Credit unions provide their members and communities with large and growing benefits

Credit unions provide their members and communities with broad economic benefits. How large have these benefits been over time? To begin to answer that question, CUCollaborate compared (1) the interest rates shown in the National Credit Union Administration (NCUA) call reports for each individual credit union, for each year during 1985-2020, for up to six types of loans (credit cards, other unsecured loans, new car loans, used car loans, first mortgages, and other real estate loans) and for up to five types of deposits (savings, checking, money market, certificates of deposit, and IRAs) and (2) the national averages for those interest rates among banks.

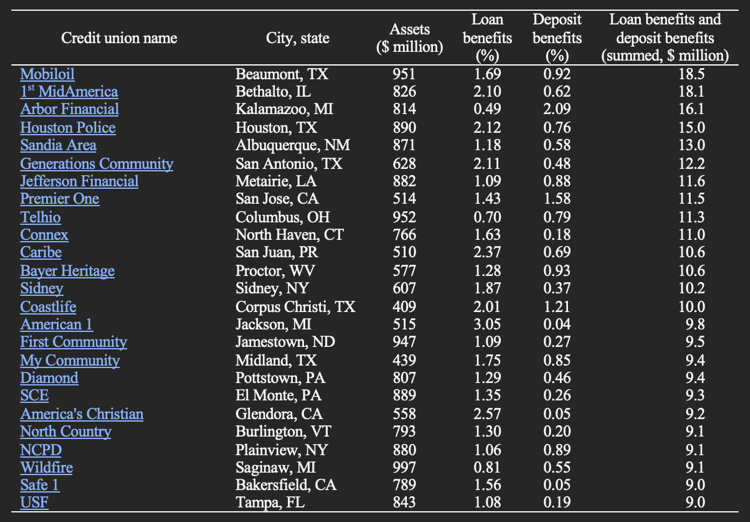

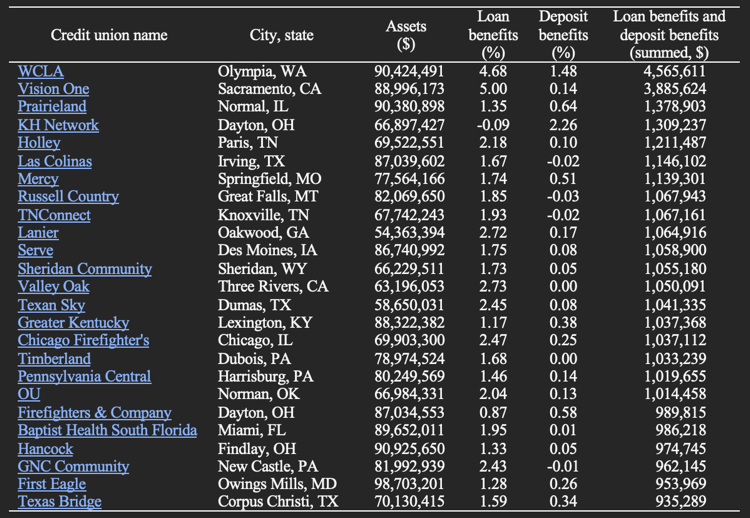

Aggregating across the many thousands of credit unions and across 36 years, we find that loan benefits (the extent to which interest rates on loans are lower at credit unions than at banks) and deposit benefits (the extent to which interest rates on deposits are higher at credit unions than at banks) have been consistently large and growing. For instance, in 2020, credit union interest rates on loans were, on average, 0.56% lower than at banks, totaling loan benefits of $6.4 billion. In the same year, credit union interest rates on deposits were, on average, 0.30% higher than at banks, totaling deposit benefits of $4.7 billion. As examples, figures 1, 2, and 3 list the twenty-five credit unions with the largest amounts of (the sum of) loan benefits and deposit benefits for three asset size ranges: (1) large credit unions, i.e., with over $1 billion in assets, (2) midsize credit unions, i.e., with between $100 million and $1 billion, and (3) small credit unions, i.e., with under $100 million.

Figure 1: Twenty-five large credit unions (with more than $1 billion in assets) with the most loan benefits and deposit benefits (summed), 2020

Figure 2: Twenty-five midsize credit unions (with between $100 million and $1 billion in assets) with the most loan benefits and deposit benefits (summed), 2020

Figure 3: Twenty-five small credit unions (with under $100 million in assets) with the most loan benefits and deposit benefits (summed), 2020

