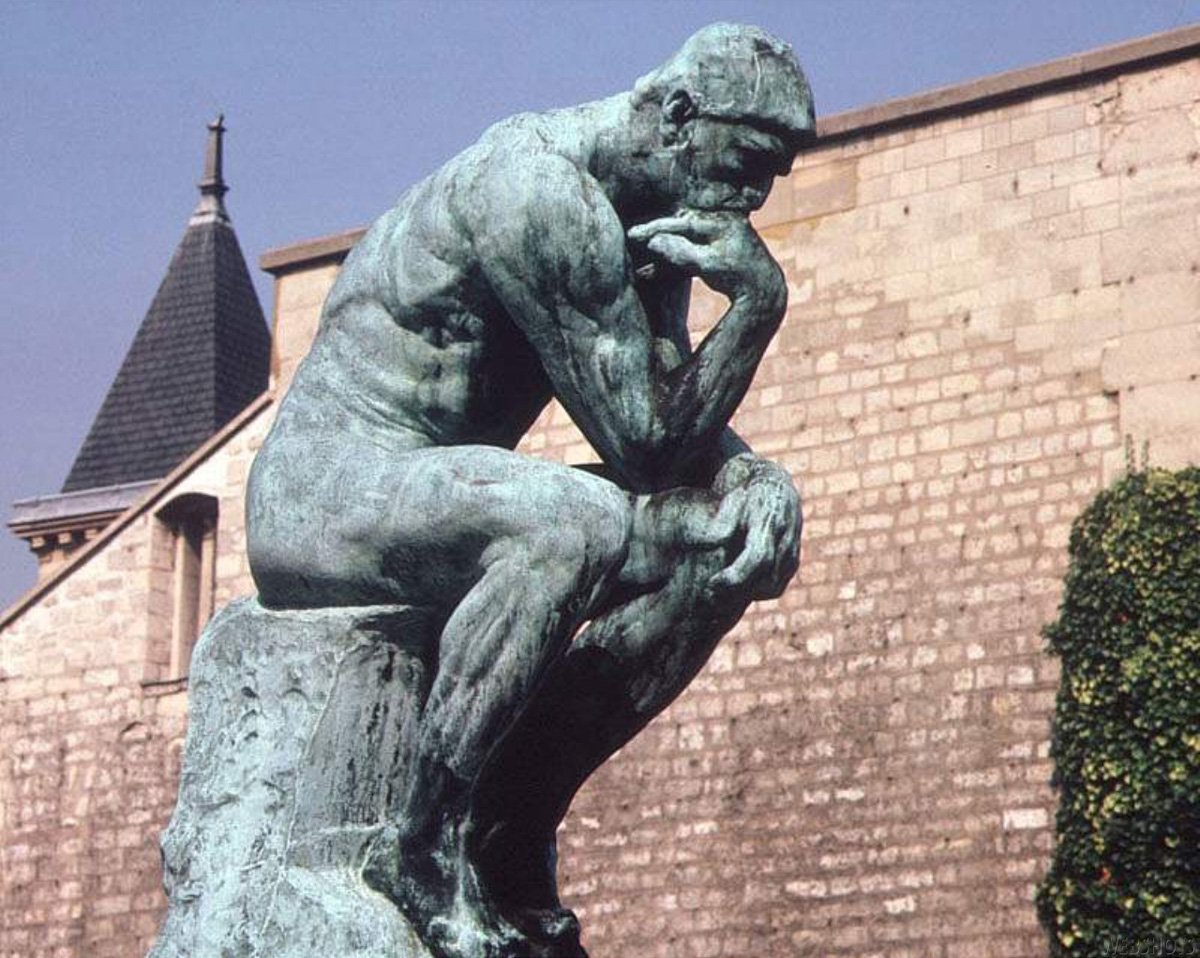

A Lot to Think About…

By. Bob Dorsa, ACUMA

During those rare moments when mortgage lenders stop and take a breath, we all realize we’re in a much different mortgage lending landscape than just a few years ago when the “new normal” was established.

Mortgage Lenders are muddling through seven different regulations just from the CFPB alone. These cover the gamete and are either being implemented now or are soon forthcoming. So, let’s not forget about regulations still warm from the recent years. Looking back we try to measure how well we managed through the last round of compliance regulations. Then we look forward to determine where we will go from here. There is no good time to go through all of this and maybe the only silver lining is ALL originators and servicers are required to take the same medicine.

I remember the phrase “when the going gets tough the tough get going” but there must be reasonableness for all of this isn’t there?

The real important issue is WHY? We know much of this is necessary. In some way things have been developing for a long time. An egregious incident occurs to which we react or perhaps overreact intensely until we reach a tolerable level of control. In my opinion there is no easy way around this. It is imperative credit unions stay the course and take full advantage of our standing in our communities to do what we do best; serve our members. I am enthused by a new spirit of unity. We are poised to create a consistent narrative as to how and why credit unions are different. A relatively simple statement but one in which members and prospective credit union members can embrace as they take comfort in the fact credit unions truly places the consumer’s interest first.

I feel strongly that we must take full advantage of low mortgage rates to benefit our members. It is a certainty, at some point rates will rise and hopefully home values too. Homeownership’s with all its benefits continues to hold value and is still relevant to consumers. Since 1974 I have witnessed the creation of the first credit cards up to and through the more recent large scale mortgage meltdown. Looking back I believe credit union mortgage lending exited the housing collapse stronger than we entered it. There are fewer credit unions now however we are all working harder to preserve the cooperative nature of our business. Through mortgage CUSOs and movement toward the strategy of mortgage lending as a genuine core value of most successful organizations, it is no coincidence our markets has grown substantially in the past few years. More and more consumers are seeking credit unions as viable alternatives for housing finance than ever before. Our expanded experience and exposure by virtue of more transactions alone, continues validating that home loans made to credit union members perform better than those provided by our competition. We refined our processes and embraced technology to be more productive and efficient regardless of the market conditions. Credit unions have more than tripled first mortgage market share in the past five years alone. This has been helped by lower rates which, presented opportunities but that’s only half the equation. We continually learn out of necessity, how to adequately manage risk and reserve requirements while extending all that we can for our members .That’s what our cooperative system is all about and that is the story we must spread far and wide throughout the nation.

The way I see it there is no turning back. We helped homebuyers and owners a great deal in 2012 and their response is they want and expect more from us. I interrupt this as a sincere compliment for your efforts, and you know who you are! Confirmation of this statistic is evident as we set new records for mortgage loan originations, more that 20% higher than in a single year in the history of credit unions.

So let’s roll up our sleeves and go to work. Most importantly we must remember every day; many existing members are still unaware of these trends and your high performing mortgage lending activities. Please don’t be shy. Tell your story, shout it from the rooftop as it were, get out in your community and state your intent to provide meaningful solutions for ALL housing finance needs and continue delivering as you did in 2012. If we can get our arms around that the rewards will be many and our system will experience growth like never before.