December spending trends: Signs of hope for the new year

CO-OP Solutions Payments Trends Report (Spending Data from December 1-31)

RANCHO CUCAMONGA, CA (January 18, 2023) — A strong holiday shopping season—along with emerging signs of a gentle landing for the economy – are buoying the spending outlook as we begin the new year.

As expected, the Federal Reserve raised interest rates by 50 basis points at the Federal Open Market Committee’s final meeting of the year in December. The benchmark Fed Fund now sits within a targeted range of 4.25% to 4.50%, the highest level in 15 years. But economic trends are appearing that may convince the Fed to begin easing its aggressive rate-raising campaign in 2023.

Inflation growth adjusted downward for the fifth straight month to an annualized rate of 7.1%. Job growth also slowed in December to 223,000, down from a 263,000 increase in November.

Meanwhile, retailers enjoyed a strong holiday shopping season with U.S. retail sales during the critical November 1-December 24 period up by 7.6% over the same period in 2021, without adjusting for inflation.

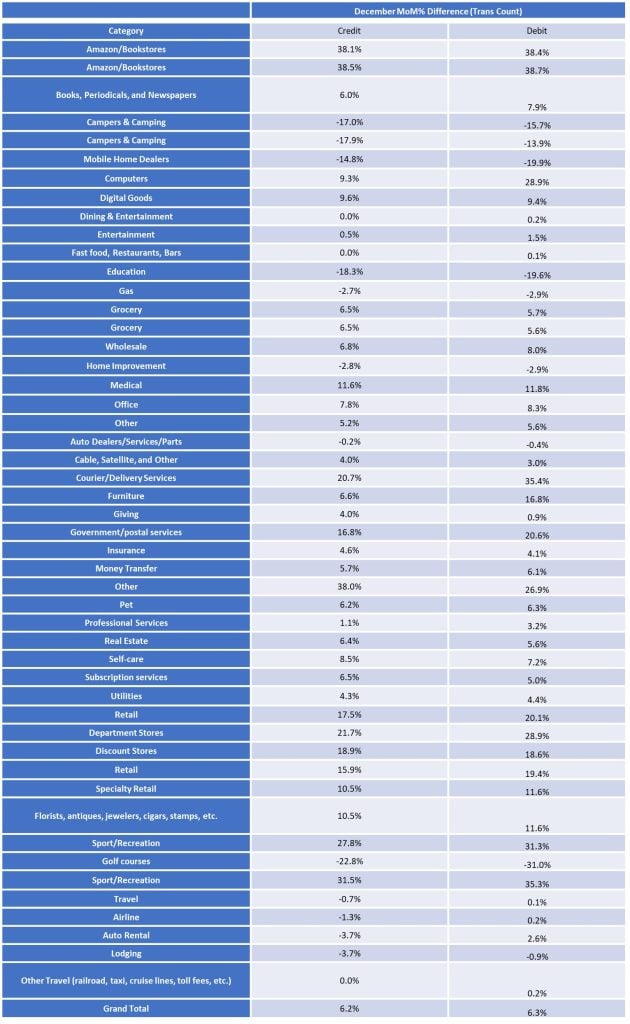

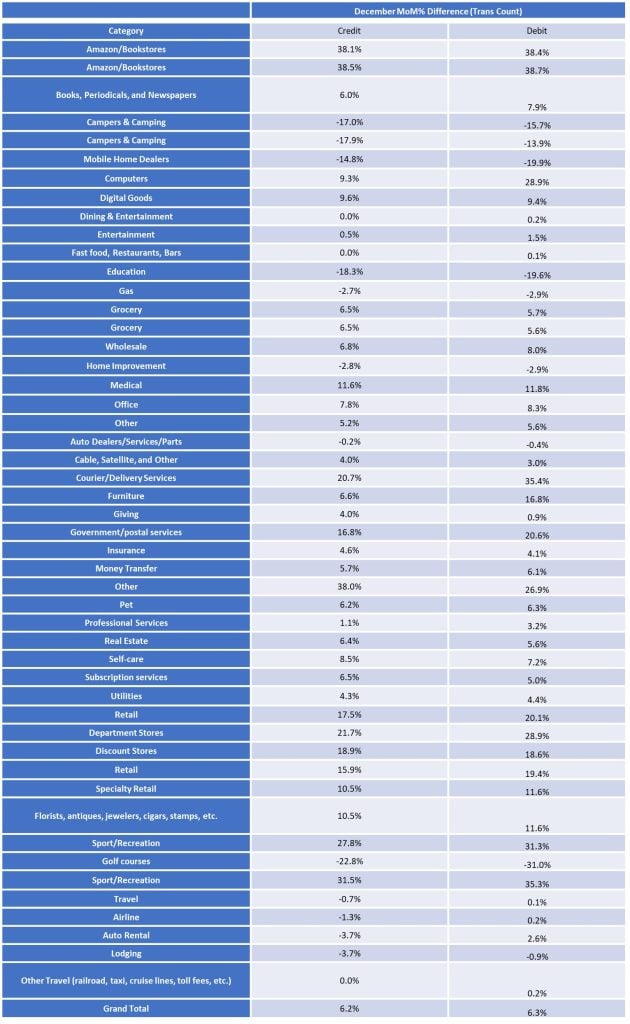

Similar results were seen across Co-op’s credit union client portfolios, which reported strong monthly spending growth across most major retail categories, including Amazon/Bookstores, Computers, Department Stores, Discount Stores and Sport/Recreation. Expected seasonal declines were seen in categories including Campers/Camping, Education and Golf Courses.

Overall credit and debit spending were up for the month by 6.2% and 6.3%, respectively.

Here are some of the key spending trends Co-op’s SmartGrowth team members are watching this month:

#1 Amazon on the Rise

Since kicking off the holiday shopping season with a special Prime Day in October, Amazon has been showing consistent growth. According to the company, it experienced record-breaking sales numbers over the critical five-day period that began on Thanksgiving Day and ended on Cyber Monday, setting a torrid pace that continued right through December.

Within Co-op’s client payment portfolios, the Amazon category recorded big month over month lifts in transaction volume of 38% in both credit and debit. And year over year, Amazon spending was up 13.8% in credit transaction volume and 9.1% in debit, remarkable considering the strength of eCommerce during the depths of the pandemic in 2021.

“Amazon’s strong results came despite many shoppers being frustrated with widespread delivery delays late in the season,” said Beth Phillips, Director, Co-op Solutions. “December’s severe storms impacted the delivery of many last-minute gift purchases.”

#2 Grocery Spending Remains Flat

Coming off surprising declines in November, Grocery spending showed only modest month-over-month growth in transaction volume, increasing by 6.5% in credit and 5.7% in debit. Transaction amounts were up significantly, however, reflecting the impact of inflation and larger purchases made per trip to the store due to the increase in entertaining at home in December. Year over year, Grocery remained flat in debit, but grew by 37.3% in credit.

