Three credit union market perspectives – Q2 2022

Below I break down three key observations we’ve made in our latest Credit Union Market Perspectives Report.

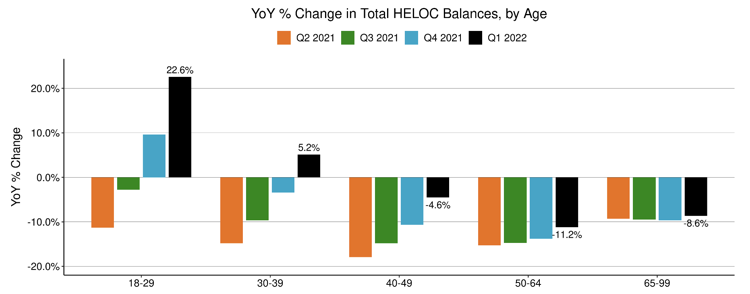

- HELOC and equity loan balance growth primarily driven by Millennial and Gen Z borrowers market – Younger consumers (18-40) drove balance growth in home equity products in Q1. The youngest consumers (18-29) grew balances by 22.6% in Q1 of 2022. Lenders looking to reverse balance runoff in home equity products should leverage credit and demographic data to better target younger consumers more likely to use the products to make home improvements or pay down high interest debt. Digital acquisition, cross sell and real-time prequalification tools are essential to reach borrowers of younger generations.

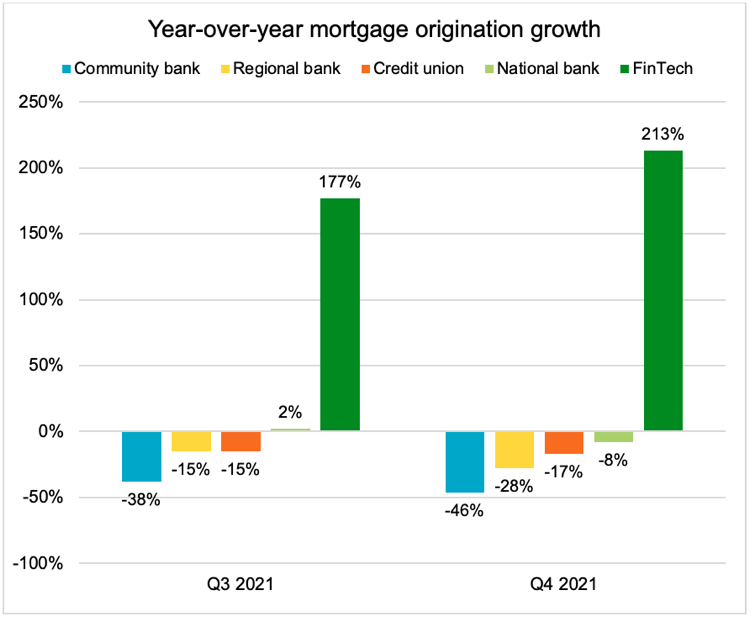

- Banks and credit unions struggle to grow mortgage originations amidst an incredibly competitive environment – Credit unions and banks of all sizes saw declines in mortgage originations as FinTech lenders added even more competition to an already crowded market. Traditional mortgage lenders voice concerns about pipeline attrition and lost opportunities to more competitive offers being presented during mortgage processing. As cost per acquisition rises, many lenders are shifting their attention to retention of existing portfolios through solutions like triggers. Additionally, best practices banks and CUs are leveraging single bureau, soft inquiry prequalification to capture consumer attention in a crowded acquisition market.

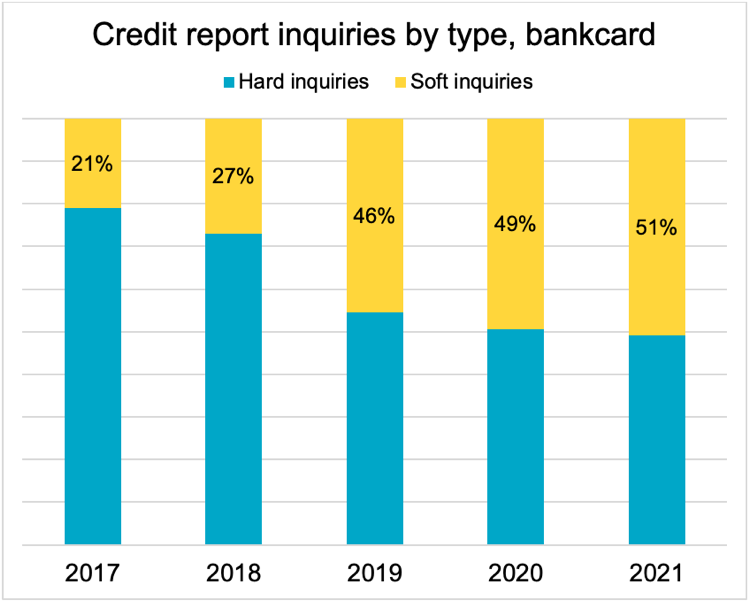

- Soft inquiries are now more popular than hard inquiries as prequalification adoption continues across financial services – More lenders are now offering prequalification as an option for consumers, allowing them to see which offers they might be eligible for before applying for credit. Once only common in the FinTech space, community lenders are actively seeking partners and vendors who can deliver a prequalification capability in their digital channels. Those who do not offer this may face member/customer attrition as prequalification moves from a “nice to have” to a “must have” feature for many digital-first consumers.

Email us at creditunions@transunion.com for the full Market Perspective Report!