Federal student loan payments are having a major impact on members’ wallets

October 2023 marked the end of a more than three-year pause on federally-backed student loan payments, and millions of Americans are now navigating a new financial landscape. This resumption, amidst record-high inflation impacting essential costs like housing and food, is placing considerable strain on borrowers.

A surge in student loan payments

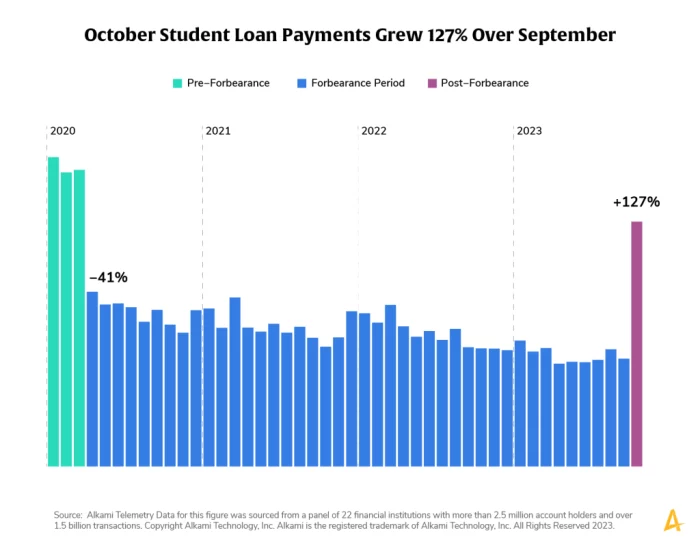

Data from Alkami shows a 127% increase in student loan payments in October compared to the previous month. This surge indicates a significant financial shift for members, who now face the additional burden of student loan expenses after a prolonged period of economic challenges.

However, nearly 9 million borrowers “missed their first student loan payment…meaning 40% of the 22 million borrowers who had payments due in October, did not make payments by mid-November” according to cnn.com.

Actions credit unions can take: Leverage first-party transaction data to observe those who have new or increased monthly student loan expenses. After more than 18 months of rising economic prices, these payments could be a very stressful addition to their personal finances. It’s also useful to watch for who may be missing payments, as an indicator of further economic stress.

Preparing for the financial impact

Credit unions must recognize the challenges faced by members. Rising economic pressures combined with the resumption of student loan payments could lead to heightened financial stress. It’s crucial to stay informed about members’ new monthly expenses and provide support during this transition.

Knowing who is struggling is just half the battle. It is also vital that credit unions demonstrate that they understand the struggles some may be going through right now. Financial institutions can use this as an opportunity for outreach and messaging to account holders through this changing stage and provide tools and products to support their financial health and wellness.

Borrowers do have different repayment options, like income-driven repayment (IDR) plans, to better manage their finances. For borrowers struggling with payments, IDR plans can offer relief based on income and family size, with the new SAVE Plan being a particularly affordable option.

The Department of Education has instituted a 12-month “on ramp” for borrowers, which runs until September 2024. During this period, if borrowers miss monthly payments, there will be no impact on the borrower’s credit: the loans will not be reported to credit bureaus as delinquent nor will the borrower be referred to debt collection agencies. This measure is critical, as past economic downturns have shown that borrowers entering repayment during such times default more quickly than those in more stable periods.

How can a financial institution support members, even though they are not their loan provider?

- Become a trusted guide, by offering resources and advice, similar to the above.

- Create a blog post or landing page on the financial institution’s website with links to appropriate resources for borrowers.

- Outreach to those now making new student loan payments, offer them consultations time, or create group learning webinars to further educate members.

