Why credit unions should keep an eye on blockchain technology

With an understanding how these technologies work, let's look a four potential uses of blockchain

The time has come to explore technological innovation constructively and openly discuss its potential applications. In part one, we took the complex relationship between bitcoin and the blockchain and it put in the simplest terms possible. While bitcoin is an incredible innovation, it’s uses are rather limited. All of the attention from big financial institutions is focused on the technology that allows bitcoin to work, the blockchain.

Money Saving

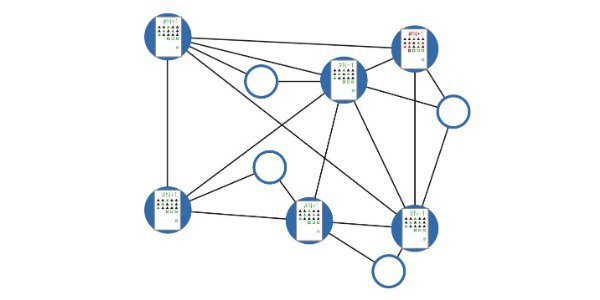

The elegance of the blockchain comes from how it removes the need for a central authority to verify trust and complete a transaction. The innate quality of the open network allows for accurate and near instantaneous payment processing. Because of how the distributed ledger works experts believe it has the potential to save both consumers and credit unions billions by cutting out inefficient banking intermediaries. Of course having unknown entities participating in transaction verification poses security questions, leading to the next point.

Security

A consortium of 42 of the world’s largest financial institutions including JPMorgan, UBS, Goldman Sachs, and Barclays, have been investing in ventures developing private, or permissioned, blockchains. While the default permissionless chain is comprised of a full network of computers who all get a full ledger of the transaction, permissioned blockchains will be setup to be used on private network where only trusted parties maintain the ledger. Keeping all of the money and time saving efficiency without sacrificing privacy.

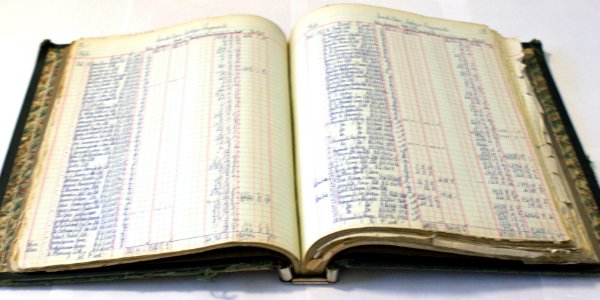

Record Keeping

In the blockchain all transactions are automatically logged including info on: time, date, participants, and amount of every transaction. Since every transaction is shared and thousands of nodes have to unanimously agree a transaction has indeed occurred, it’s almost like there is a notary present at every transaction.

Not just money

The most common mistake is assuming that blockchain is only used for bitcoins, but just as the blockchain records where a bitcoin is at any given moment, and thus who owns it, so can it be used to record the ownership of any asset and then to trade ownership. This has huge future implications on the way all financial assets such as stocks and bonds are registered and traded.

All in all, it is too early to know the extent of all possible uses of blockchain technology as even developers admit many features still lay dormant. While we can’t all have our feet in the water investing and testing this technology, there a few things to be aware of: Blockchain hype will not die and it has the potential to disrupt everything.

If you missed part one that included a simple explanation of how these digital technologies work, you can find it here.