CBC Federal Credit Union expands with help from CUCollaborate

CBC FCU recently converted to a multiple common bond charter and added four underserved areas to its service area, increasing potential membership by more than four million

WASHINGTON, D.C (April 7, 2022) — On January 24, 2022, the NCUA approved CBC Federal Credit Union (CBC FCU)’s conversion from a community to a multiple common bond charter, allowing for the addition of four underserved areas as well as three select groups to its field of membership (FOM).

In 2020, CBC FCU, based in Oxnard, California, in Ventura County, was in the process of outlining a new strategic plan and seeking to learn more about its members as well as identify potential avenues for growth. Through its research, explained Daniel Bednar, the credit union’s Vice President of Strategic Development, it was found that over 60% of the credit union’s membership was considered “low-income.”

“We wanted to build strategies around serving this underserved community better,” he added, “and we wanted that to correspond with our ability to grow membership.” Under its now-former charter, the institution served individuals living, working, worshipping or attending school in Ventura County, located just north of Los Angeles with a population close to 850,000.

Within that market, however, growth opportunities to serve this community were limited.

Faced with this challenge, the credit union enlisted the help of CUCollaborate, which specializes in field of membership consulting services specifically for the purpose of helping institutions expand their FOM with their regulator. Working side-by-side, the decision was made to proceed with a charter conversion, which would allow CBC FCU to grow its service area without losing any current members.

To achieve this balance, the credit union submitted an ultimately successful conversion application to the NCUA, which included the additions of both underserved areas and select groups to its FOM.

Under a multiple common bond charter, an institution has the option of adding well-defined local communities and/or rural districts to an FOM, provided they qualify as “underserved.” To do so, an area must meet certain standards of economic distress, have proven unmet financial needs and be underserved by other depository institutions.

It may likewise add a combination of occupational or associational select groups, provided they adhere to the NCUA standards of sharing a common bond.

In this particular case, CUCollaborate helped CBC FCU prove both the underserved areas and groups to be added indeed met all necessary criteria, along with the institution’s ability and commitment to serving potential new members immediately.

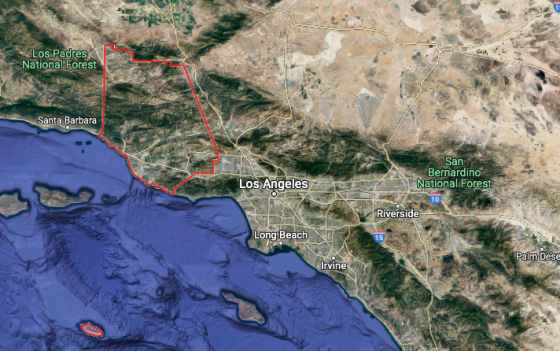

The expansion sees the additions of one underserved local community along with three adjoining rural districts covering parts of Kern, Santa Barbara, San Luis Obispo and Los Angeles counties. The combined area, with an estimated population of over four million, has the potential to increase CBC FCU’s field of membership drastically.

At the same time, the select group additions are designed to ensure current members who may reside beyond these new service boundaries will still remain eligible.

“When we found out about CU Collaborate’s mission to help credit unions reach the underserved more widely, it was a perfect alignment with our strategic plan,” said Mr. Bednar. “And, just as importantly, we can continue to serve our current FOM, which was a primary objective from the outset.”

CUCollaborate Founder and CEO Sam Brownell likewise underscored the importance of the outcome. “We are naturally thrilled with the successful conversion and expansion,” he said. “The credit union has now substantially increased its potential field of membership, which will allow it to offer its services to more people across the entire area, while also retaining its current members. This progress is vital for any institution looking to grow and we are thankful CBC FCU trusted us to be a part of the process.”

The credit union’s headquarters in Oxnard, California.

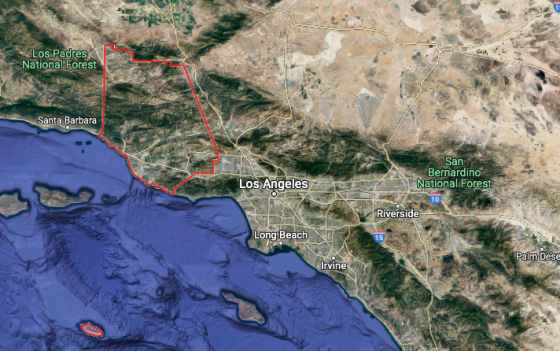

Map showing Ventura County, CA outlined in red (Map data ©2022 Google, INEGI)

About CBC Federal Credit Union

CBC FCU is headquartered in Ventura County, California with three branch locations and assets in excess of $600 million. Originally chartered in 1952, the Credit Union offers a wide array of Home Loans, Lending, Wealth Management, and Deposit products.

About CUCollaborate

CUCollaborate is a consulting, software development, and digital marketing company whose mission is to help credit unions grow. The company primarily focuses on addressing credit union’s biggest obstacle to growth, field of membership.