April 1 is Major League Baseball’s opening day. It’s a time for fresh starts and unchecked optimism. And while my hometown team happens to be the 2020 World Champions, growing up a Los Angeles Dodgers fan taught me that the path to victory can be a winding one.

For credit unions, this post-COVID, Digital 3.0 banking environment is also a new season for growth—our baseball equivalent of a winning record. Growth can feel daunting, sometimes even out of reach, amid the increasing number of fintechs, neo banks and other alternative banking challengers. These alternatives are exponentially increasing the options for consumers and businesses to store and access their money.

Challengers can create strong headwinds on the path to growth, but they do not make growth impossible. Growth is, in fact, possible, even for the likely underdog, and lessons for achieving it can come from the most unlikely places.

Winning Growth Lessons from a Baseball Underdog

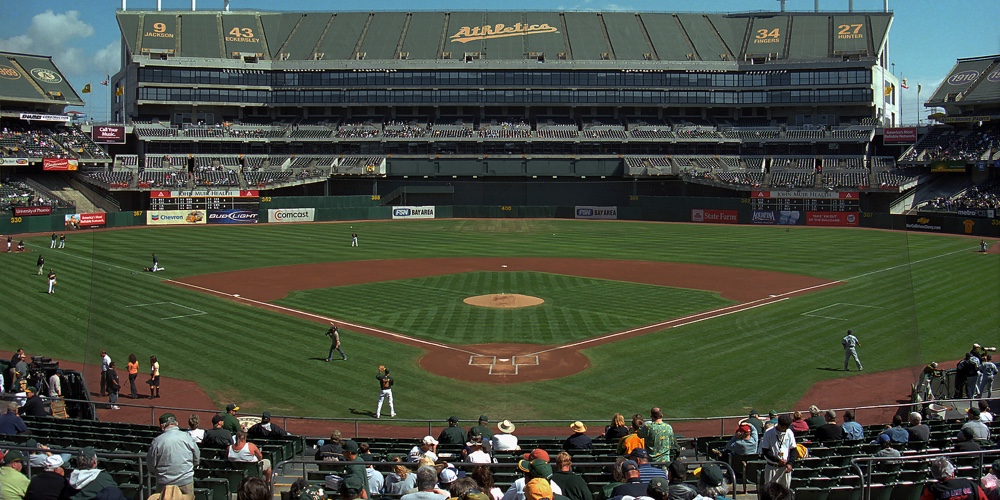

Oakland Athletics Executive VP of Baseball Operations Billy Beane knows what it’s like to compete as an underdog. He also knows how to win.

Made famous in the book and movie, Moneyball, Beane uses data to keep the playing field level for the Oakland Athletics to compete against big-market competitors like the Yankees and Red Sox. In a fireside chat with Nymbus CEO Jeffery Kendall, Beane shared striking parallels between his data-driven approach for winning and the new growth model for financial institutions.

The Athletics’ journey from the worst record in baseball to breaking the 103-year-old Major League Baseball record of 20 consecutive wins reveals four important lessons about business growth—especially when the competition is fierce and the odds feel stacked against you.

1. Think Differently

When Beane introduced data-driven decision-making to baseball, his critics said he was threatening the status quo and trying to change a system that has worked for over a hundred years. But it wasn’t working for the Athletics.

Status quo is the enemy of growth. As credit union leaders, we must honestly and critically let go of business approaches, technology, and partners that feel comfortable and familiar but do not serve our institutions’ goals and delight our members.

To compete and thrive, traditional financial institutions must embrace a new growth model fueled by rapid innovation and new thinking. Growth will come for any size credit union that takes on challenges and opportunities with a fresh perspective and chooses partners that deliver the necessary people, processes and technology to drive value and revenue.

2. Data Reduces Risk

People often tell Beane it took courage to risk throwing out the old baseball playbook, which was based on gut-based decision-making. But he argues data reduces risk and trying to solve problems without it is far riskier.

Banking transactions are data-rich. By leveraging the data and analytics of their millions of customer interactions, credit unions can craft personalized, value-added customer experiences. This is a significant opportunity to build loyalty, expand reach and grow in the seasons and decades ahead.

3. Find Value in the Undervalued

With a budget eclipsed by competitors in the major markets (think Mainstreet credit unions versus big, Wall Street money centers) Beane uses data to uncover the hidden potential of undervalued talent and transformed a struggling team into a winning one.

The untapped potential for credit unions is hyper-targeted, niche markets previously underserved by traditional financial institutions. According to the FDIC’s National Survey of Unbanked and Underbanked Households, 25% of US households either do not bank or are underbanked—have bank accounts but still use financial services outside the banking system to make ends meet. Challengers are strategically targeting the unbanked and other niche markets, like tech-savvy and cost-conscious millennials, with relevant and personalized customer experiences such as budgeting and money-tracking tools. These same opportunities are available to credit unions.

4. Buy Wins, Not Players

Big league growth won’t come from winning a few new members with one successful marketing promotion for a new checking account. Digital has blurred geographical lines, making it possible for credit unions to reach far beyond local zip codes. Long-term, winning growth is obtainable with niche banks that appeal to people not based on their geography but their interests, life stages or affiliations.

With a new thinking and a new growth model, credit unions can innovate beyond the boundaries of traditional banking, strategically compete in new spaces and spur growth this season and beyond.

Get Ready to Play Ball

In this promising new season, credit unions must rely on new thinking to remain relevant to our members and grow. Let’s borrow a page from challengers and seek innovative solutions—not only from our credit union peers, but anywhere organizations are winning—and go beyond just hitting targets to creatively hitting expectations out of the park.