If you’re a credit union marketer, chances are you’ve heard of website “speed bumps.” And, chances are, the NCUA’s guidelines about them have given you equal parts confusion and concern.

But let’s rewind for a second.

In case you need a refresher, speed bumps are those external link warnings that tell your website visitors when they click on a third-party link. The warning essentially says they’re leaving your site and heading into the Wild West of the internet. You’re basically making a disclaimer: “Hey, we’re not responsible for anything on another website even if we’re linking to it.”

And while it’s true that not a lot of websites have to give this kind of explicit notice, according to the NCUA guidelines, credit unions are expected to identify associated risks and employ appropriate “risk management techniques.”

So, given that internet users don’t see speed bumps much outside of financial institutions, let’s talk about how speed bumps could be affecting your conversion rates (the percentage of people who apply online for loans and accounts). In this article, here’s what we’re going to explore:

- How speed bumps impact loan & account applications

- Case study with Freedom Credit Union

- When you do and don’t need speed bumps (according to the NCUA)

How speed bumps impact loan & account applications

Your website’s “conversion rate” is the percentage of visitors who take the action you want them to take (i.e., apply for a loan or account). So, for a credit union, conversion rate optimization (CRO) means increasing loans and accounts through your website.

And though it’s way beyond the scope of this article to discuss the overall concept of CRO (we have other articles about that), here’s a quick overview: In a nutshell, CRO is about making your website as persuasive and usable as possible to increase conversions.

Persuasive. People have lots of options for financial institutions. Why should they get a loan or account from you? Your website has to persuade people to choose you, otherwise they won’t “convert”.

Usable. How easy is it to use your website? Obviously, people like things that are easy and convenient. The more difficult your website experience is, the fewer people will convert.

That’s why you have to look at all features of your website through the eyes of your users—including speed bumps—and ask questions like, “What value is this giving my user? Could this be made more clear, concise, or intuitive in any way?”

Unfortunately, speed bumps can negatively impact conversion rates. Let’s look at a case study with Freedom Credit Union.

Case study with Freedom Credit Union

BloomCU collected data with Freedom Credit Union on the impact of speed bumps across four different products: checking accounts, auto loans, home equity loans, and credit cards.

When users clicked to start an application, the website triggered a speed bump. This speed bump notified the user they would be leaving Freedom Credit Union’s website and would be taken to a “third-party website.” Only if the user chose to “Continue” would they proceed to the application on LoansPQ (a third-party service provider that Freedom CU partners with to process loan applications).

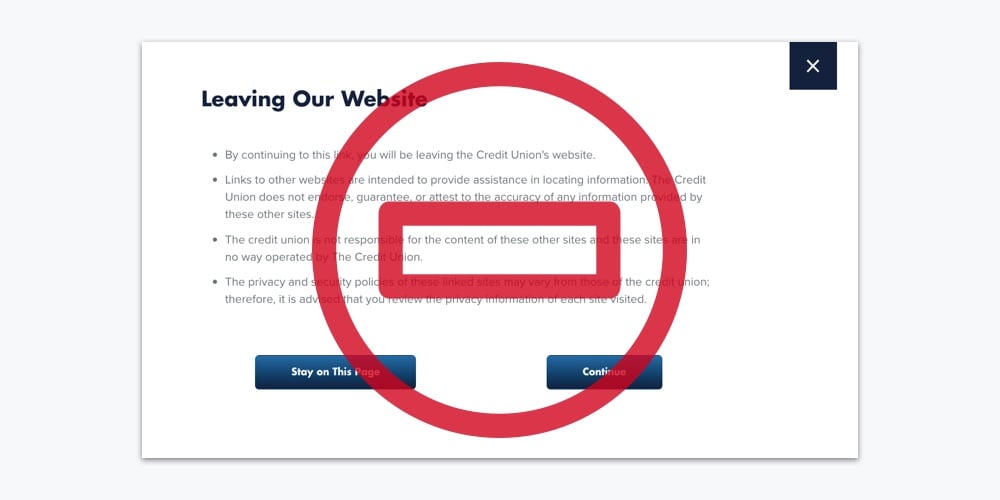

An example of what a speed bump looks like.

Many credit unions use speed bumps in this way and we wanted to measure the impact. Unfortunately, we found that most visitors abandoned the experience once they encountered a speed bump (pictured above).

Specifically, for the checking account product, only 32% of users elected to move past the speed bump by pressing ‘Continue.’ And the story is the same for the other products, with conversion rates hovering around 30%, with the highest conversion rate after a speed bump sitting at just 45% (for the auto loans product).

Here’s a visual of our findings:

We tracked the number of times speed bumps were opened and the number of times people continued through them.

Overall, across all four products, we found the average speed bump conversion rate stood at 35.1%. That means almost ⅔ of Freedom CU’s visitors dropped off when they saw the speed bump, even after they already expressed interest in filling out an application (by clicking that ‘Open Online’ button).

Out of 796 people who clicked to start an application, only 279 (35.1%) continued through the speed bump.

Clearly, speed bumps can kill conversion rates.

After seeing the negative impact on these four products, Freedom was smart to decide to remove the speed bumps. And, fortunately, they don’t actually need the speed bumps in this case from a compliance perspective. They’re using LoansPQ as a third-party service provider to help facilitate an online service, so under the NCUA rules they’re not obligated to put a speed bump here.

So, on that note, when does the NCUA say you’re supposed to have a speed bump?

When you do and don’t need speed bumps

As you likely know, the NCUA’s 2003 letter to credit unions, titled “Weblinking: Identifying Risks and Management Techniques,” addressed the use of external web links on credit union websites.

The letter gives credit unions guidance on how to protect both themselves and consumers, and here are the two “significant” categories of risk the NCUA identifies: Reputation risk and Compliance risk.

Now, the following list is by no means comprehensive, but some risks they mention include third-party privacy and security risks relating to visitor information, risk of confusion relating to financial products, and potential financial loss.

Given the possible risks of linking out to a third-party website, what does the NCUA say about mitigating those risks?

Well, among other measures credit unions should take (such as evaluating all weblinking partners), they advise, “The methods adopted to manage the risks of a particular link should be appropriate to the level of risk.”

Clearly, not all external links are equal in their level of risk exposure. The NCUA points out that a link to an “innocuous” information source, such as a weather report, will pose much less risk than time-sensitive financial planning or investing information, for instance.

Finally, there’s a very important caveat to the speed bump rule, which you can see from Footnote 3 on page 1 of the NCUA letter (and you’ll want to read this whole paragraph):

This guidance applies to links to third parties that offer products, services, or information directly to financial institution customers. It does not apply to operational links from a financial institution’s website to a third-party service provider that is providing services on behalf of the financial institution, e.g., a link to the institution’s Internet banking service provider.

Takeaways

- Only use a speed bump if you absolutely have to. They are uncommon across the internet and can dramatically lower the number of applications you get.

- You don’t need a speed bump if you’re linking to a third-party service provider that is fulfilling a service on behalf of your credit union.

Disclaimer: Neither Derik Krauss nor BloomCU LLC are providing legal advice. For legal advice about credit union compliance, consult an attorney. This article does not replace the official NCUA guidelines, nor does it provide an official or legal interpretation of the guidelines.