As the economic cycle continues to heat up, financial institutions are accessing additional deposit funding channels. From a deposit strategy, often overlooked sources of deposits are political subdivisions. Most credit unions have a relationship with their local school districts, municipalities, or other public entities such as park districts and libraries, but often stop there. Political subdivisions receive funding throughout the year and then invest to meet obligations. Funding is repeated on an annual basis, making political subdivisions reliable and consistent sources of deposits.

For some financial institutions, there are two perceived challenges with political subdivision deposits. Their balances are cyclical in nature and usually require some form of collateralization.

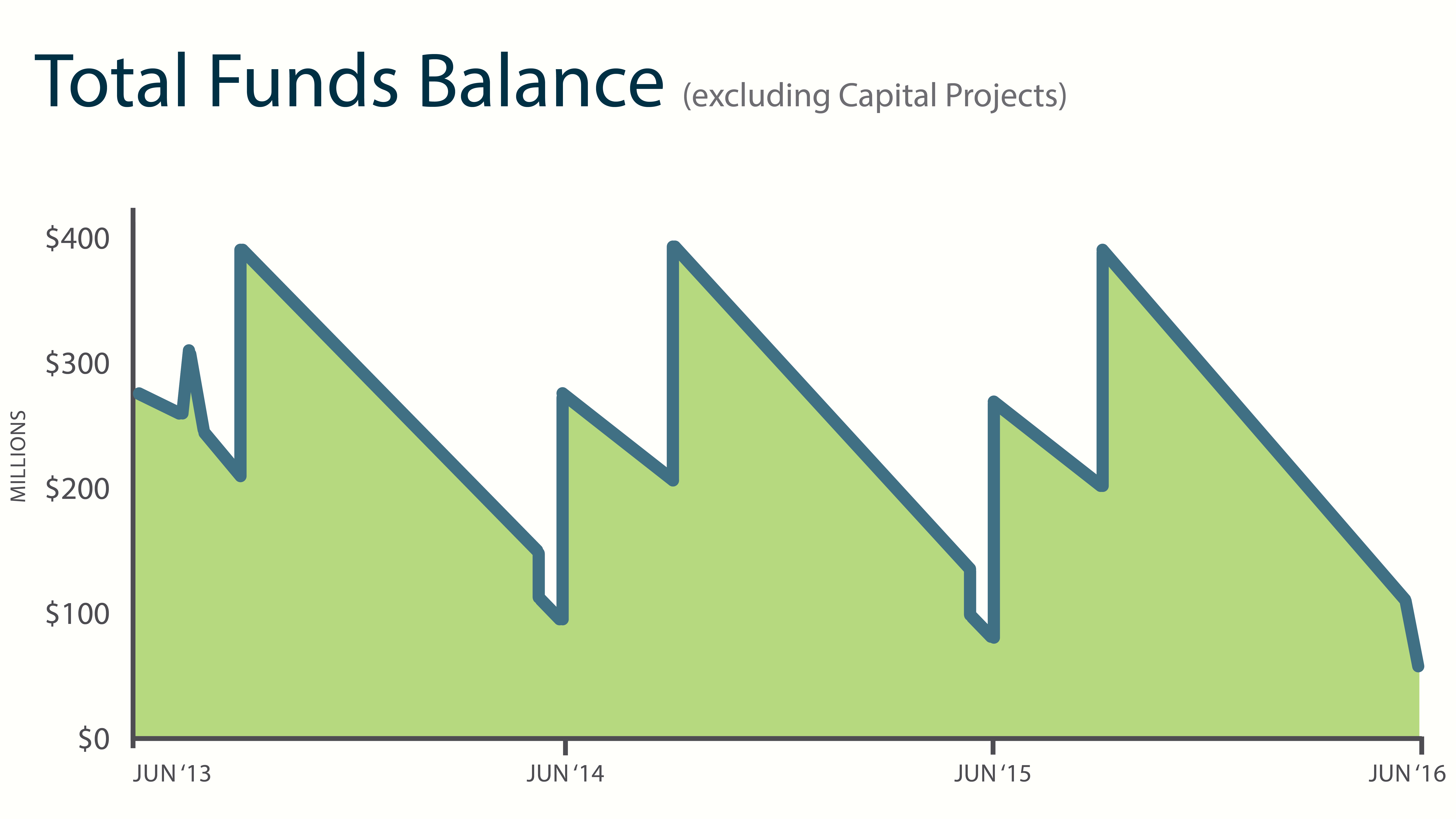

Single School District Cash Flow (Exhibit A) Chart

A typical political subdivision receives funds throughout the year and “spends down” to meet their liabilities. As the image above depicts (Exhibit A), this process creates cyclicality in their balances. However, cyclicality can be mitigated by pursuing funding diversification among political subdivision depositor entities (see exhibit B). Funding with a broader base of political subdivisions on different revenue cycles (in and outside of footprint) reduces the potential for volatility.

