4 ways email will drive growth for your credit union – if you use the right tools

Mark Twain famously said reports of his death were greatly exaggerated. If email marketing were a person, it could say the same thing. Like fashionistas who change their minds about what is this year’s “new black,” marketing predictions about the health of email marketing fluctuate from “it’s almost dead” to “it’s still useful” to “it’s alive and well.” In truth, rather than disappearing, email marketing continues to be an invaluable tactic in your marketing toolkit – and its usage is growing.

Consider this: The 2017 Inbox Report found that 89% of adults use email at least once a day. The Radicati Group reported in 2015 there were more than 4.35 billion email accounts, and projected an increase to 5.59 billion by 2019. And MarketingSherpa reports that 72% of consumers say email is their preferred communication channel with companies they do business with.

Does your credit union realize the full benefit from email marketing? Numerous studies report its healthy ROI potential, including VentureBeat’s Insight study, which reported an ROI of $38 for every $1 email marketers spend. When SmartInsights asked companies to name the top 10 marketing tactics that achieved the highest return, email marketing topped the list at 67%, followed by online marketing at 38%. It makes sense; the cost of an email marketing campaign is relatively low, expenses don’t increase when adding recipients, and well-designed campaigns are highly effective. Now, it’s your turn to do email marketing right.

Design Targeted, Personalized Campaigns

Most credit unions use email for marketing, at least to some extent. However, if you’re just sending blasts touting the benefits of a particular offer, your efforts won’t be as effective as they might. An integrated approach that builds on previous behavior, responses to other campaigns, that is targeted to the member’s specific circumstances, or is triggered by a demonstrated interest, like a search for rates on car loans, will prove much more successful.

At Doxim, our most successful clients have found targeted, personalized email marketing effective in many ways, including the 4 we will tell you more about right now.

- Improving the Member Experience

Connecting to members and strengthening relationships helps drive success. A study from CEB analysts found that highly satisfied customers buy twice as many products as those who have “average” relationships. Not only do satisfied members generate more revenue, but, as Bain & Company reports, it costs seven times more to acquirea new client than it does to sell to an existing one. It pays to keep members happy and on the membership rolls. Enhance member experience by showing members your credit union is paying attention – to them and to their individual, unique needs.

An email marketing platform can simplify sending newsletters with money-management tips, information about scams, or the benefits of new products and services. To build a truly authentic relationship with your members, use everything you know about them and craft personalized campaigns. Send trigger-based emails with birthday greetings or congratulations when a member pays off her car loan and may be ready to upgrade. Personalized messages, like this example from Keys Federal Credit Union, offer appeal on an emotional level.

A BAI study (“Quest for Deposits: The Ninety-Day Window of Opportunity“) found that 75% of all cross-selling takes place in the first few months after the new customer acquisition. Consider the results of an email campaign used by InFirst FCU ($170 million in assets, Alexandria, VA.) for member onboarding. The credit union’s campaign included a series of seven emails to new members during their first 60 days with InFirst. The first email welcomed the member to the credit union and described services, locations, and rates. Follow-up emails outlined banking options, locations, ATM locator apps, types of loans available and other account information.

The results are impressive:

- 18% of members added at least one new product or service

- Deposit accounts grew by 24% and average balances increased by more than $400

- The number of loan accounts grew by 190%.

The emails were simple and to the point, but they were designed to build a progressively more engaging relationship with the members:

