How Not To Be A Laggard – Credit Union Cloud Adoption Forecast

Historically speaking, technology adoption models have favored large credit unions with large technology budgets. In an interesting shift in dynamics, we are seeing a different pattern emerge as credit unions begin to migrate to the cloud. In today’s blog we’ll look at patterns that are emerging and shaping the credit union cloud adoption model. But first let’s look at how we normally classify technology adopters.

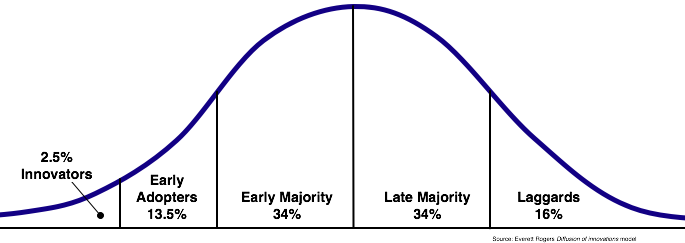

According to Wikipedia, the Diffusion of Innovations is a theory that seeks to explain how, why, and at what rate new ideas and technology spread through cultures. I’m sure you are familiar with the terms identified on the following graph.

Without getting into the specifics, we can see that technology adoption begins with the innovators (bleeding edge folks!) and wraps up with the laggards (or the ones who missed the boat!). The goal of any credit union leader is to provide the right product and services to their members and sometimes this is before the member even knows they “need” take. A great example of that is online banking. Innovators and early adopters were hugely successful as they moved into the online banking space and captured a stickier PFI (primary financial institution) relationship with their communities. Will cloud services be the next service differentiator? I think so. Not because its glamorous or even significantly less expensive – but because the mindset behind the decision to adopt cloud technologies involves a shift in the mindset from “servers” to “service” (see my earlier post).

So who are these innovators and early adopters?

continue reading »