Take me out to the ballgame

I’ve talked before about the concept of conducting a risk appetite assessment for your credit union so you can determine the alignment between management’s and the board’s appetite for risk across the credit union (“Bon Appetit,” CUInsight January 2016). I like to think of risk appetite as the board setting the curbs on the track, and management running the race within those curbs.

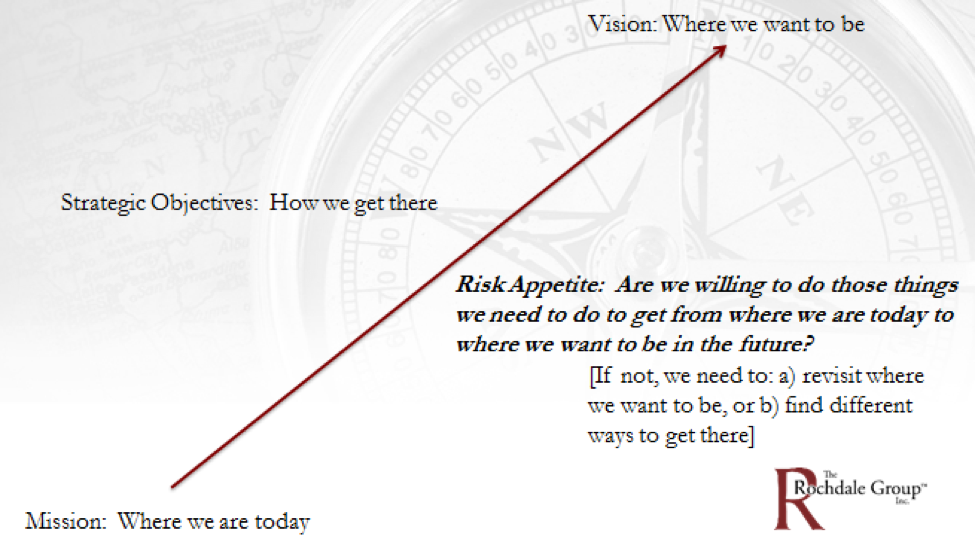

As credit unions assess where we are today (our mission) and set a vision for the future, we need to flesh out the initiatives we’ll undertake to get from point A to point B, based on our risk appetite. (See Fig. 1 below)

This isn’t always easy, and depending on our objectives, we may need to either a. revisit and redefine where we want to be in the future or b. challenge ourselves to think outside of the box on how to achieve our goals, without violating our risk appetite.

Can an unconventional approach actually turn our credit union around? I believe the answer is yes, and to illustrate my point, we’re going to turn to a great American pastime – baseball.

Figure 1: Risk Appetite in a Strategic Planning Context

Case Study: The Kansas City Royals

Prior to 2014, the Kansas City Royals baseball club last appeared in a World Series in 1985, when they defeated the St. Louis Cardinals to win the “I-70 Series.” The ensuing decades saw the Royals mired in mediocrity.

In 1993, David Glass, President of Wal-Mart, became CEO of the Royals. Glass immediately cut the Royals’ payroll by more than 50%. The Royals languished at the bottom of the American League during the remainder of the ‘90s and 2000s. Fans accused Glass of managing the Royals the way he managed Wal-Mart: cut payroll costs to the bone, sacrificing fans in the seats in October for a low cost structure. The team was derisively referred to as “the best farm team in major league baseball,” as promising players such as Johnny Damon and Carlos Beltran worked their way up through the Royals’ system, only to launch into free agency when the Royals were no longer willing to pay the premium salaries these promising players commanded. They went on to win World Series with other teams.

In short, Glass’ risk appetite was such that he was unwilling to assume the risk of spending more money to acquire and retain those star players for the potential payoff of winning a World Series, given that the odds of winning a Series are quite small. In other words, the low likelihood of ultimate success didn’t warrant the investment necessary to attain it, in Glass’ view. For a small-market team in a sport without salary caps, that seemed a reasonable approach, even if it didn’t resonate with fans.

The formula for success in baseball at that time was simple: outstanding starting pitching, designed to shut out opposing teams in the early innings; power hitting, designed to produce big runs with every at-bat (at the risk of missing out on scoring opportunities when those at-bats resulted in long fly-outs); decent fielding, designed to reduce opponents’ scoring opportunities; and a decent bullpen, designed to protect the big leads produced by shut-down starting pitching and big hitting.

In the early 2010s, Royals General Manager Dayton Moore settled on a new approach to success in Major League Baseball. In our strategic planning context, Moore helped Royals owner David Glass recognize a new way of getting the Royals from where they were at the time to where they wanted to be. This new approach would not violate Glass’ risk appetite, as the outlay required to attain success would be much lower than the traditional formula for success.