“Grocery purchasing was delayed this holiday season as consumers made plans later in the season,” said John Patton, Co-op Senior Payments Advisor. “Additionally, consumers were also dealing with the ‘triple threat’ of illnesses that, in many cases, caused their holiday celebrations and plans to be delayed or rescheduled, and that affected what we normally expect to see in this category at this time of the year.”

#3 Medical and Self-Care Show Healthy Increases

Although much of the focus at the end of year is on retail spending, medical expenditures also grew significantly, with increases of more than 11% in both credit and debit.

“Once the cold weather hits and people head indoors, spending on healthcare purchases like pharmaceuticals, medical office visits and clinical services all start to rise,” said Patton. “This season, the public is dealing with a particularly challenging ‘triple-demic’ of respiratory illness, resulting in an above average number of hospital and doctor visits.”

The Self-care category, which includes spending on feel-good services like spas, haircare and wellness items, also saw growth in December, typical for this time of year as consumers attend holiday parties and other public celebrations.

Month-Over-Month Category-Level Spending (Comparing December 2022 to November 2022)

Please note that the category spending below reflects month-over-month comparisons (rather than year-over-year) – i.e., compares December 2022 with November 2022, rather than December 2022 to December 2021.

What Credit Unions Should Do Now

Interest rates and credit balances have both risen over the past year, and members may be looking to consolidate debt after a busy holiday shopping season. Now is a great time to offer cardholders a low-rate balance transfer offer to support portfolio growth, attract new cardholders and support members’ financial wellness needs. It’s also an opportune time to adjust credit lines to accommodate balance transfer offers, but also manage credit risk moving into the new year.

And to keep credit union cards top of wallet throughout the year, be sure to activate a flexible and generous loyalty program that rewards members for the types of purchases they make every day.

More information on the Co-op SmartGrowth Consulting Team can be found here.

About Co-op Solutions

Co-op Solutions is a credit union-owned financial technology platform built using an industry-leading ecosystem, and whose mission is to connect credit unions to the technology, strategic partnership and scale they need to best serve their members and grow now and into the future. Co-op Solutions partners with credit unions to unlock their potential so they can compete; does the hard work of innovation, creating a one-stop opportunity to help credit unions grow; and offers knowledge and expertise in a world where everything must be integrated. Founded in 1981, Co-op Solutions services 2,650 credit union clients, processes eight billion transactions annually, and manages a nationwide ATM network of more than 30,000 and a 5,700-location shared branch network. For more information, visit www.coop.org.