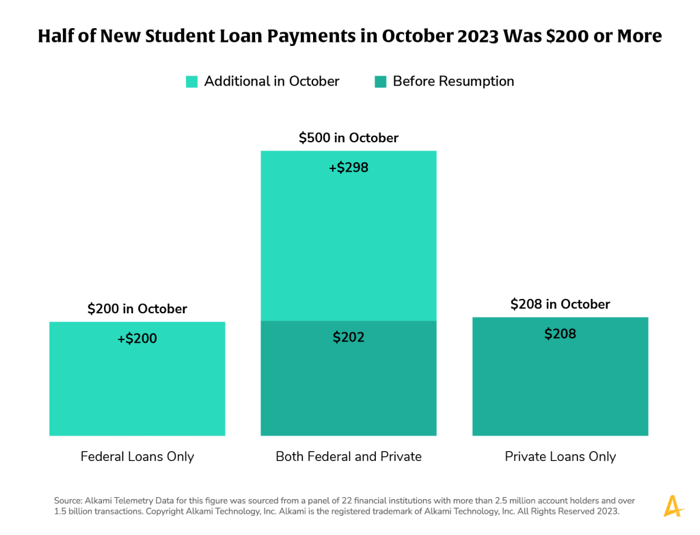

Three types of student loan borrowers

Through a transaction enrichment and analysis process, Alkami studied the wallet impact resumed payments had on borrowers, and also uncovered three types of student loan borrowers. Private-only loan holders, federal-backed loan holders, and account holders who hold a mix of federally-backed and private loans. Only the federally-backed loans were suspended; borrowers kept paying private loans throughout that period. The analysis showed that this group had a median payment of $202 for the private loans they continued to repay during the pandemic, and the resumption of the federally-backed loan added $298 to that.

Finally, there is a group who only had private loans. They did not benefit from the forbearance and continued to make payments throughout that period, a median of $208, which, depending on the size of their loan, they are still repaying. Resumption of federally backed student loan payments had no impact on this group.

The wallet impact

For some, that new expense might not be a significant burden, especially if they don’t have much in the way of other debt. But for others, it could have quite a significant impact, because these members have other monthly expenses, like credit card payments, mortgages, car loans and more.

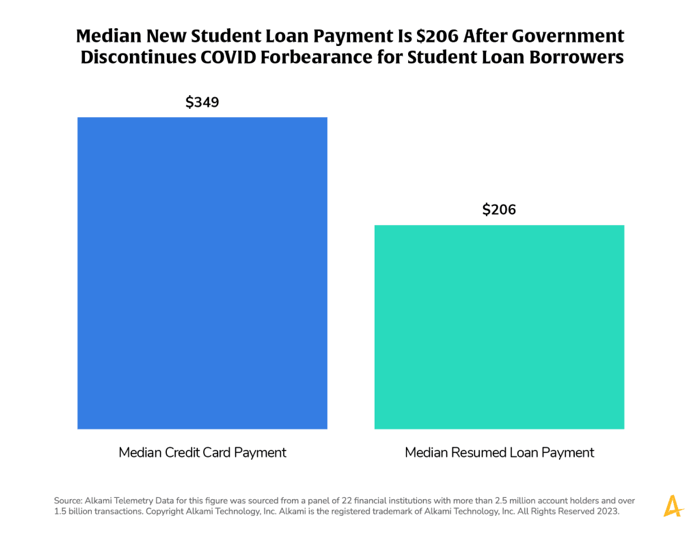

Contextualizing the burden of that new $200-300 with a broader understanding of the other monthly payments that borrower already has, can give a clearer picture of the new payment’s true impact on each borrower. As a benchmark, Alkami compared the median resumed payment to the credit card payments for this same group and found that their loan payment represented roughly 60% of their credit card payment amount. Imagine if a credit card payment suddenly grew by more than half, and you’ll appreciate what some of these borrowers are facing.

Key takeaway: The extra monthly expense that many student loan borrowers incurred in October 2023 could pose a significant burden on their budget, straining their finances. Credit unions need to know which of their members are feeling the stress of these new payments and respond with advice, education and offers that will impact people in the right ways at the right time. Might a lower-interest home equity loan to consolidate high interest debt be a solution?

As the American banking industry faces the challenge of deposit growth amidst changing economic conditions, understanding and responding to the dynamics of student loan repayments becomes crucial. Credit unions have a pivotal role in guiding their members through these changes and ensuring that the systems in place are ready to support those facing difficulties.

For more transaction enrichment research, click here.