How funnel analytics can help you grow loans and deposits

According to your website analytics, thousands of people visit your credit union website every month. But most visitors don’t apply for loans and accounts. Why do people drop off without applying? And where on your website do they drop off?

Conversion funnel analytics can help you answer those questions and increase loans, members, and deposits.

What are conversion funnel analytics?

Funnel analytics show the steps visitors take on your website to get a loan or account. The steps in a funnel are usually pages of your site, beginning with a landing page (such as your homepage) and ending with the “application complete” page—and all the steps in between.

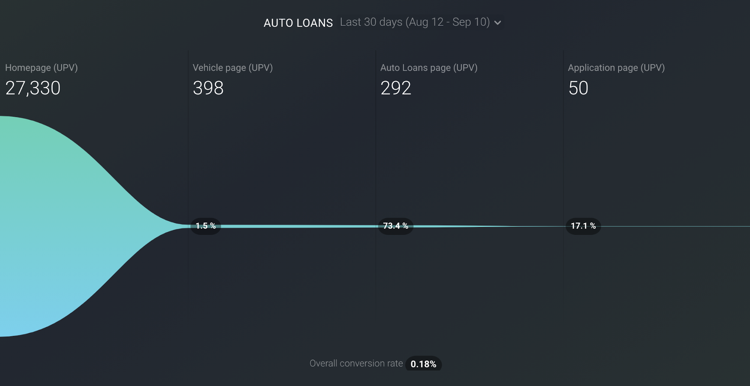

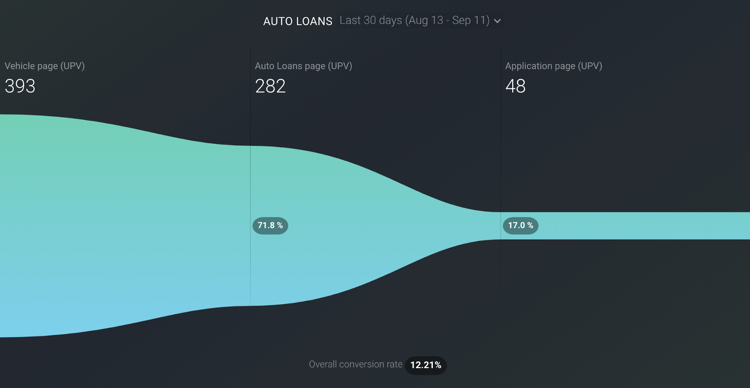

Let’s check out an example of an auto loan conversion funnel for Alta Vista Credit Union.

Example: Auto loan funnel for Alta Vista CU

First, let’s look at Alta Vista’s auto loan funnel from the perspective of a website user.

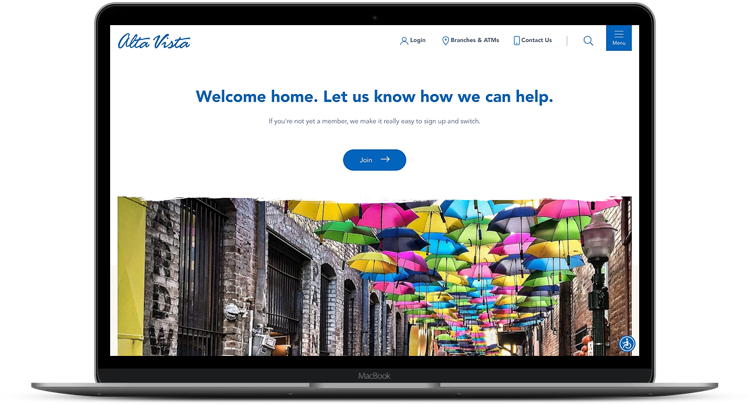

In this example, let’s say the user starts on the homepage.

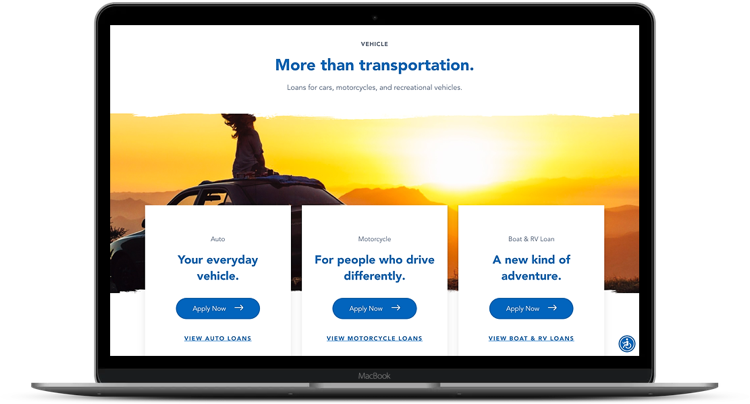

Next, they navigate to the Vehicle Loans page and select “View Auto Loans.”