- Boost Sales and Streamline Operations

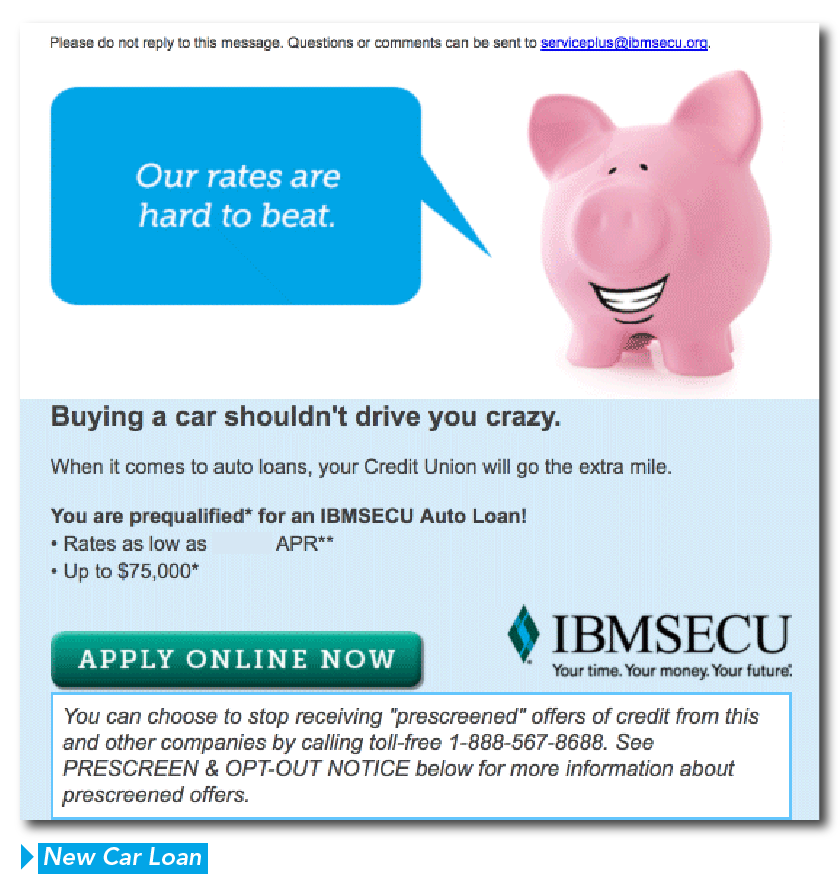

Keep your credit union on members’ minds by paying attention to their needs and interests. Emails triggered by transactions can help. If an auto loan is pre-approved, send an invitation to a car-buying seminar. If a member didn’t finish filling out a loan application, send an email reminder so he can click to go the place where he left off. Or, if he finished filling out the form but hasn’t provided all the necessary documents yet, send an email showing what’s still needed and include an easy link to upload missing information.

- Cut Loan Delinquency Rates

No one enjoys making collection calls, and one of Doxim’s client credit unions wanted to use emails to replace or minimize the need for performing this costly and unpleasant task. The email platform delivered delinquency notice messages to members’ inboxes five days after the due date (instead of the traditional 15 days). The result? Within one week after sending 673 emails, the credit union received 423 payments!

- Generate Cross-Sell and Upsell Opportunities

A robust email marketing platform can use the information a credit union already has to generate targeted, effective marketing messages. Analyzing product ownership can help identify members who might be interested in additional products. For instance, if a car loan is about to mature, it’s a good time to send a new offer – especially if current rates are better.

Email messages can be changed to reflect a member’s circumstances. For example, if she has a HELOC, an offer customized to available credit could include appropriate improvement suggestions or vacation ideas. That way, members with a higher amount available receive suggestions for a down payment on a vacation home, while those with smaller amounts are told about home renovations or vacations.

Here’s one final example of how a target email campaign can get quick results. A Doxim client wanted to increase adoption of its new credit card. After sending personalized email offers to a targeted group of members, the credit union received $283K in credit card balance transfer requests in just one month.

Reap the Rewards

Email marketing is a low cost, highly effective way to boost sales and connect with your members. But the effectiveness of email marketing means today’s consumer receives dozens of offers every day. For yours to grab attention, the campaigns must be relevant to members’ felt needs.An advanced email marketing platform, designed specifically to meet the needs of financial institutions’ marketers, can simplify the process of delivering automated multi-step, trigger-based campaigns that reach members in a way that will get their attention. Add the right tools and processes to your own CU marketing know-how, and you’ll have a winning combination to increase both revenue and member engagement.