Growth is costing small credit unions a marketing fortune

The year 2014 was historic for membership growth. For the first time in the history of the movement, credit unions surpassed the 100 million mark in total membership.

From a macroscopic perspective, our industry is on a roll. We have been posting and continue to post strong gains in membership year after year. Credit unions are individually and collectively doing amazing things.

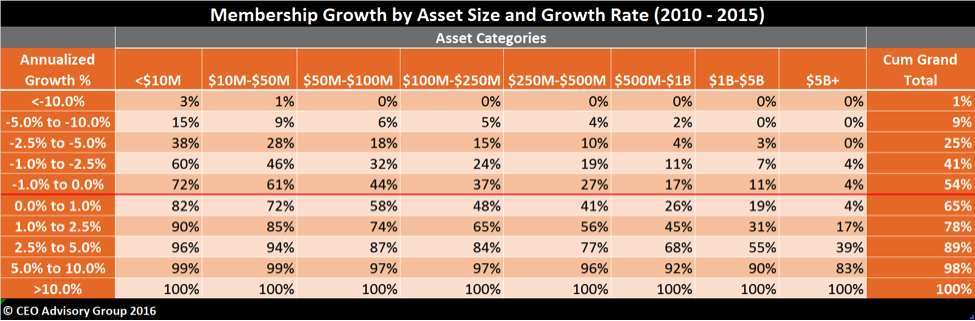

Yet below this glittery surface many credit unions are languishing. Half of all credit unions saw a net decline in membership over the last five years. You read that right; 54% of credit unions have a lower membership today than they did at year-end 2010. As shown in the table below, membership losses are, perhaps unsurprisingly, greatest among small credit unions below $100M in assets. Nearly three-quarters (72%) of credit unions under $10 million in assets and more than three-fifths (61%) of $10 million- to $50 million-asset credit unions lost members over the five years.

Many medium-sized credit unions are, surprisingly, feeling the squeeze. Well over a third of credit unions in the $100 million to $250 million asset category experienced member losses. And, over a quarter of credit unions between $250 million and $500 million in assets had net member declines.

Reviewing the account growth over the last five years revealed a similar story; half of all credit unions had negative growth in deposit and loan accounts.

Many factors lie behind the success of some credit unions and the struggles of others. Market growth, demographics, changing purchase behavior, and competition are all external factors affecting a credit union’s market position.

Internally, a credit union must carefully manage the stages of the purchase funnel (awareness, discovery, evaluation, and purchase) to ensure member growth, account acquisition, and repurchase.

Achieving brand awareness and brand preference in the midst of a transformation to digital banking is resource- and knowledge-intensive. Guerilla marketing will have its place as many credit unions have demonstrated. However, the big battle for credit unions will be achieving market shares large enough to give them critical mass and competitive advantage.

In aggregate, credit unions spent $1.4 billion in 2015 in education and promotional expenses category. In the last five years, credit unions spent over $6 billion on marketing. During this time, the credit union industry generated, on a net basis, an impressive:

- 16.3 million new members

- 45.7 million new accounts

- 1,200 new branches

- $258 billion in deposits

- $241 billion in loans

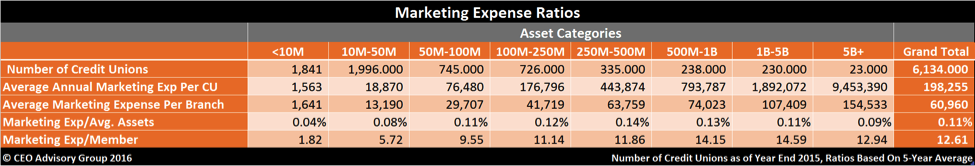

To understand how credit unions generated the brand awareness and preference that drove this growth, understand how credit unions allocated their marketing resources is helpful. Marketing expenses as a percentage of assets is a common metric for budgeting. As illustrated in the chart below, the differences in marketing expenditures as percentages of assets are not pronounced.

The differences are manifest when marketing expenses are compared per member or per branch. From a growth strategy perspective, looking at these numbers on a nominal basis is even more important. Does a credit union with an annual budget of $1,200, $19,000 or even $76,000 have the resources to move the needle on awareness and preference competing in markets against larger credit unions and bank giants?

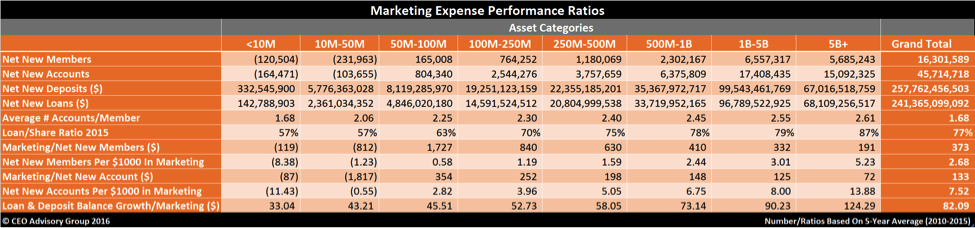

Ultimately, credit unions want a good return on their marketing dollars. They want to generate loans and deposits and deepen their relationships with members. Large credit unions have a clear advantage with the productivity of their marketing dollars—they get more bang for their marketing buck.

Large credit unions—over $1 billion in assets—accounted for 75% of membership growth and 65% of deposit growth over the last five years. Small credit unions had a negative return on their marketing for membership growth. The under-$10M and $10M-$50M credit unions netted, on average, a loss of 8.4 and 1.2 members, respectively, per $1000 spent on marketing. In contrast, credit unions in the $250M-$500M range generated a net of 1.6 members per $1,000 in marketing. Marketing economies of scale are evident considering $5B+ credit unions net 5.2 members per $1,000.

Similarly, a small credit union ($10M-$50M), generates $43 in loan and deposits balances per marketing dollar. This compares to a large credit union ($5B+) that generates a loan and deposit balance nearly three times as large, $124.

How sustainable is your credit union business model if you are spending nearly $1,700 or $800 net per member in marketing if you’re a $50M-$100M or $100M-250M in assets, respectively?

The marketing challenges for small and medium credit unions are evident today. The future will become even more challenging. We estimate that in 20 years the average credit union will be $2 billion in assets. The divergent growth paths of small and large credit unions mean smaller and medium credit unions will struggle to keep pace with the credit union giants.

The lack of marketing scale to help drive brand awareness and preference may be the biggest impediment to the survival of credit unions in the long run. Resources and talent are necessary to compete in the hyper-evolution on our industry and foster sustainable growth. Luckily, there are great examples of small credit unions that have bucked the trend and are showcases for other credit unions on reviving their strategies. For many, the answer may be to gain strength through the collaboration of merger.