May spending trends: Credit takes flight

CO-OP Payments Trends Report (Spending Data from May 1-31

RANCHO CUCAMONGA, CA (June 15, 2022) — Despite economic headwinds and mounting recessionary concerns, consumers are continuing to spend. Co-op’s May credit union card portfolio data showed stronger month over month results across most categories, while cardholders continued their year-long shift from debit to credit in an effort to preserve cash in light of increasing economic uncertainty.

Mixed economic data was the theme in May, as payrolls increased by a better-than-expected 390,000, keeping the unemployment rate steady at 3.6%, while initial unemployment claims reached their highest level since July 2021.

Of course, the biggest worry for consumers has been inflation. The Consumer Pricing Index continued its upward trajectory in May, hitting a new 40-year high of 8.6% on an annualized basis, driven by increases in gas, food and rental rates. This news reinforced expectations that the Federal Reserve would again raise its benchmark lending rate by half a percentage point at both its June and July meetings to curb runaway price increases.

These economic challenges are not limited to the U.S., as the World Bank recently warned of a growing global risk of “stagflation,” which it defines as “a protracted period of feeble growth and elevated inflation.”

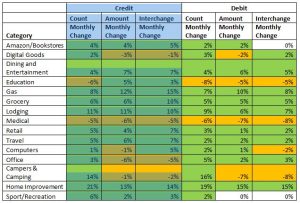

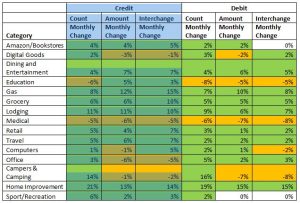

Despite these worrisome macroeconomic trends, credit union members showed strong month over month spending growth in both credit and debit across most merchant categories in May (see table below).

Here are some of the key spending trends Co-op’s SmartGrowth consultants are watching closely:

#1: Home Improvement Continues Strong Growth Trend

Home improvement was up strongly in May in both credit and debit, showing double-digit increases in both count and amount over the prior month, as homeowners continued to invest in their current residences amidst the dual challenges of a hot real estate market and rising mortgage interest rates.

Looking at May 2022 year over year data, the home improvement category grew strongly in credit, with a 39% increase in count and 24% in amount versus May 2021. In contrast, year over year debit spend fell in the category by 8% in count, while rising in amount.

“Homeowners are doing smaller home improvement and renovation projects this year versus last year,” said John Patton, Co-op Senior Payments Advisor. “And given the economic uncertainty, they’re largely using credit to finance these projects, while preserving their savings to fund more significant renovations.”

#2: Long-term Shift to Credit Continues

With economic uncertainty and rising prices ruling the day, consumers are conserving their cash, driving a steady shift over time from debit to credit. Diverse merchant categories like gas, grocery and computers all showed triple-digit increases in credit year over year, while spending fell in debit for the same categories.

“An interesting trend is emerging between the payment types, it appears debit card users are pulling back on spend, possibly moving to credit for smaller, everyday purchases,” said Beth Phillips, Director at Co-op Solutions. “While, reserving their cash available for larger purchases, like home improvement, or to keep it on hand due to economic conditions.”

“People tend to save up and use cash for special events like major sporting events, season tickets and concerts,” said Patton. “This means that we’re seeing a lot of this spend on the debit side, in the month over month data, as opposed to credit.”

#3: Credit Balances Rise for Fifth Consecutive Month

After spending most of 2021 underwater, credit balances have increased steadily since the beginning of 2022 on a year over year basis. May 2022 showed the strongest growth trend yet, with 8.14% higher balances as compared with May 2021, a lift of nearly 1% over April 2022.

“As members use their credit cards more frequently, their balances will naturally grow,” said Patton. “They’re more likely to carry higher average balances and are less likely to pay off in full each month.”

What Credit Unions Should Do Now

As balances grow, credit unions should take this opportunity to analyze their members’ credit line usage patterns to best meet their needs.

“Research shows that when a card holder approaches a 30% utilization rate on their line, they will begin to pull back on using that specific credit card,” Phillips says. “Credit unions should engage with their member before that happens, by instituting a regular automatic line adjustment campaign.”

Month-Over-Month Category-Level Spending (Comparing May 2022 to April 2022)

Please note that the category spending below reflects month-over-month comparisons (rather than year-over-year) – i.e., compares May 2022 with April 2022, rather than May 2022 to May 2021.

About Co-op Solutions

Co-op Solutions is a credit union-owned financial technology platform built using an industry-leading ecosystem, and whose mission is to connect credit unions to the technology, strategic partnership and scale they need to best serve their members and grow now and into the future. Co-op Solutions partners with credit unions to unlock their potential so they can compete; does the hard work of innovation, creating a one-stop opportunity to help credit unions grow; and offers knowledge and expertise in a world where everything must be integrated. Founded in 1981, Co-op Solutions services 2,650 credit union clients, processes eight billion transactions annually, and manages a nationwide ATM network of more than 30,000 and a 5,700-location shared branch network. For more information, visit www.coop.org.