Moore hired Ned Yost as manager in 2010. Yost, known as a players’ coach, helped to instill a winning attitude in the Royals’ young players. The Moore-Yost team also brought in Dave Eiland as pitching coach in 2011, and Dale Sveum as hitting coach in 2013. Yost’s new coaching team introduced a new formula for ultimate success in the sport.

The new coaching staff identified young players with promise, and developed them from within. But they departed from the traditional model of shut-down starting pitching, a competent bullpen, power hitting, and decent defense.

Instead, the Royals introduced “small ball.” Competent, but not stellar, starting pitching, designed to get the team through five innings relatively unscathed. An outstanding bullpen, designed to protect leads and minimize deficits. The best defense in baseball, with players like Alex Gordon and Lorenzo Cain making play after highlight-reel play in the outfield, stealing extra-base hits from opposing batters. And perennial Gold-Glovers like Mike Moustakas, Eric Hosmer and Salvador Perez ensuring that opposing hitters didn’t make it around the bases.

And the bats. Small ball meant keeping the line moving – getting players on base; relying on aggressive base running and speed to move players into scoring position; and keeping the game exciting. With the Royals of old, the running joke was that there was no lead so great that they couldn’t blow it. With the new Royals, no fan left a game early – this team would find a way to beat you, no matter the deficit, and no matter how late (witness the deciding Game 5 of the 2015 World Series).

The new formula worked. The Royals – absent a line-up of All-Star players – wound up in the 2014 World Series, stymied only by the standout pitching of the San Francisco Giants’ Madison Bumgarner. And in 2015, the Royals overcame the best starting rotation in baseball, with the power hitting to back it up, to defeat the Mets in five games for the Series win.

Small ball was a success. The Royals deployed decent starting pitching, the best bullpen in baseball, a stellar defense, consistent hitting, and aggressive, speedy base running to win the World Series. They turned modern baseball on its ear, and grabbed the brass ring – a small-market team with a low budget, defying the odds to win baseball’s biggest prize.

A strong bullpen is cheaper than a shut-down starting rotation, and great defensive players who can put the ball in play are cheaper than big hitters who have decent fielding skills. The Royals had found a path to the Series that cost the club less than the traditional MLB model, and without violating the owners’ appetite for risk in terms of spending big money for a shut-down starting rotation and a cadre of big hitters that could produce runs (but at the cost of a high ratio of strike-outs).

That success helped to transform the organization. The success of the Royals’ new model meant fans in the seats in October, which brought in unforetold millions in revenue. Late-season success translated into higher regular-season ticket sales – just try to get a group of tickets together for a Royals game in June; when in past years that challenge would have resulted in numerous walk-up opportunities for prime seats, today it means you’ll be sitting in the nosebleed section, if you can find seats together at all.

Glass realized that the new strategy would increase revenue, allowing the Royals to assume more risk by increasing the payroll to retain the proven young stars they’d groomed, while the model still kept salaries out of the stratosphere (today, the Royals’ payroll is near the middle of all teams, and they were able to retain stars Gordon and Perez after last year’s Series win).

The Lesson

The lesson in this for credit unions is that the traditional models may not be the only way to success, particularly in terms of living within our risk appetite. We don’t need to swing for the fences on every pitch, and we don’t need to shut down the competition up front. Trying to do so brings costs we may not choose to bear. We can get from where we are today to where we want to be by eschewing the traditional models of success. We can play small ball, making strategic investments in developmental opportunities; finding a niche that our competitors don’t play in; and playing solid defense – through a superior member experience – while keeping the line moving through focused sales opportunities and targeted acquisition strategies – to put us on base consistently, which will ultimately score runs.

For other credit unions – particularly those with sufficient scale (the “big-market teams”) – the traditional model may be the appropriate path. After all, it still leads to success for teams like the Mets and the Yankees. If we have the means, and the appetite, there’s no reason to abandon that model just because a smaller competitor achieves success with a different one. However, it’s worth considering the example noted above, that there’s more than one path to the same lofty goal.

The key is in knowing our strengths, our weaknesses, and our appetite for risk in pursuit of success. And that’s where assessing our risk appetite can put us at an advantage, especially if we incorporate it into a risk-centric strategic planning context. We needn’t settle for mediocrity if we size up the competition, noting its potential weaknesses, and size up ourselves, finding hidden strengths – all within the context of our appetite for risk-taking in the course of exploiting those weaknesses and capitalizing on our strengths. We can use risk appetite together with strategic planning to develop our game plan, and then – play ball!