4 ways cross-functional teams win at reaching underserved markets

Among the many pieces of value credit unions bring to their local communities is the assurance that everyone can access mainstream financial services. Because credit unions’ purpose is to provide fair, dignified financial products and not to thicken the wallets of shareholders, the cooperatives are uniquely positioned to make a meaningful difference in the pursuit of serving the underserved.

Yet, doing so is not always easy. Member outreach and growth strategies can actually be quite complex. This is especially true when those strategies are considered through a filter of regulatory compliance challenges.

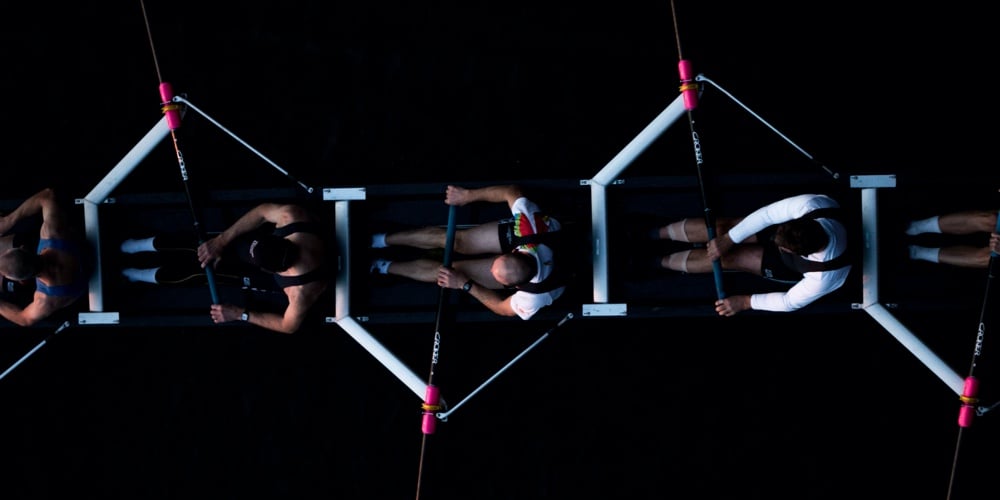

One of the ways to push through the complexities is to establish a cross-functional group that ensures compliance and experts that understand the market work hand-in-hand from the very start of any initiative.

A great example of this is the collaboration between Filene, Inclusiv, Coopera and PolicyWorks. Each brought a unique viewpoint and skillset to a series of workshops to help credit unions accelerate their financial inclusion efforts.

Blending the knowledge base and perspectives of multiple functions enables several great things to happen:

Generates buy-in across the credit union: Taking the time to adequately socialize financial inclusion initiatives is one of the most worthwhile endeavors a credit union can undertake. When that socialization is pursued by a collective of diverse leaders, the group has a much better chance of speaking the language of various decision makers throughout the cooperative.

Builds external trust that much faster: There is no one size fits all strategy to engaging with vulnerable and underserved populations. Colleagues with different responsibilities and aptitudes (not to mention their own human experiences) will bring a variety of ideas to the group, increasing the likelihood, effectiveness, and speed of building trust with new member segments.

Ensures regulatory compliance from the outset: As with any new strategy or initiative, reaching underserved markets is accompanied by a variety of surmountable regulatory and compliance components. Understanding best practices for working with regulators is much easier when the compliance function is made an integral part of the group at inception.

Smooths operational wrinkles: Cross-functional teams have a clearer line of sight into the potential pitfalls and hurdles of implementing programs like ITIN lending and small business lending programs. Contemplating the process, policy, and procedure changes is a much easier undertaking when every function is represented on the team.

Accelerating financial inclusion – within the rules set by regulators – is complex, but 100-percent achievable for every credit union, regardless of size. Cross-collaboration between marketing, operations, compliance, lending, and other departments allows credit unions to be successful, right from the beginning. With a collaborative, interdisciplinary approach, credit unions across the country will have measurable impact on the lives of the people who need them most.