Cross-generational marketing strategy

by: Amanda Lowery

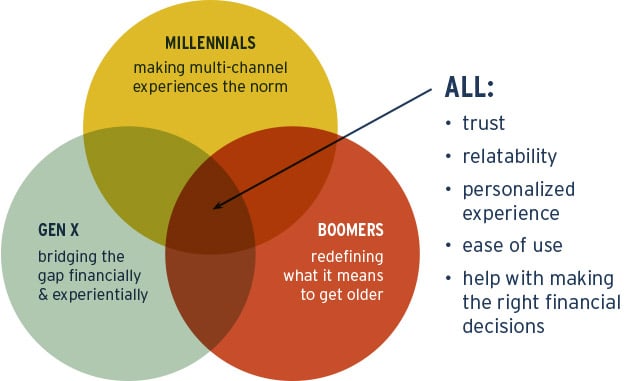

If you’re like most credit unions, you have a lot of Baby Boomer members. Your most high-value current audience is the smaller Gen X crowd, because they are in the peak earning, spending and borrowing years of their lives. And you’d like to attract more Millennials, because you know that without them your organization can’t survive or grow. Three different age groups with different sets of financial needs, media habits, and expectations. But are they really so different after all?

Money

Baby Boomers are the wealthiest generation, controlling about 70% of U.S. disposable income. But by 2018, Millennials will pass Boomers in terms of annual spending power. Both groups are better spenders than savers. The majority of Boomers (60%) have less than $100,000 saved for retirement and most plan to work well past 65. More than half of Millennials consider themselves “savers” even though they spend 82% of their income. And what about Gen X? They’re a smaller generation, but they represent your greatest borrowing potential at this stage of their lives.

Media

At one end of the spectrum, you have a group for whom black and white TV was once high tech. At the other end, you’ve got a demographic that never knew a world without the internet and smartphones. Yet all three of these age groups have made technology an integral part of their lives. Today, Boomers tend to be active in social media and social networking; their mobile use has skyrocketed in the past 3 years. Millennials average 35 hours per week on digital channels, consuming a wide variety of content. And Gen X constitutes the largest online video audience and watches more TV than any other group. They’re also more likely to use their smartphones for payments than any other age group.

continue reading »