The media landscape is shifting at warp speed, and that is more evident than ever in the world of television. As consumers abandon traditional cable and satellite subscriptions in favor of streaming services, advertisers are left with a fragmented ecosystem of platforms, apps, and adtech solutions. For credit union marketers, this presents both an exciting opportunity and a daunting challenge.

Navigating the rapidly evolving world of Streaming TV means making sense of everything from Youtube TV and Hulu, to local TV stations selling Connected TV (CTV) as an extension of their linear buys. Each player offers its own version of audience targeting, ad inventory, and measurement (or lack thereof). As a credit union leader, figuring out what’s worth the investment can feel overwhelming, even for the most experienced marketer.

What exactly is Streaming TV?

Before we dive into how credit unions can leverage this media channel effectively, it’s important to decipher the terminology. You’ve probably heard terms like “Streaming TV,” “Connected TV (CTV),” and “OTT (Over-the-Top)” thrown around. While they sound different, they all point to the same thing: TV content delivered via the internet rather than through a traditional cable line or broadcast over-the-air.

Streaming TV includes content watched on Smart TVs or through internet-connected devices like Roku, Amazon Fire Stick, Apple TV, cable/satellite boxes, and even gaming consoles. When a television is connected to the internet, advertisers gain access to a powerful new capability—household-level ad targeting based on real audience data.

This is what makes Streaming TV a game-changer: the precision and efficiency of digital advertising, now applied to the most powerful screen in the house . . . the television.

Who’s watching?

The short answer? Nearly everyone. Let’s look at the numbers.

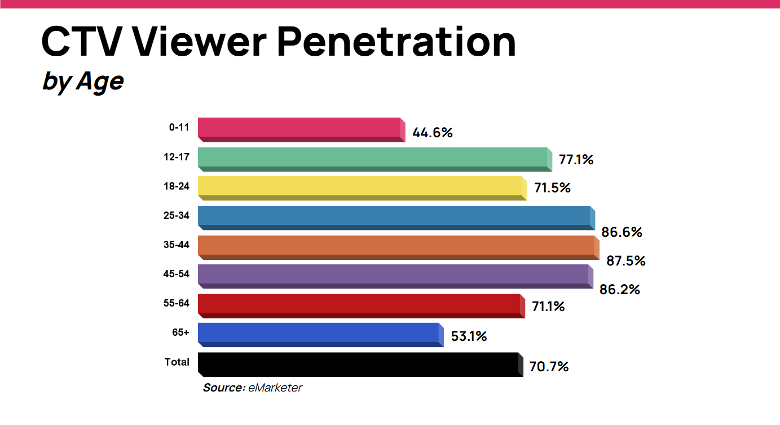

Streaming TV has officially become the most consumed form of television across all age demographics, surpassing traditional cable, satellite, and broadcast TV combined. And contrary to the assumption that this shift is being driven exclusively by younger viewers, the adoption numbers tell a different story:

(NOTE: data graphic below was created by TriAD, I have also included the data in text form if the image cannot be used inline with the article)

| Age Group | Connected TV Penetration (U.S., 2025) |

| 0–11 | 44.57% |

| 12–17 | 77.06% |

| 18–24 | 71.54% |

| 25–34 | 86.60% |

| 35–44 | 87.53% |

| 45–54 | 86.20% |

| 55–64 | 71.07% |

| 65+ | 53.13% |

| Total | 70.71% |

This kind of reach was unthinkable just a few years ago. Today, credit unions can now tap into more than 87% of households in any given U.S. market, down to the zip code, with Streaming TV ads—no matter the age bracket they’re targeting.

What this means for credit unions

For credit unions, Streaming TV levels the playing field. You no longer need a national media budget to run highly targeted, effective, and affordable TV campaigns. Streaming TV ad-targeting enables your marketing team to focus messaging based on real behaviors and life stages—like new movers, auto loan intenders, or households actively shopping for a mortgage. All pre-qualified to meet your credit union's unique membership requirements before your commercial is ever served to their TV.

Here are just a few strategic use cases credit unions can explore with Streaming TV ad-targeting:

- Membership growth/awareness: Reach potential members who meet your field of membership criteria and are likely to respond to your brand message.

- Auto loan campaigns: Serve ads to individuals who are in-market for a vehicle, layered with pre-qualified credit score, geography, or other demographic filters.

- Home loan & HELOC promotions: Deliver messages to homeowners with equity, or first-time homebuyers within a specific age and income bracket.

- Checking account acquisition: Target households that have recently purchased a home, started a new job, been promoted, had a new baby, or are new to the area—when financial habits are most likely to change.

Thanks to real-time data and geographic precision, Streaming TV allows for customization, control, and accountability at a level previously unavailable in traditional TV advertising.

Closing thoughts

TV has always been a powerful storytelling medium. For decades, it’s helped brands build awareness, educate communities, and influence decision-making. But for many credit unions, the barrier to entry was simply too high—too much waste, too little control.

That’s no longer the case.

With Streaming TV, credit unions of all sizes now have access to the best of both worlds: the emotional power and broad reach of TV, combined with the precision and performance of digital. In a media landscape full of noise, this is your opportunity to break through—strategically, efficiently, and with confidence.

My advice? If your credit union is not currently running TV ads, circle up your leadership and marketing team to review the data. Discuss how an effective Streaming TV ad-targeting strategy could help you hit your initiatives and growth targets. If you are already running a linear TV or Streaming TV program, talk to your agency or current media buying partner to review and refine. 79% of US consumers (your future members) report that TV ads influence their purchase decisions. The question is, are you reaching them?