6 steps to develop a data-driven vision

by: Nate Wentzlaff

As an industry in the middle of a massive shift, credit unions must steer in the best direction to enter a prosperous future.

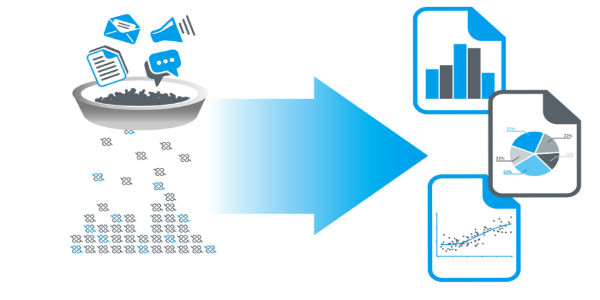

The Financial services industry has traditionally been an industry where change happens gradually at the direction of a few large institutions. Since the introduction of the internet in the 1990’s, finance has been in a state of exponential change. The digitalization of money is causing an even more powerful catalyst of change: the proliferation of data at a pace most credit unions cannot fathom. Consequently, credit unions must form a data-driven vision to act as a strong rudder to navigate through the data storm.

Step 1: Establish a Data-Driven Culture

Big Data/Analytics experts have been preaching the need for organizations to establish a data-driven culture for years. Many authors have spoken at length of the necessity and advantages of becoming a data-driven organization. Credit unions are no different. With more data than most industries can only dream of, they stand to gain the most (or fall the hardest). Management must lead by example by developing data-driven metrics for the entire credit union. Establishing a culture that relies on data is essential to the progression of a data-driven vision.

continue reading »