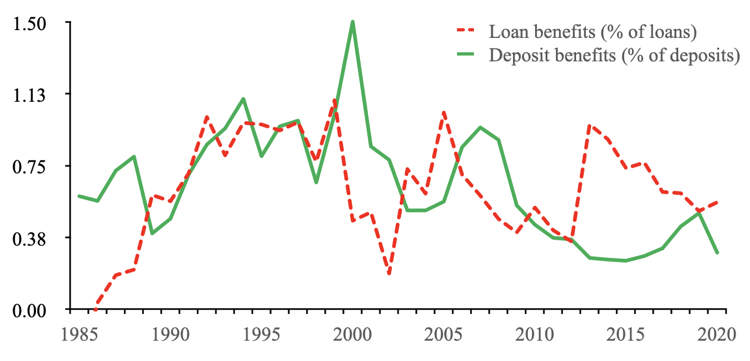

Figure 4 shows that the loan benefits and deposit benefits that credit unions provided to their members had their ups and downs during 1985-2020, as (1) credit unions sometimes changed their interest rates at different speeds than banks when economy-wide interest rates changed, (2) as net interest margins have shrunk, and (3) as credit unions have increased their market shares. Despite some ups and downs, credit unions’ interest rates have consistently been substantially more consumer-friendly than banks’ at nearly all points during the last several business and interest rate cycles. Thus, during 1985-2020, credit union loan benefits averaged 0.61% and totaled $124 billion, and deposit benefits averaged 0.65% and totaled $151 billion. (All figures are adjusted for inflation and expressed in 2020 dollars). Loan by loan, deposit by deposit, and basis point by basis point, credit unions’ consumer-friendly interest rates have made their members better off by a very sizable total of $275 billion during 1985-2020.

Figure 4: How much lower are interest rates on loans at credit unions than at banks (i.e., loan benefits) and how much higher are interest rates on deposits at credit unions than at banks (i.e., deposit benefits), 1985-2020.

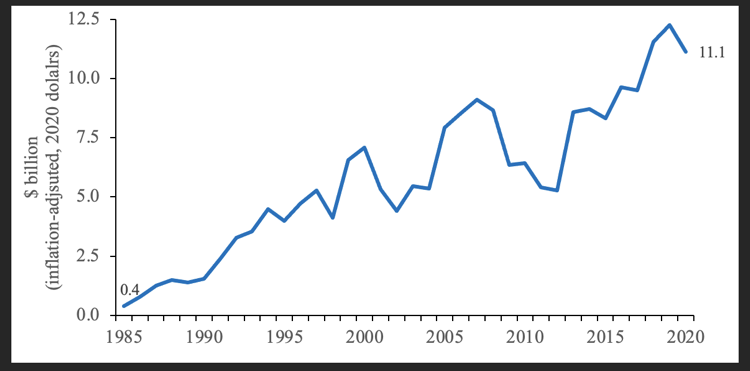

Figure 5 shows that, despite some ups and downs, as credit unions’ market shares have grown, the sum of loan benefits and deposit benefits has also grown steadily from under $1 billion in 1985 to over $10 billion in 2020. However, loan benefits and deposit benefits are, of course, not the only benefits that credit unions provide to their members and communities. Other, very important, benefits include: (1) ready access to lending that sustains jobs in members’ local communities, (2) lower fees than at banks, (3) broad ranges of products and services, (4) responsive and friendly member service, (5) service through a range of channels from networks of shared branches and ATMs to online and mobile access, (5) the personal satisfaction of participating in cooperative endeavors, and (6) many forms of community outreach, charitable giving, and employee volunteering.

Figure 5: Credit union loan benefits and deposit benefits (summed), 1985-2020.

To conclude, in this article we focused on loan benefits and deposit benefits for three key reasons. First, these two remain the benefits that can be computed the most readily and reliably both on a historical and on an ongoing basis. Credit union managers, directors, employees, and members will likely all make better decisions when they focus on the most reliable data. Second, by any account, loan benefits and deposit benefits remain, and for the foreseeable future are likely to remain, the largest measurable benefits that credit unions provide to their members and communities. Third, and most importantly, attractive interest rates on loans and deposits remain very important to members.

Financial consumers’ needs change over time. Members demand more and more of their credit unions. For instance, in addition to attractive interest rates, financial consumers today demand broader ranges of services, quality service in person and, increasingly, quality access through online and mobile platforms. As consumers demand more and net interest margins tighten economy-wide, many credit unions find that providing consumer-friendly interest rates is becoming harder. However, the fact that providing attractive interest rates may be becoming harder does not mean that members do not want, expect, or need them. Credit unions should not focus on price alone, but they should continue to also focus on price. Members continue to value attractive interest rates and credit unions should continue to proudly deliver on all of: quality service, broad product ranges, community outreach, AND consumer-friendly interest rates.

If you want to learn more about our estimates of your credit union’s current and historical member benefits, or about our analyses of your credit union’s member-centric and financial performance during 1980-2020, please reach out at www.cucollaborate.com.