2014-2015 E-Scan offers marketing insights

The Credit Union National Association recently released the 2014-2015 Environmental Scan. The E-Scan offers insights in 10 primary areas affecting credit unions, including lending, mobile payments, big data and of course marketing/business development. The E-Scan is a must-read for any credit union executive and is also an outstanding planning tool to use.

The marketing section is entitled “Tell Your Credit Union’s Story.” And it aptly notes “Your credit union needs broader distribution of its compelling story—about how you help members achieve their financial dreams. Your story is your credit union’s unique brand.”

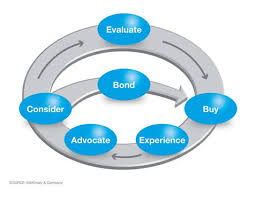

According to the E-Scan, the traditional consumer decision funnel used by many marketers is now replaced by a journey. This journey has six steps:

(1) Consider

Credit unions currently only hold 6.8% of all the assets held by depository institutions in the U.S. The only way to move that number up: create strong brand awareness for consumers to actually use your brand. Suggested tools to use in this stage are sequential messaging, mobile technology, social advertising and immersive brand experiences.

(2) Evaluate

“During this stage, members traditionally have asked friends and family for advice about financial institutions, but they’re now more likely to turn to social media for that advice,” the E-Scan says. Suggested tools for credit unions to assist consumers during the evaluation stage are rating sites, blog posts and tweets.

(3) Buy

Credit unions must create an “omni-channel” experience for consumers during the buying process. You must align every single marketing channel into one database. This lets you make specific offers to members based on purchase patterns, social network affinities, website visits, loyalty programs and other information. Your credit union has tons of data on your members; now you need to use it.

continue reading »