About Member Loyalty Group

Member Loyalty Group is a CUSO formed by leading credit unions in 2008 to develop a common member loyalty benchmark for the credit union industry and is the 2012 winner of NACUSO's Collaboration & Innovation Award. The CUSO has an exclusive relationship with Satmetrix, the Net Promoter® company, to provide credit unions with the most effective tools for managing a Net Promoter® program to collect and act on member feedback that increases loyalty, growth and retention. Member Loyalty Group serves nearly 100 credit unions, many of which are over $1 billion in assets, across the country. For more information visit www.memberloyaltygroup.com

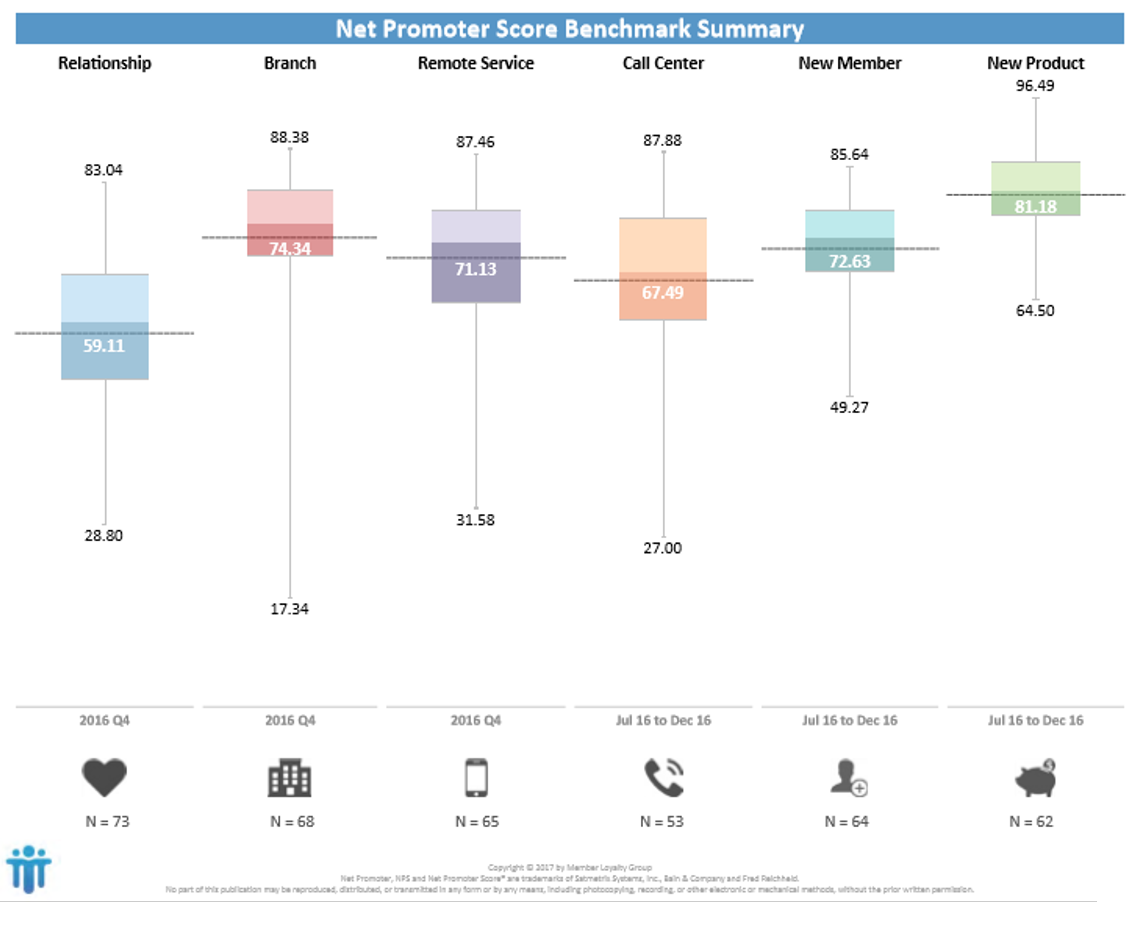

About Net Promoter®

Net Promoter® is both a customer loyalty metric and a discipline for using customer feedback to fuel profitable growth in your business. Net Promoter® has been embraced by leading companies worldwide as the standard for measuring and improving customer loyalty. Financial Institutions obtain their Net Promoter Score® by asking customers a simple question on a 0 to 10 rating scale: “How likely is it that you would recommend the organization to a colleague, family member or friend?” Based on their responses, consumers can be categorized into one of three groups: Promoters (9-10 rating), Passives (7-8 rating), and Detractors (0-6 rating). The percentage of Detractors is then subtracted from the percentage of Promoters to obtain a Net Promoter Score®.

Net Promoter, NPS, and Net Promoter Score are trademarks of Satmetrix Systems, Inc., Bain & Company, Inc., and Fred Reichheld.