Credit union digital marketing feels a lot like having baby

“It’s time,” my wife said in the early hours a few weeks ago.

Driven by a rush of adrenaline, I checked my phone to find the fastest route to the hospital. As it had been raining all night, I anticipated wet streets and potential flooding would make for a messy morning Houston rush hour.

We left the house a few minutes later, both unaware that Houston would soon experience some of the worst flooding it has ever seen in some areas. In fact, as we made our way to the hospital, I grew concerned that we might not make it at all and I would end up delivering our fourth child in the backseat of our car.

Fortunately, that was not the case as my GPS guided us safely along the way as we missed most of the flooding. Had we left 15-minutes later, though, we would not have made it as rising water began shutting down the Houston roads.

At the hospital, we were greeted with the news that it take a while until we could get into a delivery room as the nursing staff was running at 30% capacity due to the flooding and road closures.

The day’s events were not going as neither of us had planned nor expected. Flexibility and patience were key to get both my wife and me, two Type A personalities, through the day.

And so we waited.

And waited.

And waited.

Eventually, we were ushered into the delivery room, and thankfully, we welcomed our fourth child into the world later that afternoon. Within 24 hours, we were back home with our healthy, happy, new bundle of joy.

But then it hit me.

Panic. Anxiety. Overwhelment.

Even though we had done this three times before, adjusting to the change of having a new human being in our house scared me greatly.

Taking time off of work to help with the baby, I moped around the house in a depressive, somber mood. In my wife’s great wisdom, she told me to go for a run to clear my head and come back in a better mood.

In my reflection, I realized the feelings I felt with our new baby are often the same feelings financial executives have about digital marketing.

Through our Digital Marketing Boot Camps and Digital Marketing Blueprint planning engagements, we continue to find financial executives feel overwhelmed about digital marketing. I can relate to and understand this feeling, both in that we undertook a digital transformation at CU Grow a few years back and more recently, the birth of our fourth child. This feeling of overwhelment is rooted in three types of fear:

- The fear of change

- The fear of the unknown

- The fear of failure

The Fear of Change

With each child my wife and I have welcomed into the world, we have had to change as parents and as a family just as we were becoming comfortable with life the way it was.

Change is scary.

By our human nature we prefer an environment, or in the case of credit unions a business model, that is steady and constant.

But change is needed for credit unions to evolve their business models from one that is currently built around branches and broadcast to one that is optimized for digital and mobile in order to keep pace with changing consumer behaviors and expectations. It is important to remember these expectations are being set by players like Amazon, Netflix, Uber, and Spotify who provide a simplified digital user experience.

The Fear of the Unknown

With every new child we have, I am scared of the unknown. For example, will the child be healthy? How will the other kids adapt to the baby? Will my wife and I have anytime left for each other or will we be exhausted zombies?

Like children, digital marketing does not come with an instruction manual. And if it did, the manual would receive so many revisions that by the time you finished it, the content would look completely different from when you started it.

I understand how digital marketing can feel overwhelming as a credit union executive trying to figure out the correct path forward without direction and guidance. That’s why we’re on a mission to simplify digital marketing so credit unions will grow and overcome the fear of the unknown through training, planning, and implementation.

The Fear of the Failure

Finally, each time we welcome a child into our family, I fear failure. Will I be a good father? Will we still be close during their teenage years? How will they remember me when I am dead and gone?

Upon digging deeper into recent Digital Marketing Blueprint engagements, I continue to find a fear of a failure that permeates throughout some executive teams. Ironically, this fear almost always stems from a fear of the unknown and fear of change.

As a driven Type A personality, I understand the fear of failure at a very deep and personal level. However, we can no longer let the fear of failure hold our credit unions back from realizing our greatest of potential.

Digital Marketing Does Not Have to Feel Overwhelming

I understand digital marketing can feel overwhelming.

But it does not have to if you know where you are today and where you are headed to in the future.

A good place to assess where you are on your digital marketing journey is to start by answering the following nine questions that frame the Digital Marketing Blueprint:

Purpose, Goals, and Budget: Do you have the vision and budget required to achieve your digital marketing goals?

Consumer Segments: How do your consumer personas and market segments go beyond basic demographic data?

Product Positioning: How do you differentiate yourself from others who promote “great rates and services?”

Staffing and Processes: What staff and processes are needed for you to achieve your goals for growth?

Consumer Journeys: What digital journeys have you documented to guide consumers through their buying cycle?

Technology Platforms: What marketing technology platforms do you need to achieve your goals for growth?

StorySelling: What process do you use to produce digital stories that emotionally connect with consumers?

Distribution Channels: What distribution channels do you need to communicate with your key consumer segments?

Key Performance Metrics: How do you quantify digital marketing success with KPIs tied back to your goals for growth?

Don’t worry if you find yourself struggling with the above questions. You’re not alone in your endeavor as over 70% of banks and credit unions have a hard time answering them too because they do not have a defined digital marketing strategy.

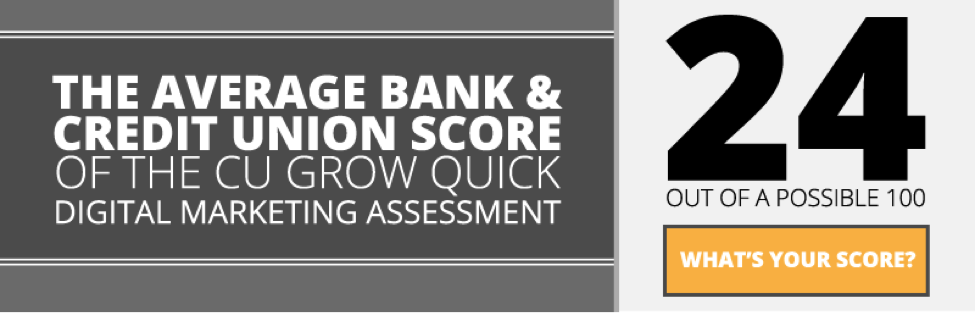

To leap ahead of your competition and get an even better understanding of how you compare to other banks and credit unions, take five minutes to complete the Free Digital Marketing Assessment, and you will receive your Digital Marketing Score along with recommendations to help guide you along your digital marketing journey.