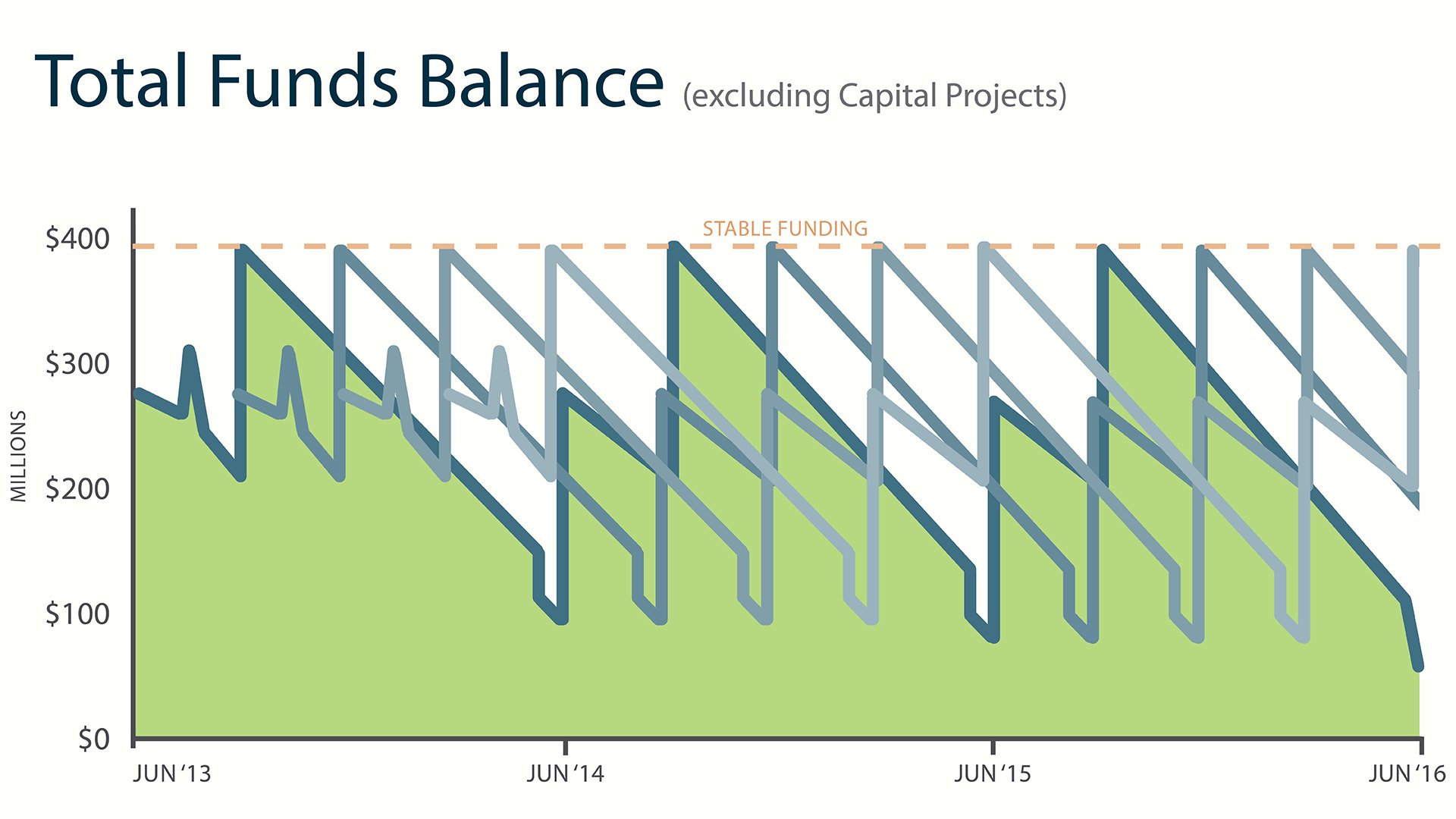

Multiple School District Cash Flows (Exhibit B) Chart

Exploring outside of a financial institution footprint for political subdivision deposits is often overlooked due the perceived nature that all political subdivisions act the same. A common perception by financial institutions is that by adding more political subdivisions to their deposit portfolio, they will be introducing more volatility. In fact, the opposite holds true. By relegating your political subdivision deposit portfolio to your immediate surrounding area, a financial institution is creating more volatility due to the increased likelihood that those deposits will be “funded” and “spent down” around the same times.

Another alleged difficulty with political subdivisions is their need for collateralization and a lack of understanding of what are acceptable forms. There are a variety of options available which offer varying degrees of pros and cons. Let’s take a look:

Pledging of Securities

Traditional securities collateralization through a third party custodian is still very prevalent, but we are seeing financial institutions and political subdivisions expand the types of securities being pledged. There is a shift away from U.S. Treasury and Agency Securities toward municipal bonds or other forms of collateral. Each state and individual political subdivision may have restrictions on the type of bond that may be used as collateral, but these restrictions are manageable. Pledging securities requires monthly reporting, monitoring of value and release of securities collateral.

Federal Home Loan Bank Letter of Credit

A Federal Home Loan Bank (FHLB) Public Unit Deposit Letter of Credit (PUD LOC) is an attractive alternative to the traditional method of pledging highly liquid securities(1). The FHLB allows for the pledging of a variety of loans and in return issues a direct pay PUD LOC for the benefit of the public depositor. The Government Finance Officers Association Best Practices lists Letters of Credit (LOCs) from a government sponsored entity as an important safeguard on public unit deposits. The FHLB PUD LOC is easy to issue (typically within 24 hours) and is operationally efficient. The FHLB PUD LOC does not require monthly reporting, monitoring of value or release of securities