Engaging members at every stage of the credit lifecycle

Now is the perfect time for community financial institutions to grow revenue from their credit card programs. Over the last year, low unemployment and high consumer confidence have driven increased spending and credit card usage. Higher interchange fees on credit vs. debit and revolving balances offer even more revenue potential. Plus, a recent study1 indicated that community credit card PV (purchase volume) is up for the community segment as compared to larger financial institutions. To capitalize on your card program, you’ll need to employ best practices throughout the entire credit card lifecycle. It’s important to create a plan that starts with acquisition and activation but then continues throughout the entirety of the consumer’s card ownership and usage.

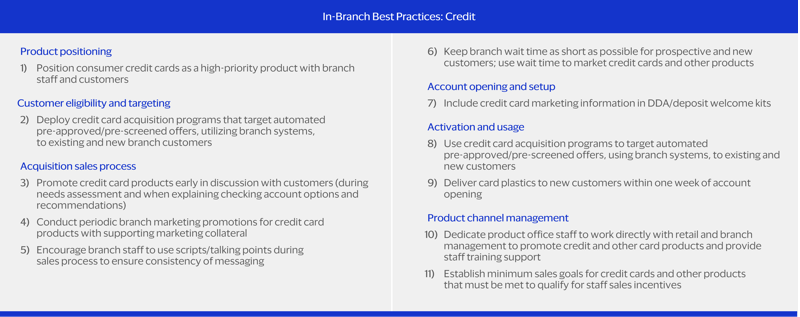

Acquisition

When looking to acquire new credit card users, your branch is a critical channel. Make sure your card is positioned as a high-priority product to both members and staff, then deploy pre-approved/pre-screened offers utilizing branch systems.

Acquisition sales process

- Promote credit card products early in discussion with members

- Conduct periodic branch marketing promotions with supporting marketing collateral

- Encourage branch staff to use scripts and talking points for consistency of messaging

- Keep branch wait time as short as possible, but use any unavoidable waits to market credit cards

- Implement digital sales tools to reduce application friction pain points, such as text to apply (financial institution gets credit, member can apply at their convenience). Digital sales also capture applicants’ affirmative consent

- Branch exclusive acquisition, offers to draw prospects and members in

Account opening and setup

- Include credit card marketing information in DDA/deposit welcome kits

Activation and usage

- Use credit card acquisition programs to target automated pre-approved/pre-screened offers, using branch systems, to existing and new members

- Deliver card plastics to new members within one week of account opening

Product channel management

- Dedicate a product team to work directly with retail and branch management to promote card products and provide staff training support

- Establish minimum sales goals that qualify for staff sales incentives (if allowed by your organization)

Outside the branch, you’ll want to implement a targeted, multi-channel acquisition strategy. Direct mail, email, social posts, online banking/mobile app and targeted digital ads are all good ways to reach beyond your current customer base. It will require resources and infrastructure but is a critical component of creating a new acquisition pipeline.

Activation

While most cardholders activate their card within the first 20 days, activation rates start to slow during days 20-50, so there’s a significant opportunity for targeted marketing. Communicating early and often, as part of an effective Early Month on Book (EMOB) strategy, is critical in maximizing the impact of your credit program. There are various ways to enact an EMOB strategy, and the one you choose will usually be dictated by your budget, available channels and targeting capabilities.

- Data-driven strategies are built from, and targeted based on, customer behavior — including activation and usage. These plans are more complex and segmented but are also more effective since they’re more salient to consumers.

- Inactive messaging strategies are a great way to drive card activation, but they might miss an opportunity to stimulate early card use. To counter this, consider offering a first-time usage credit to encourage consumers to make that initial purchase. For example, you could offer a $25 cashback offer on the first $100 spent by the consumer.

- Direct mail strategies can be less cost efficient but are a good way to support a critical message or connect with consumers that you can’t contact through email. Many issuers only have about 30% of their cardholder base opt into email marketing, so direct mail allows issuers to reach a larger percentage of their consumers.

Usage

Creating an ongoing marketing and customer management strategy is essential to maintaining a profitable credit portfolio. Marketing in this stage of the lifecycle is designed to drive engagement, stem attrition and create loyalty through targeted campaigns that provide education and drive spend, transactions and engagement.

Here are a few usage tactics to consider:

- Spend stimulation: Segment-based stimulation strategies can provide a rich mix of educational messages, offers and brand recognition to drive increased retention. For example, you can offer increased rewards on gas station purchases for users who frequently purchase fuel or a cashback program for a user’s online purchases.

- Credit line increases (CLIs) and APR reductions: These both build balances and create top-of-wallet positioning. They also give your members a valuable benefit and allow you to deepen your relationship with them while still helping to grow balances and revenue.

- Balance transfer offers: Building a successful balance transfer program requires rigorous analytics support — persistence with this tactic is critical, as models are effective at identifying who is likely to take a balance transfer but not as adept at signaling when the transfer may occur.

- Reward and reward reinforcement: To drive continual usage, ensure your loyalty platform and program are competitive, then remind card members of accrued rewards and redemption options.

Upgrade

There is a significant spend lift for cardholders who are upgraded from a non-reward to a rewards card or rewards card to a premium rewards card. Spend and transaction lifts are sustainable over the six-month observation period, and cards less than two years old show a 66% higher lift1. Segmented upgrade strategies based on member usage are the most effective — for example, offering a travel rewards card to a member who uses their card across the country.

Following credit lifecycle best practices at each step of the member journey is key to ensuring a successful, ongoing relationship with your credit cardholders.