The street fight for deposits and liquidity continues

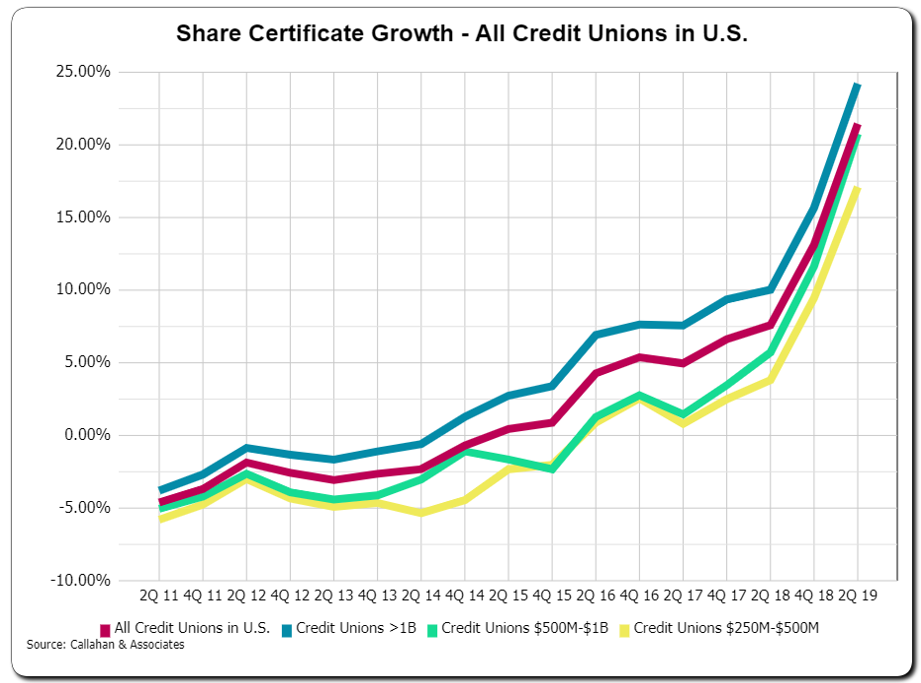

Growth in core, low-cost deposits seems to be a source of frustration for many credit unions of late. While overall credit union deposit growth is positive, much of the growth is in the form of higher rate member certificates. Member certificates can be a reliable source of liquidity, but the higher cost chews into loan profitability, squeezes the net interest margin, potentially lowering the return on assets.

For many credit unions, the more desired type of deposit growth, regular share and checking growth, has been a significant challenge over the past year. As discussed in previous blogs, a key reason for the difficulty in growing core deposits is the ongoing rate advantage for members to move money around.

On top of continued interest rate incentive to move money, competition is aggressively focusing on core deposits with enticing new account bonuses. While new account bonuses are by no means a new tactic to generate growth, Chase’s latest offer is one of its most appealing.

continue reading »