Credit Unions: What to Expect from Congress in 2013

By Hon. Daniel A. Mica, The DMA Group

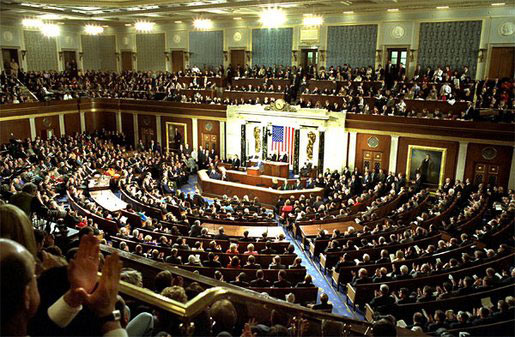

All eyes are on Washington and anxiety is rising as we approach the debt ceiling deadline in March. The decisions that are about to be made will almost certainly impact the entire US economy and directly or indirectly affect credit unions. Frankly, we all know the debt-ceiling vote is not the real issue. It is actually being used as leverage on other issues such as the need to reduce government spending.

In basic terms not raising the debt ceiling is much like refusing to pay a credit card bill because it is more than what was budgeted for. This is the first part of the two absolutes in this situation. The debt ceiling must absolutely be raised and spending must absolutely be reduced. As an aside, the media and political parties each try to blame the other for the problems we are facing. When you think about it, the President cannot spend a dime unless the Congress authorizes and appropriates funds. They need to work together to find an acceptable solution. The fact is that the House, the Senate and the President are all at fault. Indeed we all share in the blame. Every time any spending cut is put forward, we the American people usually rise up and say, “no!” Acknowledging that, as we move forward, there are somethings that will and will not happen this year in Congress that impact credit unions.

Here are a few of my 2013 predictions for the Congress:

Health Care (aka – Obamacare)

Just in case you missed it the debate is over for this Congress. The law will not be repealed. The cost and/or benefits to Americans and credit unions essentially “is what it is.” Count on it and include it in your planning. Any changes will be on the fringe.

Social Security

Congress will not cut Social Security benefits for current recipients. All efforts are aimed at adjustments that will grandfather those receiving benefits. The most likely scenario is to raise, on a sliding scale, the retirement age for those under 50. These types of changes should not have a negative impact on credit unions.

Charitable Deductions

Congress will not add additional limits on charitable deductions. However, they may target some areas where there have been concerns over abuses. There have been congressional hearings on not-for-profit hospitals, not-for-profit educational institutions and questionable religious organizations.

Mortgage Deductions

The economy is still on the upswing and Congress understands the important role the housing sector plays in growing the economy and creating jobs. Because of this Congress is highly unlikely to make major changes to mortgage deductions. There could be some minor tinkering but mortgage deductions will not be directly capped or reduced. A more restrictive cap on total deductions is a possibility. Of course any change could directly affect credit unions.

Tax Reform

There will be talk about a flat tax to replace the entire tax code. I believe it will just be talk, as there doesn’t appear to be enough support at this time to make it a realistic option. The entire year will see efforts at tax reform. As ideas are floated it will add uncertainty to the economy in general, the business community and credit unions. Count on it. For the next year or two this will become the new “normal”. Remember the worst rarely happens, think Y2K, the last debt ceiling vote, and the fiscal cliff. Don’t overreact………..we do need tax reform!

Credit Union Tax Exemption

Finally, regarding adjustments to the credit union tax status, there are two schools of thought. First comes from the banker’s association. In a bulletin to all of their members just a few weeks ago they promised to urge the taxation of credit unions in this Congress at every level. We can expect that they will indeed carry through on that commitment.

Aside from the community bankers, there is almost no one in Washington supporting an effort to tax credit unions. The second school of thought (almost everyone else) is that the last thing Congress wants to do in such a divided and contentious atmosphere is to be forced to choose sides in a bank and credit union battle. Banks have a great deal of money and credit unions have 100 million members, most of whom fervently love their credit union. This, as they say, is a rock and a hard place. Credit unions will be called on to weigh in and on this issue and they will put forth a united front. As I have said before, if the movement is united, credit unions will meet the challenge and come through this stronger than ever.