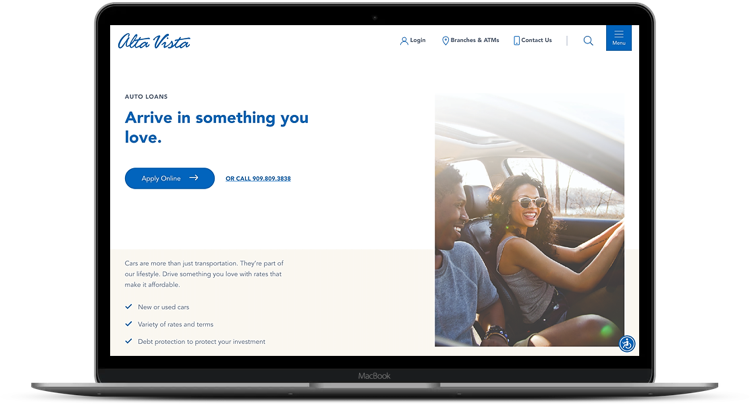

Third, they arrive at the Auto Loan page.

Finally, after clicking “Apply Online,” they land on the application page.

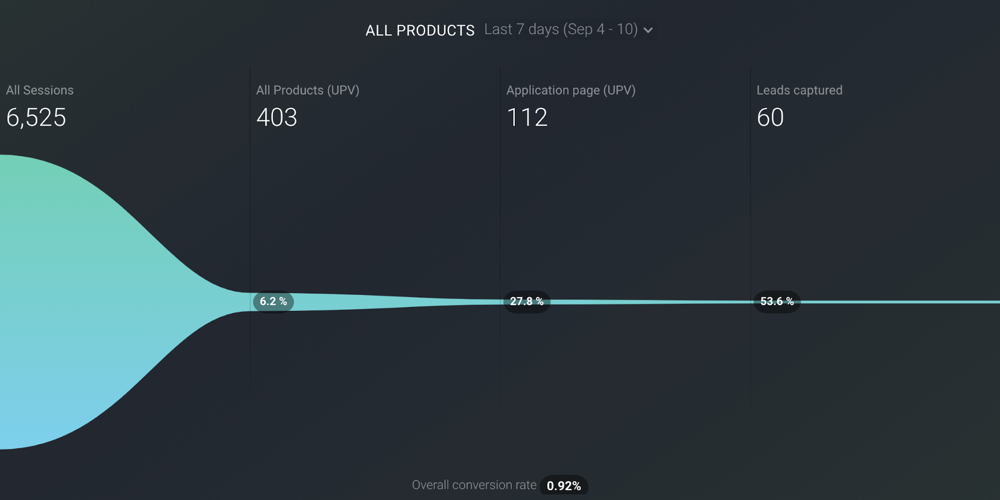

Above is what Alta Vista’s auto loan funnel looks like for website users and below is what it looks like from an analytics perspective.

Alta Vista’s auto loan funnel, created using Google Analytics and Databox.

How to create an analytics funnel

You can make your own funnels using Google Analytics and some sort of visualization tool, like Databox or Google Data Studio. All you have to do is map out the steps (typically pages) in the user experience and then pull in the number of Unique Pageviews for each step.

Watch this video to learn how to set up an analytics funnel step by step.

Why bother with funnel analytics?

As a credit union marketer, your job is to get people to apply for loans and accounts. If you don’t have funnel analytics, then you probably don’t know what’s happening on your website, and you certainly wouldn’t know where people are dropping off in the buying decision process. In other words, you’re flying blind.

Every credit union has a website, but only those with clear analytics know how their sites are performing. We’ve found that credit unions with over $100M in assets should be generating millions in revenue through their websites. How about yours? The only way to know is by quantifying your site with analytics. (Use this Website Revenue Calculator to see how much money your website is making.)

How to use funnel analytics

Funnel analytics don’t show you what to improve, but where to improve. They help you understand important conversion points and highlight bottlenecks in the user experience.

This bottleneck shows we should investigate ways to increase the clickthrough rate of Alta Vista’s auto loan page.

Wherever there is a bottleneck, there is an opportunity for improvement; and widening a bottleneck means more completed applications. That’s the value of funnel analytics: knowing where you stand and seeing where to improve.

Funnel analytics are vital to conversion rate optimization (CRO). To learn more about CRO, check out this article: “How to get more revenue from your website: Conversion rate optimization.”