collateral. In addition, some FHLBs offer a PUD LOC that can be established using a fluctuating balance feature so fees are paid based on actual deposit levels only. In addition, evergreen language can be incorporated so that a single PUD LOC can be issued to capture all activity of an individual depositor, including both fixed term and liquid balance. Many FHLBs are willing to work with depositors to customize the language to fit their needs.

Excess FDIC Deposit Insurance Bond

Excess FDIC Deposit Insurance Bonds left the market in the aftermath of the Great Recession of 2008, but have recently been reintroduced into the market. There are a variety of insurers that provided deposit insurance to both rated and non-rated institutions at price levels competitive to other collateral options. The bond is designed to reimburse a depositor for a loss resulting from a financial institution’s insolvency or failure to meet obligation and can be utilized on both term and liquid deposits.

Reciprocal Deposit Programs

Reciprocal deposit programs, like Promontory’s CDARS and ICS(2), allow financial institutions to attract political subdivision deposits without having to pledge collateral. The two services allow financial institutions to take large block dollar deposits without the need for collateralization by offering customers access to multimillion-dollar FDIC insurance on funds placed through the network.

Conclusion

As a financial institution, it is critical and beneficial to have a variety of collateral options available to utilize in securing and maintaining political subdivision deposits. What is the key takeaway? To implement and periodically test each form of collateralization to ensure availability and gain operational efficiency. In addition, take the time to educate political subdivision depositors about the various forms of collateralization so they are comfortable with the process while remaining compliant with their investment policies. The more flexibility a financial institution has in utilizing various forms of collateral, the more competitive a financial institution can be in working with political subdivisions.

(1) FHLB CHICAGO: https://www.fhlbc.com/products/letters-of-credit

(2) PROMONTORY INTERFINANCIAL NETWORK: http://www.promnetwork.com/

Co-Authored by:Todd A. Terrazas