or worry about keeping the place clean. All you need is a website.

Wrong.

What do consumers do when they go online? They might navigate straight to Google, and start a search. But what will they search for? “Checking account”? “Best deposit account interest rate”? “Bank”? (I’m willing to bet they won’t be searching for “credit union.”) They might go to facebook, and update their status to “I’m looking for a new bank, any suggestions?” They might go to a consumer website like mybanktracker.com or findabetterbank.com and look for recommendations. Before the internet, you only needed to worry about the impression your branch made on passersby. Today you need to think about how to make your brand visible to consumers searching in a million different ways.

If by some miraculous chance you’ve actually managed to show up in their search results, how are you going to get them to sign up for your institution? With branches, most of your marketing work was done when the consumer walked in the door. Simply put, it’s hard to walk away from a person. Even if your branch was a little dingy, or a frustrated customer was yelling at the teller, that consumer would still probably open an account. With a website, there is no such obligation. If your page looks like it was built in 1999 or if they can’t find they information they need in 10 seconds, they’re outta there. If quick search returns a bad review, even if it was posted 5 years ago, they’re outta there. Financial marketers today essentially need to read the mind of online shoppers to figure out what information they need to provide and how to craft a message that resonates, all while keeping things simple enough to navigate.

Alright. Say you’ve managed to get them to your website, and to keep them there for more than 10 seconds. Now, how do you convert them? Putting a big ol’ orange button that links to an online application is definitely a good place to start. But it’s not enough, because we don’t just live in an online world, we live in a multichannel world, and some of those online shoppers are going to want to come into a branch to open their account. So to cap it off, financial marketers need to offer consumers a choice, and figure out how to message that choice appropriately to make sure that all that marketing effort actually produces a sale.

Make no mistake. There is nothing easy about online financial marketing.