The lowdown on low-income credit unions

Liquidity Crisis has become a term all too familiar over the last several months. The increase in demand and decrease is liquidity supply is leaving some credit unions feeling a bit panicked. While it’s every credit union’s goal to maintain and grow their deposits and enhance their revenue, sometimes it is easier said than done when it comes to meeting consumer demand. There are typical, more traditional ways to increase deposit growth, such as reward checking and checking account referrals, but credit unions have a list of non-traditional options to consider as well, especially if they qualify for a low-income designation (LID).

To be a low-income designated credit union (LICU), at least 50.01% of the credit union’s members must qualify as “low-income members,” which can vary from city to city and state to state. This designation, during times of decreased liquidity, can help give credit unions a helping hand as they give access to secondary capital, are exempt from the member business lending cap, and are eligible for grants and low-interest loans, to name a few.

So, what are some additional ways credit unions can increase deposits with an LID you ask?

DTC-Eligible Share Certificates

LICUs can access non-member deposits with the issuance of DTC-Eligible Share Certificates, or securities that are held and serviced by the Depository Trust Company (DTC). This non-member funding is a beneficial way to increase deposits and allows LICUs to receive funding from a vast collection of investors purchasing government-insured deposits in traditional brokerage channels.

Secondary Capital

Secondary Capital is another alternative to increase growth for LICUs. It allows a credit union to build temporary capital from external sources, such as institutional investors. Secondary Capital provides support for additional lending and helps to reduce potential failure by absorbing potential losses. In addition, it gives credit unions the flexibility to expand their branch, grow organic member loans, increase acquisitions, or enhance technology.

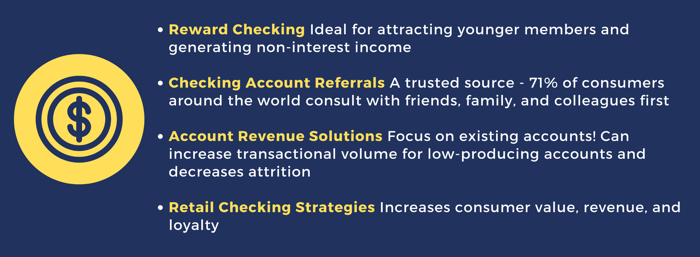

Of course not all credit unions fall under the LICU umbrella, but still need to generate revenue and grow deposits. In this fin tech fast-paced world, having an account system that is fast and frictionless is key in keeping up. Fortunately, there is a toolbox full of solutions to help all credit unions with their growth. When it comes to deposit growth, credit unions should consider looking into some of the following options to add to their strategy:

Deposit growth solutions should be a part of every credit union’s lending strategy. Between a possible recession, liquidity challenges, fluctuating interest rates, and more, equipping your institution with the right products will help to keep your credit union pivoting when economic challenges are thrown its way.

About Allied Solutions

Allied Solutions is one of the largest providers of insurance, lending, risk management, and data-driven solutions to financial institutions in the US. Allied Solutions uses technology-based solutions customized to meet the needs of 4,000 banks and credit unions, along with a portfolio of innovative products and services from a wide variety of providers. Allied Solutions is headquartered in Carmel, Indiana and maintains several offices strategically located across the country. Allied Solutions is a wholly owned and independently operated subsidiary of Securian Financial Group.